Australian Dollar: ANZ Says Feb. RBA Rate Cut Now Unlikely

- Written by: Sam Coventry

Image © David McKelvey, reproduced under CC licensing

The Australian Dollar will have RBA caution in its corner in 2025.

New research from ANZ, one of Australia's biggest lenders and investment banks, says it no longer predicts the fist Reserve Bank of Australia (RBA) interest rate cut to happen in February.

ANZ now predicts the first RBA rate cut will land in May 2025 while also reducing the total expected rate cuts from three to two.

The Australian Dollar has come under pressure as Donald Trump threatens to hike import tariffs on Australia's major trading partners. However, the prospect of higher-for-longer interest rates in Australia has proven an offsetting and supportive force for the currency.

The ANZ shift is attributed to several factors, including "stronger-than-expected employment growth, a lift in hours worked and some stabilisation in forward-looking labour market indicators," according to Adam Boyton, Head of Australian Economics at ANZ.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

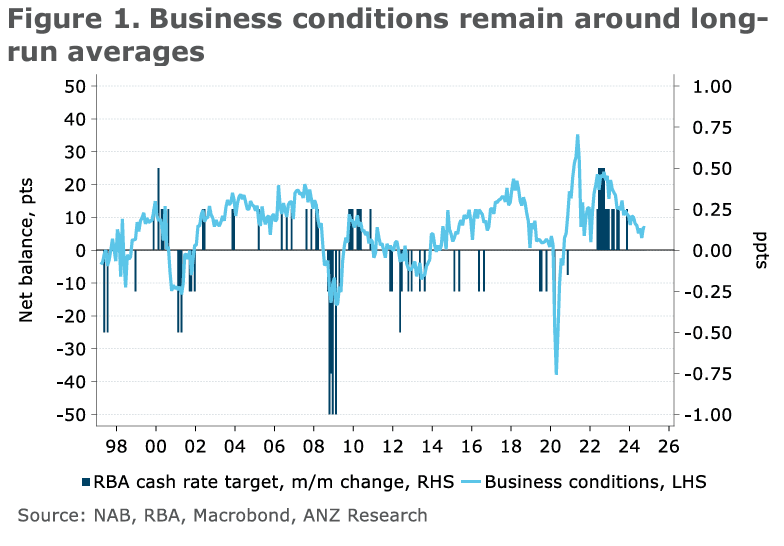

Additionally, "business conditions" are "holding around long-run average levels" and "consumers have noticed the Stage 3 tax cuts, with a lift in consumer confidence."

The report notes that the RBA's tone remains hawkish. "With the Board still focused on the level of demand exceeding supply, our forecast for six-month annualised trimmed mean inflation to fall just within the RBA’s target band by the February meeting is no longer looking like enough," explains Boyton.

While the primary forecast is for rate cuts in May and August 2025, a February cut is not ruled out. This would depend on weaker-than-anticipated Q4 CPI data and softening in the labour market, prompting a more pre-emptive response from the RBA than current communication suggests.

🎯 GBP/AUD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Markets have steadily moved to price in a reluctant rate cutting cycle from the RBA, which has offered AUD exchange rates support.

However, a downside risk to the Aussie currency in 2025 would be if the RBA defied expectations and cut rates sooner and further than currently expected.

"Absent a shock or some other material policy easing, a rate cutting cycle still seems more likely than not, albeit off the back of lower inflation, not a collapse in activity," says Boyton.

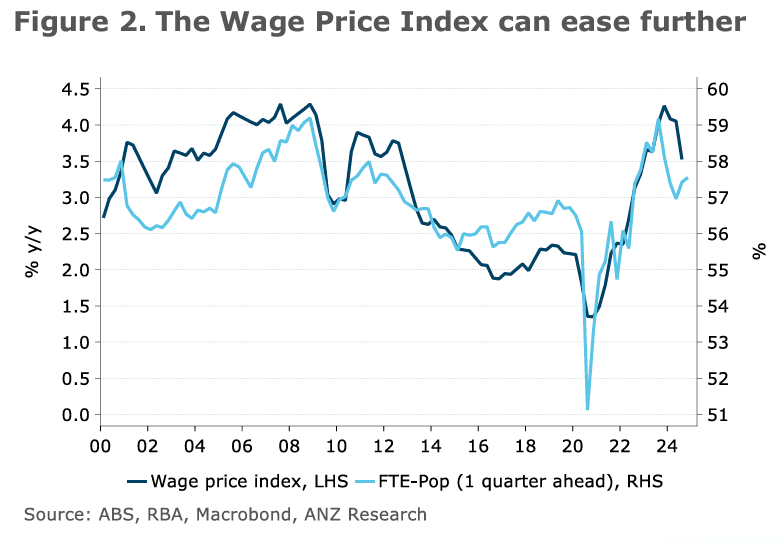

This is based on the view that wage growth will likely fall short of RBA expectations and that the current interest rate environment is restrictive, considering the weakness in private demand and the housing market cool-down.