Australian Dollar Slips: What is Eating at the Aussie?

The Australian Dollar is selling off rather heavily versus the US Dollar, which is raising eyebrows in some foreign exchange analyst circles.

It has fallen from 0.7750 to 0.7555 in seven days, which if we look at historical precendent, is quite large:

There appears to be no single driver for the sell-off, rather a mixture of factors.

Given the lack of a single fundamental reason there is a strong possibility technical traders are massing to sell the currency having witnessed it reach seamingly expensive valuations.

The trendline just above the 0.7750 peak which contained prices in the Autumn of 2016, appears to be doing the same thing again.

Yet technical selling alone probably isn’t enough to explain all the downside.

Another possibility is that Aussie bulls are taking profit – look at that long run higher from the December 2016 lows to the recent February peak – that’s a big rally and some positions may have grown increasingly ‘fat’ – ergo time for a harvest.

This Couldbe a Temporary Blip

Another possibility behind the Australian Dollar's weakness is that we are watching a temporary correction, perhaps due to profit-taking as stated above.

This seems especially likely when looking at the two major moving averages (MA’s) on the daily chart, the 50 and 200-day MA’s are clustered just below the current level of the exchange rate at 0.7500

The MA’s are likely to act as a very robust obstacle to further downside and may prevent a deeper sell-off.

Moving averages are not just indicators of long-term equilibrium or trend indicators but also dynamic areas of support and resistance in and of themselves.

Markets can and often do rotate at MA’s, especially major ones, and given AUD/USD has two together at the same level.

We may need to act with caution in relation to the current bearish sell-off despite its severity, and reserve the right to be wrong if the market changes its mind.

US Dollar Rises at Expense of the Australian Dollar

There is also a noted shift in appetite on global FX markets with Australian Dollar holdings being liquidated in favour of US Dollars.

The rally in the GBP/AUD pair has not been nearly as severe as the fall seen in AUD/USD, so a strong Dollar is definitely part of the story.

We’ve heard a lot of positive commentary from US Federal Reserve board members in recent days saying they think the US economy is really coming into its own and further interest rate rises are therefore warranted.

The Fed’s Lael Brianard is the most striking case as she has gone from being a pessimist in favour of cutting interest rates to saying the economy is in “transition”.

This has boosted the Dollar, which seemed to be on holiday during Trump’s positive State of the Union Address, and seems to have provided it with a delayed rally.

All eyes are now on Janet Yellen’s speech on Friday to see whether she will add her voice to chorus of speakers crowing for higher interest rates.

Those betting on even more hawkish blah blah from Yellen may be disappointed though argues Hantec Markets analyst Richard Perry, who notes how several times before she has ‘cried wolf’ and may be more reticent on this occasion.

“Yellen has had a tendency of 'crying wolf' in the past over Fed moves and is will be interesting to see if she is more reserved than many of her FOMC colleagues who have been steadily preparing the market at least for the potential of a March hike,” said Perry.

