GBP/AUD Rate Forecast: Trading Heavy in Narrow Range

- Written by: James Skinner

Image © Adobe Images

The Pound to Australian Dollar exchange rate (GBP/AUD) has consolidated its rally into early August and could now be likely to trade within a narrow range just above the 1.93 handle over the coming days.

Sterling steadied above support coming from a major Fibonacci retracement around 1.9315 against the Australian Dollar on the charts last week, helped by some upbeat UK economic data.

However, by Friday, the attempted bounce through the opening half of the week was smothered by a broad depreciation of the US Dollar that lifted the Aussie to a slightly greater extent than Sterling.

“AUD/GBP can head higher towards resistance at 0.5192 (50% fibbo) if the RBA’s August meeting minutes are perceived to be hawkish,” Commonwealth Bank of Australia strategists said in a Monday note to clients.

“RBA Governor Bullock has been at pains to emphasise that interest rate cuts are not likely in the near term,” they added.

Above: Pound to Australian Dollar rate shown at daily intervals with Fibonacci retracements of 2024 uptrend indicating possible areas of technical support for Sterling.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The Commonwealth Bank of Australia team’s outlook for AUD/GBP implies that GBP/AUD would have scope to fall towards 1.9260 if minutes of the central bank’s recent meeting are perceived as hawkish on Tuesday.

This outcome would be especially likely if the US Dollar also remains soft in the interim as gains in pairs like AUD/USD and GBP/USD are often at least a modest headwind for the likes of GBP/AUD.

Tuesday’s release of the August meeting minutes is the main calendar highlight for GBP/AUD ahead of Wednesday’s meeting minutes from the Federal Reserve and the release of S&P Global PMI surveys of the manufacturing and services sectors in the US, UK and Europe on Thursday.

“AUD/USD is likely to spend much of the week above our end quarter forecast of 0.6700. A weaker USD will push up AUD/USD later in the week,” the CBA research team said. “GBP/USD can follow the USD trend over most of the week. A softer USD can support GBP/USD.”

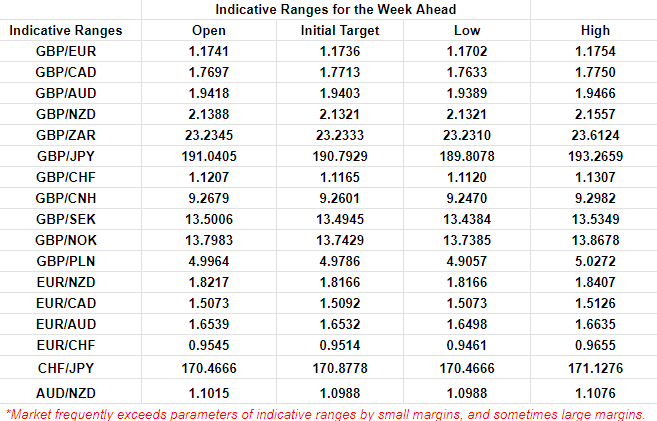

Above: Quantitative model estimates of possible ranges for the week. Source: Pound Sterling Live.

While GBP/AUD could benefit if the S&P surveys suggest a further recovery of the UK economy from last year’s technical recession, the US surveys and their impact on the US Dollar are likely to be more important.

The latter will be scrutinised closely for any signs of US economic momentum moderating in August, while the prices barometers in the surveys will be interrogated for any signs of further disinflation being in the pipeline.

Either such outcome would weigh further on an already-soft US Dollar and act as a headwind for GBP/AUD, keeping it heavy around 1.9315, if not below there.

However, the main event for the US Dollar and global markets this week is the Federal Reserve’s Jackson Hole Symposium where Chairman Jerome Powell speaks on Friday. Market focus will be on whether he validates or pushes back against expectations for up to 100 basis points of interest rate cuts this year.

Any validation of current market assumptions could act as a trigger for more profit-taking on the spceculative market’s US Dollar long position, which would be supportive for pairs like AUD/USD and GBP/USD, while also likely acting as at least a modest headwind for the Pound to Australian Dollar pair.