Pound Poised for a Breakout Against Australian Dollar in the Coming Week

- Written by: Gary Howes

-

Image © Adobe Images

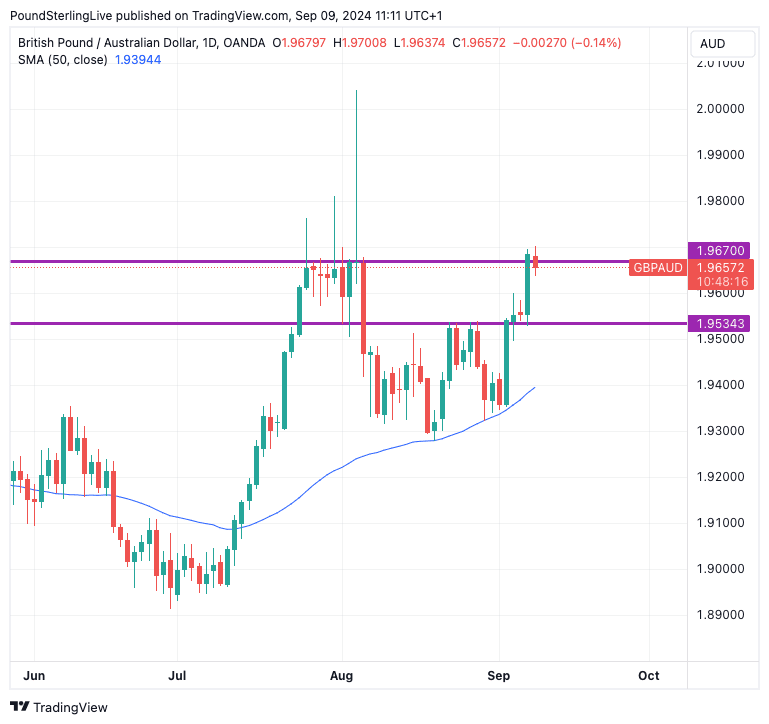

The Pound to Australian Dollar exchange rate (GBP/AUD) is forecast to break above a key resistance line in the coming week amidst falling commodity prices and soft investor sentiment.

An interesting technical development is underway in GBP/AUD with a breakout of a notable resistance point, which if successful, opens the door to higher levels for Aussie Dollar buyers in the coming days and weeks.

Last Monday's Week Ahead Forecast said, "we hope for a more decisive breakout from Thursday onwards," an expectation that was duly delivered with a 0.67% jump in GBP/AUD on Friday. The rally to 1.9695 tracked a global equity market selloff linked to receding expectations for a sizeable 50 basis point rate cut at next Thursday's Federal Reserve decision.

This confirms that global factors are incredibly important for this pair and why we think Wednesday's U.S. inflation release could be the key event in GBP/AUD's calendar this week. But before we look at the details of the release, we must consider the technical picture and the UK calendar, which will also offer some volatility.

GBP/AUD investment bank consensus forecast for 2025. See the median, mean, highest and lowest targets, giving a highly accurate forecasting resource. Request your copy now.

The charts show the break of the previous resistance at 1.9670 is potentially underway. Note, though, that Monday brings us some weakness, so the move is not yet confirmed. The risk for AUD buyers is that the resistance level holds strong and a retreat back into the range transpires again.

Downside targets are 1.9534 and then 1.93 further out. We think there are neverthless better odds of chasing GBP/AUD upside and think the break will hold. This opens the door to a test of July highs near 1.98 in the coming days and weeks. Note September is traditionally a tough month for investor sentiment and seasonality alone bodes for further upside in GBP/AUD.

The Australian Dollar is under pressure amidst an ongoing commodity price decline, which has its roots in China where the property sector simply no longer has the growth to underscore demand for Australia's all-important raw materials. Monday sees this trend extend, with coal dropping to a more than two year low at CNY 1191 and iron ore reaching a fresh one-year low at CNY 662. Both are major Aussie exports.

"The soft Chinese data generally of late, has also seen AUD/USD decouple from relative rates. Slowing growth in the US, China and the Eurozone isn’t comforting for growth-sensitive currencies in general," says Kit Juckes, head of FX research at Société Générale.

We will monitor Chinese data and watch the newires for any further signs of stimulus from authorities there as this can impact AUD trade. "Markets have kicked off the week with ongoing concerns about the Chinese economy as inflation surprised to the downside, while rates traders push back against the idea of a 50bp Fed cut this month," says Juckes.

This brings us to the U.S. inflation report at 13:30 BST on Wednesday, which will likely have the biggest impact on the Australian Dollar, as was the case when last week's jobs data and speeches from two influential members of the Federal Reserve's interest rate setting committee ultimately eliminated the odds of a 50 basis point rate cut at the Fed next week.

"Markets are giving up on a 50bp Fed cut," says Juckes. This has resulted in higher U.S. bond yields and weaker equity markets, which has weighed on AUD, which is highly sensitive to equity performance.

If Wednesday's U.S. inflation print beats expectations, then the Aussie will come under further pressure as any lingering hopes of a 50bp cut in 2024 fade entirely.

GBP/AUD will also monitor Tuesday's UK jobs report: The market looks for employment to have risen 84K in the three months to July, with the unemployment rate at 4.1%. It will be the wage figures that will potentially be of more significance for the Pound as this is something that Bank of England will be watching closely.

Average earnings is predicted to have risen by 4.1% in the three months to July, down from 4.5%. The Bank is not expected to cut rates again in September, but there is some debate over whether they will move again in October and November. Weaker figures will boost the odds of an October cut, which will weigh on GBP/AUD.

Wednesday will see the release of UK GDP figures for July, with the market looking for 0.2% growth, up from the previous month's flat 0% outturn. On paper, the GDP figure is secondary to the wage release, but any sizeable surprises (i.e. more than 2pps) can shake the market, with Sterling likely to weaken on any disappointments and rise on any surprising strength.

There are no calendar events scheduled for Australia this week.