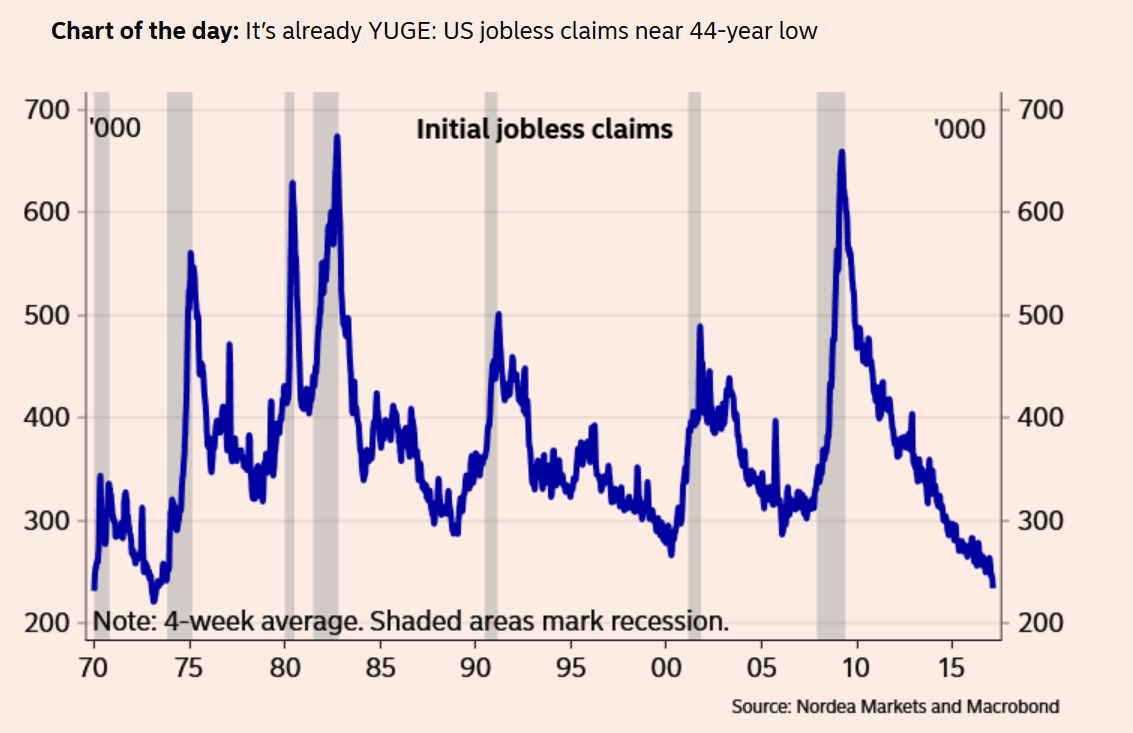

But hard data has also been good for the US – for example, Jobless Claims have reached a low not seen since 1973!

“Yesterday, the data for last week’s US jobless claims came out, which almost reached a 44-year low. Initial claims for state unemployment benefits dropped by 19,000 to 223,000 for the week commencing 19th February. This is the lowest level since March 1973 – boosting sentiment for a further rate hike in March and supporting the dollar well,” said Smart Currency’s Carl Hasty.

The Australian Dollar's China Problem

Weighing on the Aussie side of the pair, meanwhile, are those nagging fears of an expected slowdown in China.

Recent Chinese Manufacturing data was surprisingly good which would typically lead to a recovery in the Aussie.

However, there are still major qualms about the Chinese housing sector.

Chinese construction is a major market for Australian commodity exports so a slowdown in property activity could still impact negatively on AUD, even with broader manufacturing doing alright.

“The housing cycle has clearly turned towards a downtrend due to tighter mortgage conditions and outright house purchase bans in most large cities. In addition, the government could introduce a nation-wide property tax this year, further dampening real estate demand,” said Nordea Markets’ Amy Yuan Zhuang

In addition to this, are recent reports that China is increasingly preferencing Brazilian ore over Australian ore because it is higher grade and therefore creates less polution.

Data for 2016 suggests as much after Brazil's share of Chinese iron ore imports rose from 17% to 22% whilst Asutralia's share fell from 55% to 51%.

Beijng is also reducing steel mill output due to polution, which saw smog in Beijing increasing 80% year-on-year in January 2017.

RBA Meeting - Time for a Rebound?

Nevertheless all these factors don’t necessarily explain the suddeness and magnitude of the Australian Dollar's sell-off, which was over 2.5% over a week.

Indeed, RBC Capital Markets noted how data in Australia has been quite strong lately and is likely to bias the Reserve Bank of Australia (RBA) to sounding neutral at their policy meeting next Tuesday (March 7) - rather than pessimistic.

“Having just refreshed its forecasts as part of its February communication, we do not expect much policy signal from the RBA. Global growth looks increasingly robust, the terms of trade have held their recent gains, Q4 domestic growth was almost ½%pt better than its estimate, and the housing market has been resurgent. Countering this, data on prices have been soft. We expect this will leave the statement with a neutral tone, though it may be hard to curb the optimism on the improving global outlook,” says RBC’s Michael Cloherty.