The Australian Dollar, A Government Report and the Depressing Outlook for Iron Ore

The Australian Dollar tends to track the price of iron ore quite closely.

Iron ore is the country’s largest export, comprising roughly a quarter of all exports from the country, so when its price goes up the aggregate demand for Australian Dollars to purchase it increases as well.

Economist Robert Hill neatly encapsulates the relationship:

“It is little wonder then that the Australian dollar is so closely linked to iron ore prices. Aussie ore must be purchased with Aussie dollars at the end of the day, and as demand falls for the base metal, so too does demand for the AUD. However, the relationship between the pair has not always been so obvious.”

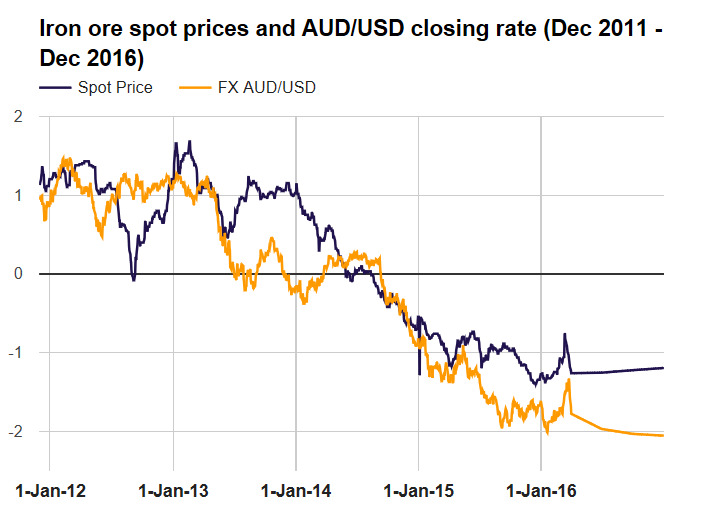

Hill’s Chart below illustrates the historical relationship between the two.

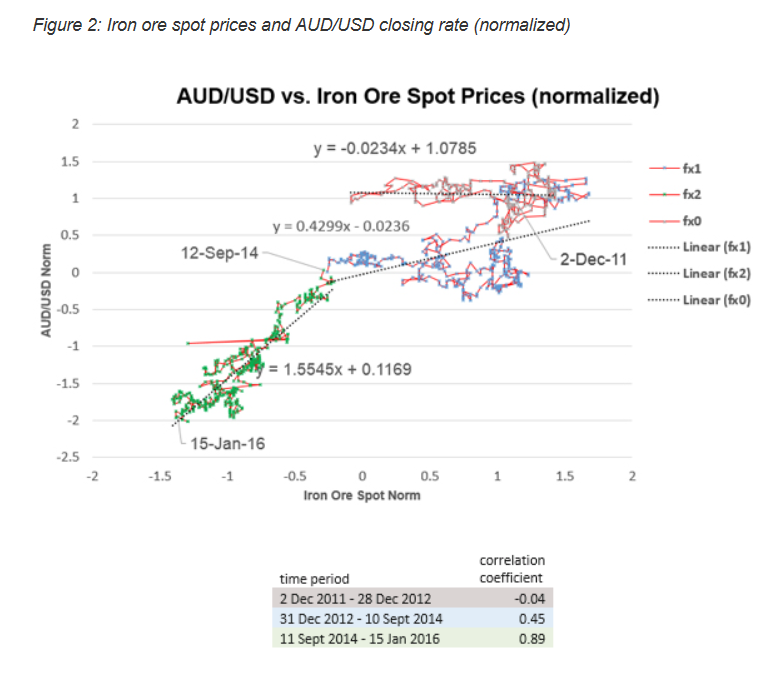

A second chart below is a more scientific depiction of the correlation between the two.

It shows how the correlation has differed at various times in history, for example, high in 2014-16 to almost no correlation in 2011-12.

A correlation coefficient of 1.00 means the two move simultaneously – one of -1.00 that they are perfectly inversely correlated.

It is already common knowledge that the price of iron ore is forecast to fall.

The fall in the commodity has mainly been driven up by increased demand from another infrastructure drive by the Chinese government, the booming property market (steel girders) and by Chinese speculators, however, a crack-down on the exchanges as well as tighter monetary policy in China is likely to slow demand from these sources in the future.

Now the Australian Department of Industry, Innovation and Science have put their stamp of authority on the predictions, publishing a paper which forecasts deep price declines for iron ore.

Commenting on the report, Credit Suisse’s Honglin Jiang, notes how the Department forecast the same price for end of year 2017 as his employers.

