The Australian Dollar Forecast to Decline Over 10% by end of 2018

Labour market uncertainty, stubbornly low wages and volatility in commodity prices are expected to keep the Australian Dollar under pressure until the end of 2018 according to a new report on the currency's outlook released by Westpac Bank.

The forecast includes a nearly 15% drop against the Dollar from its current level of 0.77 - to 0.66, a lesser fall against the Euro of 0.71 to 0.69 and a 10% drop versus the Pound, which would see AUD/GBP go from the current 0.62 to 0.55 by the end of next year.

One of the most significant drivers in currency markets are relative interest rates as investors transfer capital from lower interest rate currency jurisdictions to higher interest rate currencies.

This drives up the currencies with higher interest rates and has been one of the major factors supporting the relatively strong Australian Dollar over recent years.

A closing of the gap between Australian interest rates and those of its counterparts, however, is expected to be a major factor behind the projected decline.

Compared to US interest rates at 1.00%, UK at 0.50% and Eurozone at 0.00% Aussie rates are still substantially higher, at 1.50%, however, this gap is forecast to narrow as the other rates rise but Australian rates remain unchanged.

The Reserve Bank of Australia (RBA) is not likely to raise interest rates due to increasingly strained household finances which could not withstand higher debt repayments.

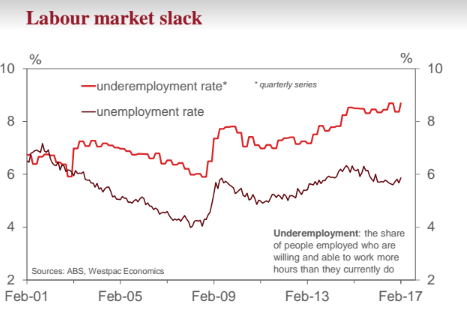

Continued problems in finding full-time work appear to be capping attempts by workers to raise their incomes; Australia’s unemployment rate is still well above the optimum 5.0% at 5.9%.

Referencing the latest RBA meeting statement, Westpac note the main change in the Bank’s message was in their negative assessment of jobs and wages.

“The Governor referred to the insipid growth in household incomes and linked to that effect the observation that employment growth has been concentrated in part time jobs. Those considerable headwinds for the economy have been known for some time but, recently, he has chosen not to highlight them,” said Westpac in their note.

Another concerning feature of the current economic climate is the fall in consumer spending as households appear to be tightening their belts.

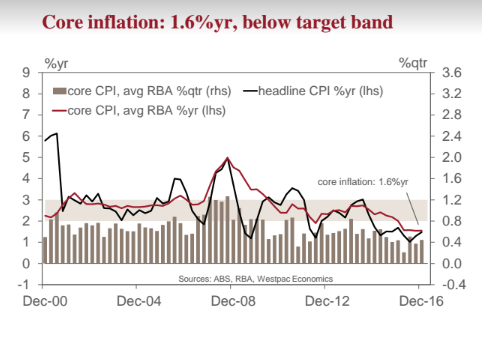

This is likely to keep inflation low and prevent the central bank from increasing rates.

The current core inflation rate of 1.6% remains below the RBA ideal and below historical averages.

Past increases in consumer spending were mainly due to shoppers saving less, rather than earning more.

“The March Westpac Melbourne Institute Consumer Sentiment survey shows a disturbing deterioration in confidence around household finances and a lift in households’ risk aversion. The sub-index tracking views on ‘family finances compared to a year ago’ has fallen 9% since December to its lowest level since June 2014 when respondents were shaken by the Abbott government’s first Budget. A separate question asking consumers about the ‘wisest place for savings’ also shows a clear shift towards risk aversion with the proportion nominating ‘pay down debt’ jumping from 20.5% in December to 25.7% in March, and the proportion favouring real estate dropping to just 11.6%, a record low since the survey began in 1974,” said the note from Westpac.

Nor are the RBA likely to cut interest rates any lower in response to the slowing conditions, as they would not wish to make borrowing cheaper and fuel the anomalous, steep, appreciation in House Prices, especially in major cities like Sydney and Melbourne.

Westpac note that finding themselves between the horns of a dilemma the Bank will likely do nothing.

Rising Commodity Prices

The main single factor behind current Australian growth comes from the familiar source of its abundant natural resources.

Commodities rebounded from historic lows in 2016 with Iron Ore, Australia’s biggest single export seeing a very substantial increase over the period since then.

These have supported high levels of growth over the last 12 months and are a considerable source of hope for future economic growth.

However, despite this, Westpac are circumspect about both the sustainability of the rises and the trickle-down effect in terms of wages and investment.

They point to caution from mining companies as a sign they do not expect price gains to last.

“Mining companies are cautious about the sustainability of current prices (we believe appropriately so) so investment and employment has been slow to respond.”

Indeed, it appears that a large part of the increase in Iron Ore prices has been as a result of rampant speculation on Chinese futures exchanges as well as stockpiling ahead of expected higher prices and fear of Renminbi devaluation.

We have notes in other articles on Pound Sterling Live the current trend in China for preferring high grade Iron ore from Brazil to lower grade Aussie ore because it produces cleaner air.

The government is legislating against air pollution so this trend is set to rise and could adversely affect the desirability of Australian Iron Ore, as well as the coal used to coke it in steelmaking.

Nevertheless, Overall Outlook for Australian Economy “Sound”

Despite labour market and wage incomes remaining a key uncertainty, Westpac describe their overall view of the outlook as “Sound”.

Jobs will be a key variable to this positive view.

“Employment trends have been a key dynamic associated with the shifting momentum in the overall economy over the past two years. In 2015, jobs grew by a brisk 2.6% in response to the labour intensive activity of the home building boom and strength across the service sectors.”

Despite these job gains, the economist notes an element of ‘overshoot’ which is currently rebalancing.

“However, this included an element of overshoot, which gave way to an under-shoot in 2016, with employment up a sluggish 0.8%.”

Sign so far in 2017 are promising.

“Our Westpac Jobs Index points to solid job gains early in 2017, consistent with rising demand across the non-mining economy. However, there is the risk that job outcomes fall short if businesses remain fixated on cost cutting.”