Pound to Australian Dollar Week Ahead Forecast: Further Recovery Potential

- Written by: Gary Howes

Image © Adobe Stock

The Pound to Australian Dollar exchange rate (GBP/AUD) is forecast to probe the upper end of a short-term range in the coming days, thanks in part to disappointment over weekend events in China.

The Australian Dollar is softer at the start of the new week as Saturday's stimulus announcement from China didn't quite meet expectations and investors will have to wait for further policy details.

China's Ministry of Finance announced trillions of yuan would be made available in a special local bond fund, while special local government bonds can be used to hoover up unsold housing inventory, land acquisition and redevelopment.

The central government also has room to borrow more and allow for the deficit to increase. A one-off and "significant" government debt swap programme was also announced.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

There is an expectation that China is taking steps to boost the economy, but until a 'big bang' moment is announced the Australian Dollar will likely reflect growing investor caution and disappointment.

"Policymakers have recognised the issues and are putting a genuine effort to coordinate better support domestic demand and repair confidence. More time maybe needed for support measures and approvals to come through," says Christopher Wong, FX and Rates Strategist at OCBC.

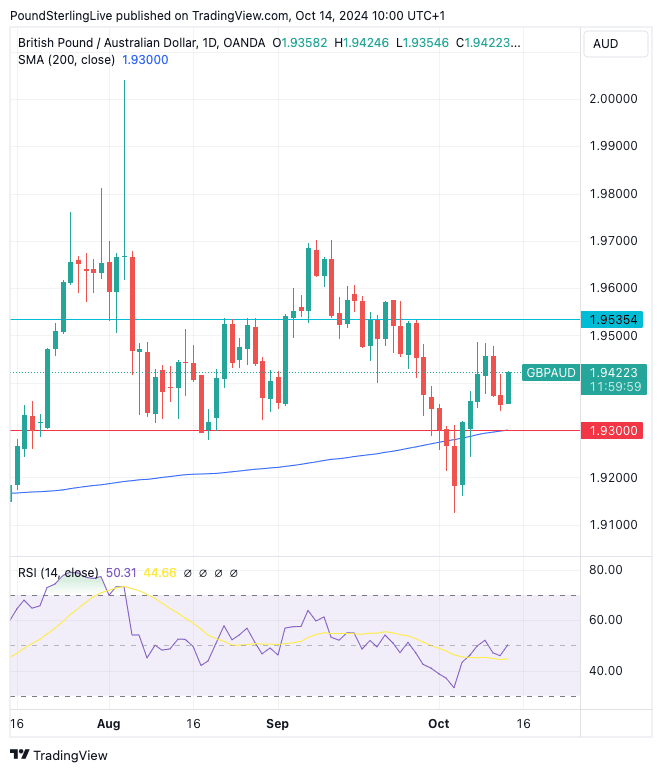

GBP/AUD rebounded last week and broke above the 200-day moving average (DMA) in the process. Why is this significant?

Our Week Ahead Forecast approach states that a break below the 200 DMA would have shifted GBP/AUD into a medium-term downtrend that would have delivered progressively lower levels.

The recovery of the 200 DMA - currently at 1.93 - negates this, even if it does not necessarily mean the GBP/AUD is ready to reach for the stars once more.

GBP/AUD can recover further, and we would be comfortable eyeing a test of horizontal graphical resistance at 1.9535 in the coming five-day timeframe.

Look for any GBP/AUD weakness in the week ahead to be limited to around 1.93 in the coming days. This is the confluence of graphical horizontal support and the 200 DMA.

🎯 GBP/AUD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Thursday's release of employment data will dominate the domestic Aussie calendar.

The market expects 25.2K jobs to have been filled. Anything less will weigh on the currency, as it could lead to a potential interest rate cut at the Reserve Bank of Australia (RBA) before year-end.

The UK also releases labour market data this week, with Tuesday's focus being on UK wage growth.

The average earnings release should show growth of 5%, down from 5.1%. When bonuses are included, the figure is expected to be 3.8%.

Anything below this would put the Pound under pressure.

Wednesday's UK inflation figures will be closely watched. The headline CPI rate is predicted to be 1.9%, which is back below the Bank of England's 2.0% target.

"We estimate that CPI inflation temporarily dipped to 1.7% in September, which would be the lowest reading since April 2021. Two factors are likely to have weighed on inflation last month," says a note from Oxford Economics. The primary factor cited by analysts at Oxford Economics is the fall in global oil prices, which is not necessarily a sign home-grown inflation has plummeted.

Nevertheless, the Pound is sensitive to interest rate expectations; two weeks ago it dropped sharply after Bank of England Governor Andrew Bailey said the Bank would be more "activist" on cutting interest rates if the data allowed.

Could this week's fall in headline inflation below 2.0% give the "activist" Bailey the ammunition he is looking for?

We think it could, as the Bank will likely want to ignore the fact that falling oil prices are behind the fall in inflation.

So, while the global picture should support GBP/AUD's upside as AUD unravels excitement over China, UK-specific risks could keep gains limited and keep the pair in touch with the 1.93 support zone.