“The Australian Department of Industry, Innovation and Science released its quarterly Resources and Energy report, forecasting an iron ore price slump to $55 USD/MT in 4Q17 (matching Credit Suisse forecasts) as supply outstrips demand growth,” he says.

The response from the market to the news was immediate with Dalian futures selling off 7%, although Jiang notes that even this is not enough to reflect the bearishness of the forecast.

“Dalian futures sold off 7%, though are still indicating market pricing of around $60 USD/MT in 4Q (after accounting for VAT), suggesting that market price falls may still have some way to go,” said Jiang.

“Coking coal and steel rebar futures also fell, suggesting the market is broadly rethinking prospects for Chinese demand in these hard commodities,” he added.

In line with the close correlation between the commodity and the currency, the AUD/USD pair followed suit and sold off by 0.25%.

EUR/AUD rose on the news.

Nevertheless, the sell-off can’t have been that strong since the Australian Dollar still managed to outperform the Pound, suggesting the weakness in the currency was not very reflective in terms of magnitude to the 7% decline in the commodity’s spot price.

Delve a little deeper into the Australian DIIS report and you can see why this may be so.

For although it forecasts a slow fall in iron ore it says that aggregate Export Earnings will reach an all-time high in 2017-2018

“Australia’s resources and energy export earnings are forecast to reach an all-time high of $215 billion in 2016–17 and 2017–18.

In real terms, this represents 32 per cent growth on 2015–16. Higher prices for iron ore and metallurgical coal, as well as increased LNG export volumes, are likely to be the most significant contributors to growth in export earnings,” says the report.

Nevertheless, this may well represent a peak.

“The price gains are not expected to last. Production of steel in China is expected to decline over the next five years, as construction activity slows, particularly in the residential sector.”

The main factor supporting Australian exports are – and will be the increasing volume of Liquid Nitrogen Gas (LNG) exports. These are likely to take the sting out of declining iron ore and coking coal exports.

“The most important source of growth will be LNG. Australia’s LNG export volumes, which grew by nearly 50 per cent in 2015–16, are forecast to double in the next three years, as new production capacity comes fully online,” said the report from the Department of IIS

The report states that non-energy commodity demand is to remain robust bit increase at a lower level in the next five years.

“Global demand for resource and energy commodities are expected to continue to grow in the next five years — but at a markedly slower rate than in the previous five years.”

The emphasis will see a shift to a preference for higher grade resource exports, which Australia produces alongside the lower grade materials and has stockpiled in reserves, which may help it through the uncertain future.

“With reserves of high-energy coal and highgrade iron ore, demand for Australia’s resources will remain strong, as China moves away from using (and producing) low-energy coal and lowgrade iron ore to limit air pollution in some of its large cities,” noted the report

Looking on the bright side, although Chinese urbanization may have peaked most of the rest of Asia is still playing catch up.

“Other parts of Asia are also urbanising rapidly. In India, over the next five years, urban populations are projected to grow by 11 million persons a year, while in South East Asia, urban populations are projected to grow by 7 million persons a year. Urban populations in ‘Other Asia’ (i.e. excluding China, India and South East Asia) are projected to grow by 11 million persons a year.”

There is also Africa Urbanisation to consider.

“Africa is also urbanising rapidly, with the annual number of newlyurbanised persons expected to overtake China in the next few years. However, to date Africa’s urbanisation has not been associated with the same rates of industrialisation as experienced in China and other developing countries.”

On risk to Australia’s resource exports is the rise in protectionism which could impact on Australia negatively, according to the report’s Authors, as its resources tend to be passed on in the great global supply chains.

“The rise of trade protectionism has the potential to negatively affect Australia’s resources and energy exports — even if protectionist policies are not directly targeted at Australia,” said the authors.

Nevertheless, the market should be ready for a decline in non-energy resource.

“Over the five years to 2022, growth in global demand for the types of non-energy resource commodities that Australia produces — mainly iron ore, gold, aluminium, copper, nickel and zinc — are projected to be slower than in the previous five years. This will dampen the potential for further price rises, and potentially affect the viability of some of Australia’s higher cost mining and refining operations.”Unfortunately Iron Ore and Coal are likely to be the worst hit, although how much this will impact on the Aussie Dollar is an unknown.

Unfortunately Iron Ore and Coal are likely to be the worst hit, although how much this will impact on the Aussie Dollar is an unknown.

“The slowing in commodity demand growth— will be most noticeable in metallurgical coal and iron ore, both used in steel making. This is because steel is an early development–cycle commodity — primarily used in the construction of buildings and infrastructure. As China develops and transitions to a more consumption-driven growth path, its ‘steel intensity’ will plateau.”

Save

Save