GBP/AUD Week Ahead Forecast: Big Bag of Data

- Written by: Gary Howes

Image © Adobe Images

The Pound to Australian Dollar exchange rate (GBP/AUD) is firm at the start of week packed with Australian data releases and the UK's midweek budget.

The Aussie trades broadly softer on Monday following the release of Australian business inventory data which showed a sharply -1.7% decline, as the economy slowed further into year end.

"Inventories will make a substantial negative impact on Q4 growth, subtracting a large -1.0ppt vs our expected -0.5ppts impact," says Andrew Hanlan, an economist at Westpac.

Job advertisements meanwhile fell 2.8% in February, "suggesting employment growth is likely to let up from the current rate and that the unemployment rate will continue to gradually lift higher," says Besa Deda, Chief Economist at St.George Economics.

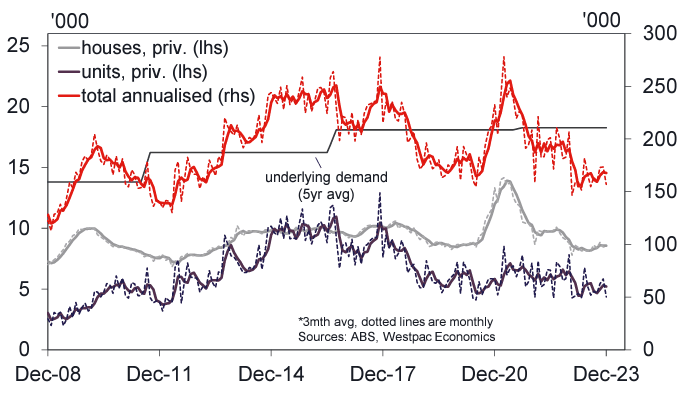

Australian dwelling approvals meanwhile fell 1% month-on-month in January, (+4.8% y/y), which signals a soft start to the year; "the absence of a rebound and the approvals detail suggest there has been an underlying trend weakening although low we always need to be careful when interpreting housing data over the Dec-Jan period," says Matthew Hassan, an economist at Westpac.

The Pound to Australian Dollar exchange rate trades a quarter of a per cent higher at 1.9427 and the Euro to Aussie is higher by 0.17% at 1.6635.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

The Australian Dollar to U.S. Dollar is flat at 0.6519; "for almost a year, the AUD/USD has stuck to a trading range in broad terms of 0.6300-0.6900. We can’t see the AUD/USD sustainably lifting and breaching the top side of this range until the Fed starts cutting and provided the Fed cuts deeper and faster than the RBA," says Deda.

Until AUD/USD makes a break higher, the Australian Dollar will likely remain under pressure against GBP and EUR.

Looking at GBP/AUD specifically, the outlook remains relatively constructive with the pair bouncing off, and trading above, the nine-day moving average at 1.6578. This follows last week's relatively shallow setback for the exchange rate.

Above: GBP/AUD at daily intervals, with RSI in lower panel. Track GBP/AUD with your own custom rate alerts. Set Up Here

The pair remains above the major moving averages while the RSI and ADX are positive, which gives GBP/AUD a broadly constructive setup that puts a test of 1.67 on the cards for this week.

Data will be important as "today kicks off a huge week for economists – there is no less than ten major data releases out," says Deda.

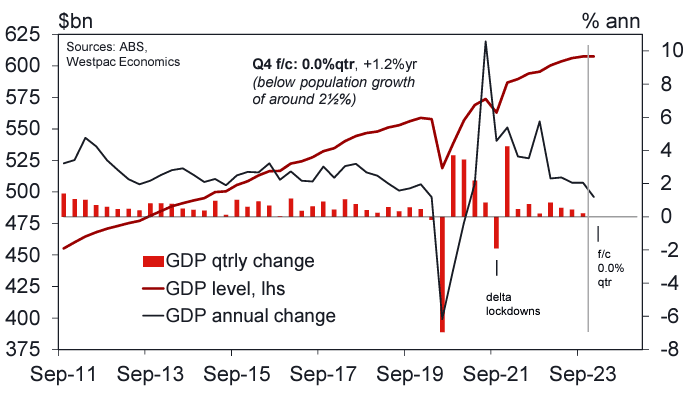

"The biggest in the bag locally is the national accounts data on Wednesday where we receive an important update on the pace of economic activity at the end of 2023. This data could have important implications for the timing of rate cuts," he adds.

Above: Australian dwelling approvals fell away sharply into year-end, a 9.5% drop in Dec, unwinding all of the ‘mini-rally’ through Oct-Nov. Image: Westpac.

The market looks for a reading of 0.3% quarter-on-quarter for Q4, taking the annual increase to 1.4%. An undershoot can result in a softer Aussie Dollar through midweek.

Ahead of the GDP release is the Judo Bank PMI release (late Monday UK time) and the current account update, which is due Tuesday. Both are unlikely to have a major impact on the Aussie.

Thursday sees another trade update (the trade balance) and the release of home loan figures, adding further insights into the housing market.

Above: Aus GDP release will likely show Australia’s economy slowed further in the December quarter against the backdrop of high inflation, higher interest rates and global uncertainty. Image: Westpac.

Money and FX markets remain fully priced for rate cuts to start in September, with one rate cut fully priced in by the end of this year.

Deda says the risk of a second hike is sitting at a probability of around 75%, but this could change after this week's data deluge.

Should data undershoot, the market could raise the odds of a second rate hike, implying AUD weakness, all else being equal.

A potential trigger for GBP moves would be Wednesday's UK budget announcement, the only event worth speaking of on the UK calendar.

We reported recently that if Chancellor Jeremy Hunt gets the March 06 budget wrong, the Pound could fall by as much as 2%, but analysts say the Pound would find some positives if a credible fiscal easing is announced.

Furthermore, any efforts to boost UK productivity, such as business investment tax breaks, can also result in a stronger Pound.

The big risk for the Pound is if the Chancellor announces big tax cuts deemed unaffordable by bond market players, as was the case with Liz Truss' botched budget of September 2022.

ING estimates a 40 basis point risk premium in 10-year gilt yields, "suggesting markets aren't totally immune to UK fiscal risk".

"Were Chancellor Hunt to misread the mood of gilt investors and cause another upset, sterling would again come under pressure," says Chris Turner, Global Head of Markets at ING. "Short-term models suggest a 2% sell-off in sterling could happen quite easily were investors again to demand a risk premium of sterling asset markets."

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes