Australian Dollar Under Pressure In Wake of Soft Chinese Inflation, Trade Prints

- Written by: Gary Howes

- AUD underperforms most peers

- Following soft Chinese inflation data

- AUD saw biggest daily fall since March on Thursday

- Following U.S. inflation figures

Image © Adobe Images

The Australian Dollar was underperforming on the day China revealed below-consensus inflation and trade figures, suggesting Australia's most important trading partner is still struggling to build growth momentum.

China - which accounts for the bulk of Australia's foreign exchange earnings - said inflation was flat at 0% year-on-year in September, which undershot a market consensus expectation for a reading of 0.2%.

China also revealed that its trade surplus increased modestly to $US78BN, although Chinese exports and imports decreased by 6.2%/yr.

These numbers provide further evidence that China is failing to rebuild any meaningful growth momentum, which can weigh on China-linked proxies, such as the Australian and New Zealand Dollars.

"A poor sign for both the Chinese and world economies. The poor outlook for the world economy is a negative for CNH as well as commodity currencies such as AUD and NZD," says Joseph Capurso, a strategist at Commonwealth Bank of Australia.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

"Chinese exports are likely to remain weak in Q4, due to still-sluggish demand from the U.S. and EU. China’s domestic demand is on the path of a slow recovery on the back of further targeted support, especially funding for infrastructure and manufacturing investment," says Duncan Wrigley, Chief China Economist at Pantheon Macroeconomics.

Asian markets were lower in response to the numbers, and the Australian Dollar was recorded down against the majority of its peers. The Pound to Australian Dollar rate extended its recovery to 1.9320, the Australian Dollar-U.S. Dollar rate was lower at 0.6312.

To be sure, Chinese data has been improving over recent weeks, which has aided the Aussie Dollar against the likes of the Pound and Euro. Although on the soft side, there is nothing alarming contained in Friday's inflation and trade numbers, potentially limiting any downside to AUD via this channel.

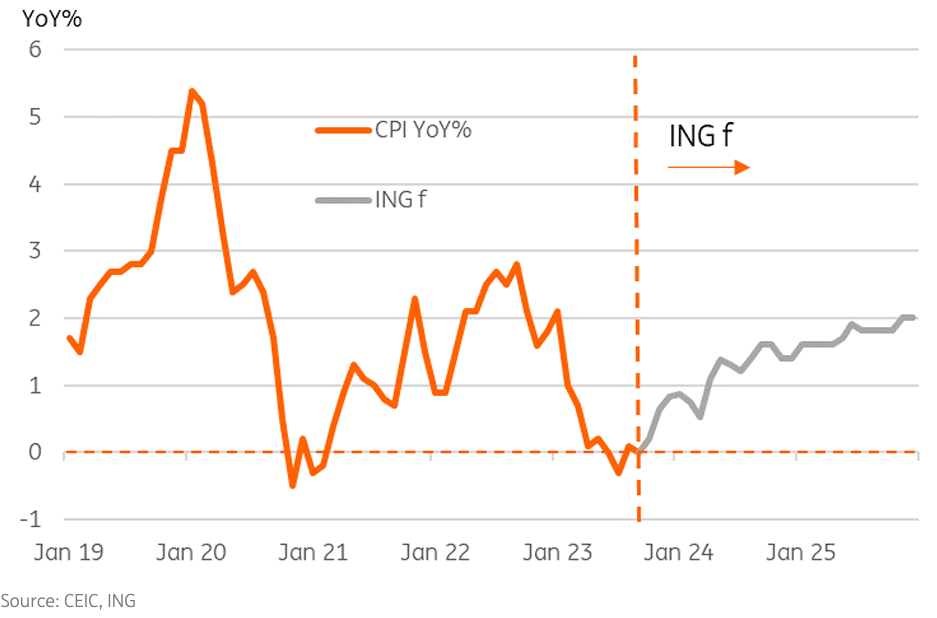

Above: Chinese CPI and projections by ING Bank.

Looking ahead, much will depend on further measures announced by Chinese authorities to boost growth.

Pantheon's Wrigley notes local governments sped up the issuance of local government special-purpose bonds to complete the annual quota by the end of September.

"More fiscal or quasi-fiscal support is likely in Q4, as China seeks to calibrate support to offset downward growth pressures from insipid exports and the struggling property sector. This points to continued modest import demand increase, notably for energy and raw materials," he says.

Ahead of the Chinese data, the Australian Dollar was limping into the final day of the week following Thursday's sharp selloff in response to strong U.S. inflation data.

Global markets fell and long-dated bond yields spiked after U.S. inflation beat expectations and suggested the Federal Reserve might have little choice but to raise interest rates again before the year is out.

The dynamics created a 'risk off' sentiment that traditionally penalises the Australian Dollar. The AUD/USD exchange rate lost 1.50% in value on Thursday, its largest single-day loss since March.

"AUD/USD held onto its US CPI‑fuelled losses and is near 0.6320. Australian government bond yields followed US yields higher across the curve," says Capurso.

U.S. core services inflation (excluding shelter) registered a second consecutive month of strength, as it lifted 0.5% m/m after a 0.4% increase in the month prior.

The Federal Reserve's preferred measure of prices tied to underlying demand, non-housing services, saw another substantial increase of 0.5% in the month.

"The underlying detail in the report suggests that demand-side price pressures are heating up and will likely require more restrictive monetary policy. As a result, we expect the Federal Reserve to raise rates in December, allowing some time for more data and to judge the durability of the tightening in the bond market," says Ali Jaffery, an economist at CIBC Capital Markets.

The 'higher for longer' expectation for U.S. interest rates will ensure global financing conditions remain elevated, which will weigh on global growth dynamics, in turn penalising commodity-linked currencies such as the Australian Dollar.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes