Australian Dollar Week Ahead Forecast: More Gains vs. Pound and U.S. Dollar Seen, But Beware RBA

- Written by: Gary Howes

- GBPAUD looks to lower end of the recent range

- AUDUSD could be about to embark on "extended upmove"

- RBA interest rate decision dominates the calendar

Image © Adobe Images

The Australian Dollar enters the first full week of December with a spring in its step with technical setups against the Dollar and Pound looking increasingly constructive, although Tuesday's Reserve Bank of Australia meeting could provide a setback.

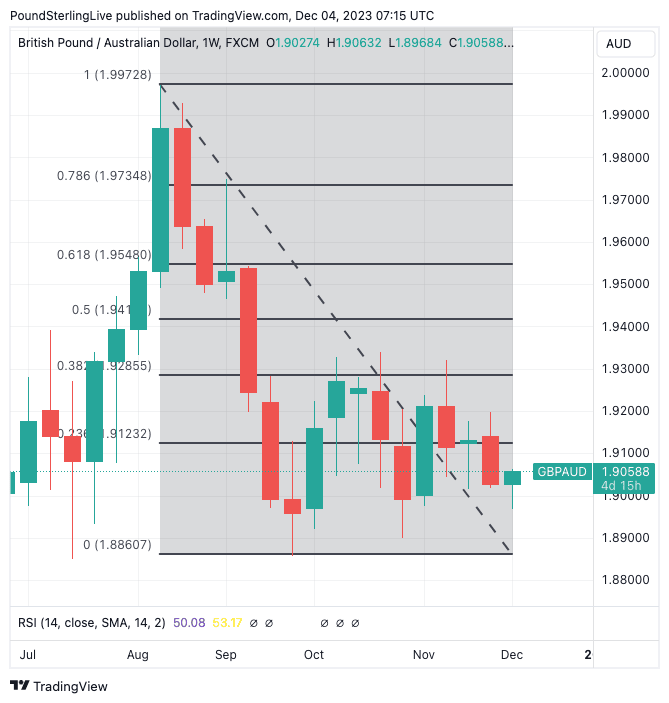

The Pound to Australian Dollar exchange rate fell half a per cent last week to close at 1.9027 to confirm a soft technical outlook is building.

The pair is contained within a sideways range with 1.8860 at the bottom (the September multi-month low) and 1.9285 at the top (this is the 38.2% Fibonacci retracement level of the August-September selloff).

Note, 1.9285 also forms the approximate level of the 100-day moving average, which will add to the resistance interest in this area and cap gains in the event of Australian Dollar weakness and Sterling strength.

Above: GBPAUD at weekly intervals showing Fibonacci levels. Track AUD with your own custom rate alerts. Set Up Here.

The range is likely to hold in the current macroeconomic environment. However, the recent Australian Dollar strength suggests momentum in GBPAUD is increasingly pointed to the downside, and we are now more likely to test 1.8860 before we see 1.9285.

The 200-day moving average is now located close at hand at 1.8959 and could provide some support over the coming days by arresting any weakness and delaying a retest of 1.8860.

Note, GBPAUD has not traded below the 200 DMA since February, and a move below here could indicate a more decisive swing lower is underway on a multi-week basis.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

