GBP/AUD Week Ahead Forecast: Moderate Pressure

- Written by: Gary Howes

Image © Adobe Images

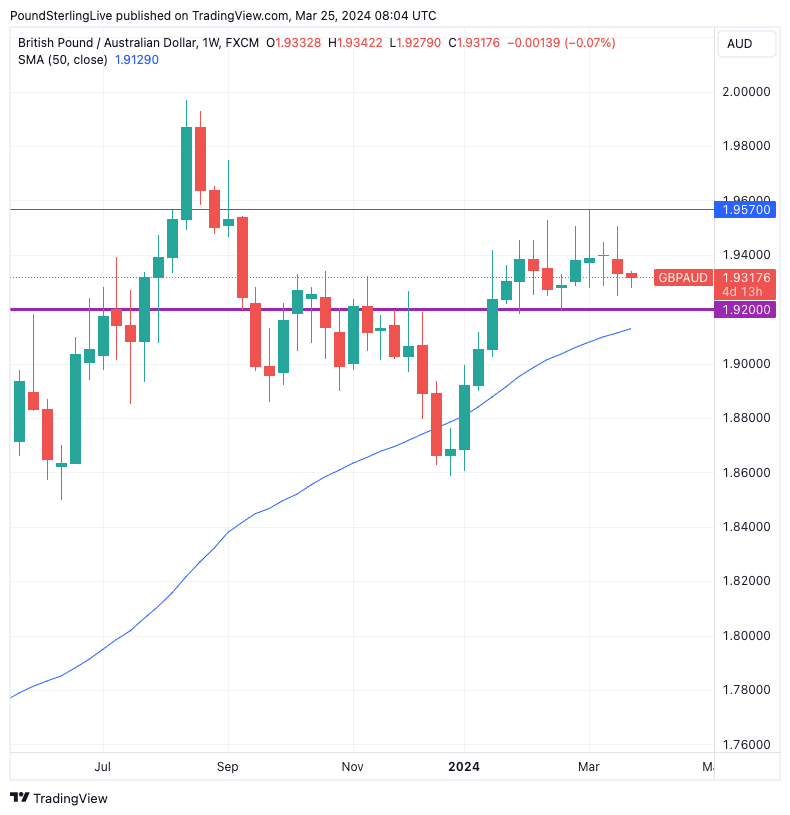

Pound Sterling could stay under moderate pressure against the Australian Dollar in the coming week owing to a softening technical setup and the risk monthly inflation figures will beat expectations.

The Pound to Australian Dollar exchange rate (GBP/AUD) has fallen for three consecutive weeks, although the pullback has not been severe and is consistent with a multi-week consolidation.

GBP/AUD started the year with a strong 5% rally, but since late January, the exchange rate has been trending sideways around a pivot located at 1.9360.

The most recent declines have evolved within the context of the multi-week consolidation and taken us back to this pivot, and further losses to the 1.92 horizontal support are possible in the near term.

Above: GBP/AUD at weekly intervals showing the consolidation range that can hold in the coming week. Track GBP/AUD with your own custom rate alerts. Set Up Here

For now, we expect the consolidation range to hold and wouldn't anticipate a breakdown of that area. The exchange rate remains above the 200-day moving average, which signals to us that the broader trend remains to the upside.

Thus, when the current consolidation is resolved, we anticipate the break being higher, with the 1.9971 2023 peak being the first target.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

Confidence in the timing of such a breakout is limited, and given the respective stance of the Reserve Bank of Australia and Bank of England, the fundamental backdrop to such a move makes it a low conviction expectation at this point.

Last week, the Bank of England (BoE) laid the groundwork for an interest rate cut later this year. This resulted in a weaker Pound Sterling and boosted market confidence that a cut in June would be highly likely.

At the same time, the market expects the Reserve Bank of Australia (RBA) to cut rates a few months after the BoE, offering AUD interest rate carry support. Expectations for an RBA rate cut receded after last week's "extraordinary" job report, which showed the economy added 116.5K jobs in February.

This week's calendar is dominated by Australia's monthly CPI inflation report, due Wednesday, where a rise to 3.5% y/y from 3.4% is expected. Should the figure beat, AUD can rise further.

Thursday sees the release of retail sales data, with the market looking for a slide to 0.4% y/y in February, from 1.1% previously.

"Australian retail sales data will reflect the Taylor Swift effect and likely remain strong. Australian monthly inflation data will reflect more services data coming into the monthly data set and begin to track back higher," says David Forrester, an economist at Crédit Agricole.

Looking forward, watch the release of the RBA minutes for the March 19 policy update on April 02: "We anticipate that the RBA Minutes will not be interpreted as dovish by the market as the RBA’s shift in its bias given that they will reflect the upside and downside risks to inflation and growth that leaves the RBA “not ruling anything out," says Forrester.

"While the RBA dropped its slight tightening bias this week for something more neutral, strong labour market data suggests the RBA will likely be one of the last, if not the last, G10 central bank to begin cutting rates," he adds.

It is this late starter status when it comes to cutting rates that can offer AUD fundamental support over the coming weeks.