GBP/AUD Week Ahead Forecast: Staying Constructive

- Written by: Gary Howes

- GBP/AUD technical setup advocates for further gains

- But coming days could see a small pullback

- Much rests on the tone of UK data releases

Image © Adobe Images

The Pound to Australian dollar exchange rate retains a constructive feel in the near term, but we will require this week's UK economic data to beat expectations if a nearby area of resistance is to be broken.

GBP/AUD has trended higher in 2024 amidst receding expectations for a Bank of England interest rate cut that has made Pound Sterling one of the year's best-performing currencies.

On the other side of the coin, we see the Aussie Dollar's underperformance linked to ongoing Chinese economic disappointments and financial market concerns that culminated in a recent commitment by Chinese authorities to support its stock market.

"China growth expectations have had a noticeable imprint on EM FX returns lately, and it looks like that is also true for AUD. The correlation between Chinese equity performance and AUD returns has increased since the start of the year," says a recent analysis from Goldman Sachs.

"We expect that persistently weak Chinese activity and depressed sentiment will continue to counterbalance this policy convergence story and AUD’s typical equity beta, keeping AUD somewhat under pressure for now," adds the Wall Street bank.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

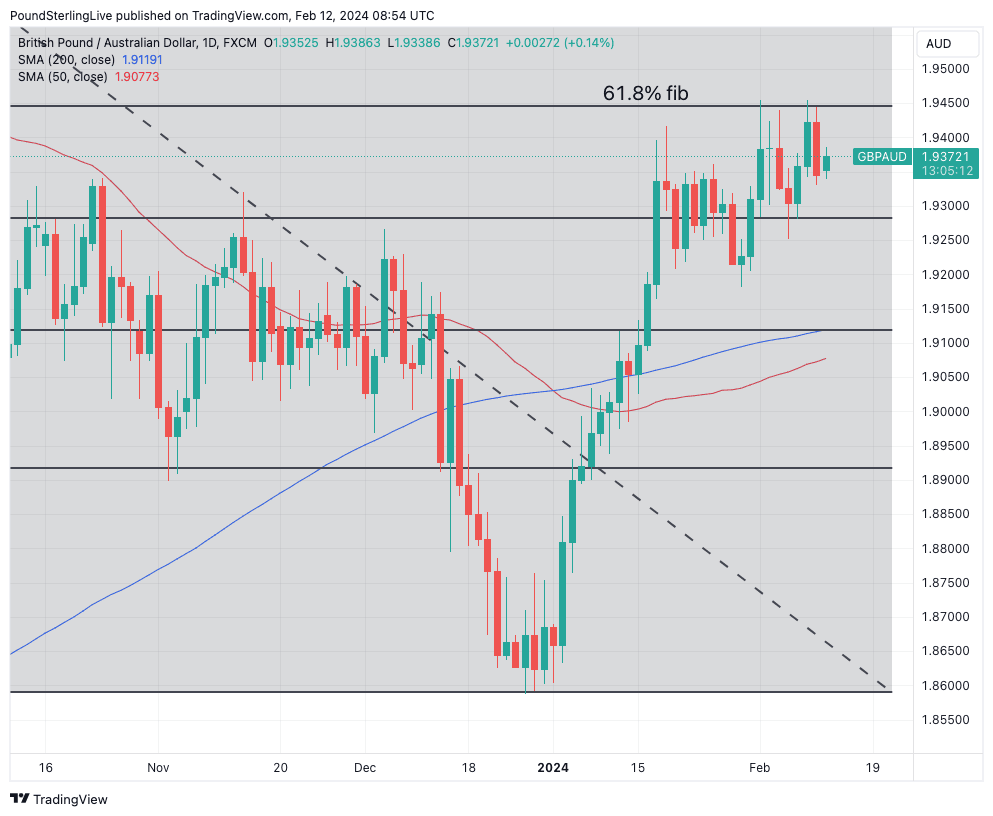

Fundamental noise aside, the daily chart is consistent with further GBP/AUD gains as momentum indicators remain constructive, and we therefore hold an upside bias for the pair.

The rally has found some resistance at the 61.8% Fibonacci retracement level of the August-December downtrend (at 1.9449), which could frustrate progress in the coming days.

Further consolidation in the 1.92-19450 could occur this week if the upside remains capped by this technical barrier:

Above: GBP/AUD at daily intervals. Track GBP and AUD with your own custom rate alerts. Set Up Here

That said, it's a pivotal few days for UK data releases with inflation, wage, GDP and retail sales figures on the docket and heightened volatility can be expected.

It would likely take an outright clean sweep of stronger-than-expected prints to trigger the next upside leg in GBP/AUD, eventually resulting in the pair returning to 1.97.

Disappointment from the data would likely risk a return to 1.92, although we would expect downside damage to be limited given the global context of fading rate cut expectations that traditionally hampers the Aussie and supports the Pound.

Monthly wage data will be released on Tuesday, where a 5.7% 3M/yr reading is expected for December. Inflation is due Tuesday, and markets expect headline CPI inflation to read at -0.3% m/m and 4.1% y/y in January, with the important core CPI rate at 5.2% y/y.

UK GDP data for December 2023, Q4 and full-year 2023 are all due on 15 February at 07:00 GMT; the market looks for -0.1% m/m, -0.1 q/q and 0.2% y/y for the respective releases.

"The UK economy remains on the very cusp of a recession, with our forecast of a 0.2% fall in December GDP enough to deal the final blow and deliver a mild 0.1% contraction in output in the final three months of the year," says Gabriella Willis, UK economist at Santander CIB. "After the fall in GDP already logged in the three months to September, this would be enough to give the UK the unwelcome 'badge' of recession."

Friday brings retail sales data; one only needs to recall that January's release of December retail numbers provided the biggest surprise for the month, sending the Pound lower.

Another weak outturn could result in a dour end to the walk, although we note that survey data has suggested the economy picked up steam in January, which suggests the figures could land on the positive side.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes