NAB Not Budging on 2015 Australian Dollar Forecasts

The temptation to lower their forecasts on the Aussie dollar has been rejected by the currency strategy team at NAB.

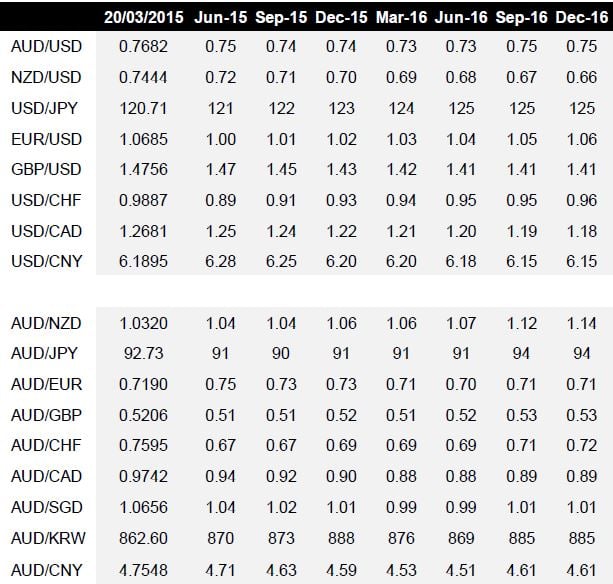

Please see the detailed forecast table at end of article.

Analysts say they had considered further lowering their Aus dollar forecast targets alongside that of the euro.

However, a decline in the USD exchange rate complex since the FOMC meeting mid-month has prompted NAB to maintain current predictions.

We have also seen strong moves registered against the pound sterling, taking it back to the lower end of recent ranges.

“Ongoing pressure on Australia’s terms of trade led by the relentless decline in iron ore prices argue for still lower AUD levels, but the pressure on AUD/USD from Fed policy tightening are lessened. We maintain our 0.74 end-2015 and 0.73 early 2016 forecasts,” says a client note issued by NAB towards the end of March.

Latest AUD Levels

For reference, the pound to Aus dollar exchange rate (GBPAUD) is quoted at 1.9031. We are fast approaching the 1.90 level which, as we note here, could hold the key to a resumption of the pound’s rally. The year’s high was at 2.0032.

The euro to Aussie dollar rate (EURAUD) is at 1.3913. The 2015 maximum was reached at 1.4895.

The Australian to US Dollar (AUDUSD) is at 0.7831. This is down from a high of 0.8295.

The Australian to New Zealand dollar exchange rate (AUDNZD) is at 1.0295, the highest level was seen at 1.0798.

Downside Risks to the Aussie Forecast Do However Exist

It must be noted that analysts still do see the potential for the AUD/USD exchange rate to sink to 0.70 at some point this year or early next.

“But for this to be realised, it is likely we’ll need to see the Fed move more than twice on policy before year end, or a much steeper fall in the AU terms of trade that we already factor in,” say NAB.

On present indications the latter it appears that risks look skewed to the latter – terms of trade could indeed deteriorate further than many are expecting.

NB. All currency quotes mentioned in this piece reference the wholesale market. Your bank will affix a discretionary spread when transferring money internationally. However, an independent provider will seek to undercut your bank's offer, thereby delivering up to 5% more currency in some instances. Please learn more.

NAB are also working from the assumption that no more than two, 25-point, tightenings are to be delivered by the FOMC this year based on the FOMC’s new median ‘dot point’ forecasts at face value.

NAB say using their AUD short term fair value models, the addition of a full 1% to the US interest rate from present levels only produces about a 3 cents fall in the fair value estimate for the AUD

The latest fall in iron ore prices, meanwhile, that makes up 32.2% of the RBA’s commodity price basket, has brought the year to date decline to 23% (using China import prices for the 62% fines grade).

This points to fresh pressures ahead for the AUD argue analysts.

With regards to the RBA’s own policy, don’t expect too much impact on the Australian dollar exchange rate complex.

The AUD Forecast Table.

Below are the late March predictions issued by NAB.