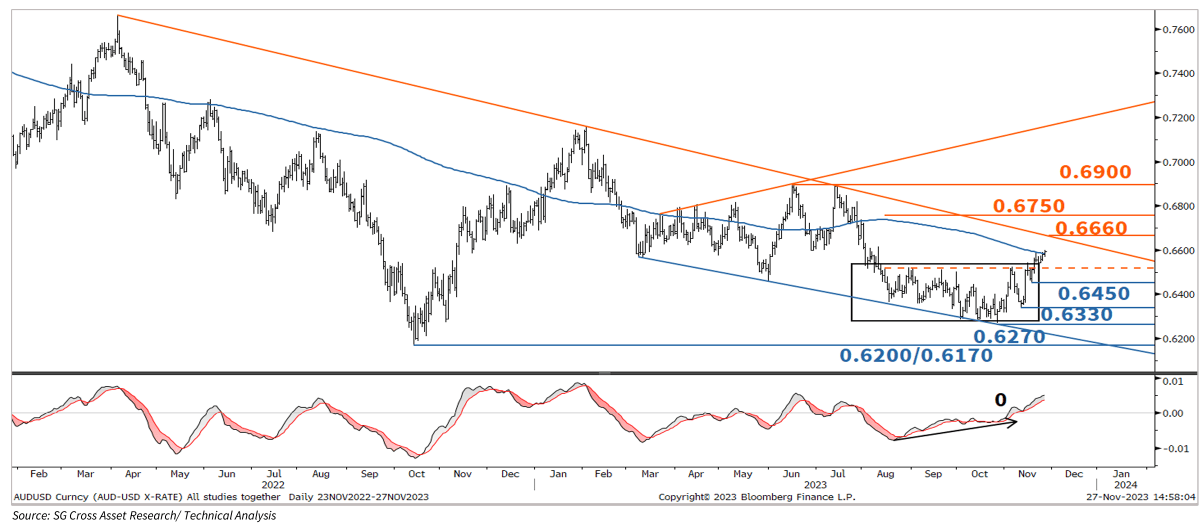

Further downside pressure in GBPAUD is likely if the Australian to U.S. Dollar exchange rate (AUDUSD) is able to execute a breakout higher, something analysts at Société Générale are anticipating.

"AUD/USD formed a higher low near 0.6270 and evolved within a small base. Breakout from this range has led to the onset of a steady rebound, leading the pair towards 200-DMA.

A retest of the trendline drawn since 2022 near 0.6660 is expected," says Tanmay Purohit, a technical analyst at Société Générale.

Purohit says once 0.6660 is overcome, "AUD/USD could embark on an extended upmove".

The next potential objectives could be located at July highs of 0.6900.

"Recent pivot low near 0.6450 is expected to provide support in case short-term pullback develops," he adds.

Above image courtesy of Société Générale.

The main event of the coming week for the Australian Dollar pairs is Tuesday's Reserve Bank of Australia policy decision, where interest rates are expected to be kept on hold following last month's hike.

The decision itself is therefore unlikely to bother AUD, but the guidance and tone of the statement is where the disruptive powers lie.

"We expect that cash rate to remain unchanged at tomorrow’s meeting. However, this does not mean the RBA is finished with rate hikes. While our central view remains that we are at the cash rate peak, an upside surprise cannot be ruled out, particularly on the services side of the economy," says Pat Bustamante, Senior Economist at St. George Bank in Sydney.

Should the RBA signal a strong likelihood of a further rate hike, the Aussie Dollar could benefit.

"The RBA is set to keep the cash rate unchanged in December, but a hawkish bias will be maintained into February 2024," says Micaela Fuchila, an economist at Bank of America.

Yet should the RBA sound more confident that its 'job done' on rate hikes, the market could move to bring forward bets for 2024 rate cuts, easing recent Aussie upside potential.

AUD fell in the wake of the November hike owing to accompanying guidance that further hikes won't be likely. "Although the RBA hike was expected by the majority of the forecast community, markets were not completely sold on the idea, which is why it is curious that the AUD weakened on the decision and that bond yields fell," said Robert Carnell, Regional Head of Research for Asia-Pacific at ING Bank, at the time.

We would be wary of such repeat price action in December.

Also, keep an eye on Wednesday's Australia GDP due for release Wednesday, as this could underpin any message from the RBA regarding the outlook for rates.

The market looks for a 0.3% increase quarter-on-quarter in the third quarter, meaning anything below could disrupt the Australian Dollar's upside potential if the market pares back expectations for RBA rate hikes as a result.

A stronger-than-expected reading would have the opposite effect.

National Australia Bank (NAB) sees a +0.5% q/q (1.9% y/y) GDP print for Q3 2023.

"For the RBA, such an outcome would confirm the economy is tracking through a period of below-trend growth but has avoided major contraction. The support to activity from rapid population growth will be evident with per capita GDP likely falling further – reflecting a larger ongoing adjustment to pressures in the household sector at the individual level," says Alan Oster, Group Chief Economist at NAB.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes