GBP/AUD Week Ahead Forecast: Still Under Pressure, RBA Dominates Focus

- Written by: Gary Howes

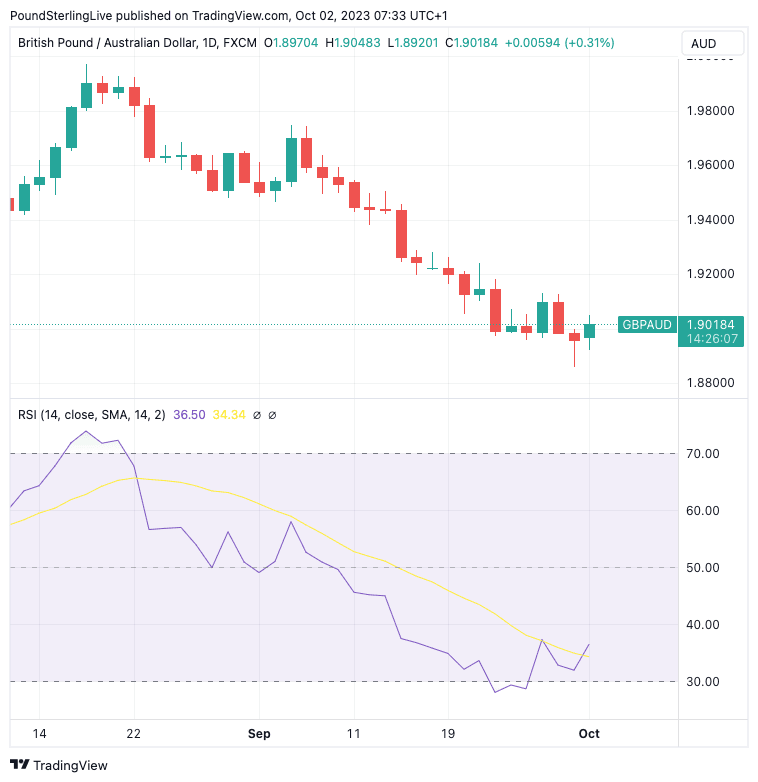

- GBPAUD consolidating from oversold conditions

- But downside still favoured

- RBA in focus, tipped to strike 'hawkish' tone

- This can boost AUD further

Image © Adobe Images

The Pound's recent selloff against the Australian Dollar has eased over recent days but the exchange rate remains vulnerable to further losses, particularly if Tuesday's Reserve Bank of Australia (RBA) decision is more 'hawkish' than expected.

In our previous week ahead forecast for GBPAUD we said the pair was likely to consolidate as it had become oversold, and that is what we saw, with levels above 1.8960 being respected. Indeed, GBP/AUD ended the week relatively flat with a slight -0.17% move, which contrasts to the +1.0% declines witnessed in the previous two weeks.

So maybe downside pressures are easing, but there is little evidence that the GBP is ready to stage a notable comeback and the bias remains one of weakness.

Above: GBPAUD at daily intervals with the RSI in the lower panel. The RSI has corrected from oversold conditions, explaining the recent stability in GBPAUD.

Improved investor sentiment towards the end of last week resulted in a stock market rally that boosted risk-sensitive currencies such as the Aussie and Kiwi Dollars against the likes of the British Pound.

"High-beta currencies such as the Australian dollar, New Zealand dollar and Swedish krona rebounded significantly," says Natixis, the investment and commercial bank. "After spending five sessions on the back foot and kicking off the session lower, equity indices rebounded."

Stock markets have struggled of late as the cost of borrowing across the global economy continues to rise on account of the surge in long-dated bond yields, led by the U.S.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

This rise in yields has proven negative for markets while at the same time benefiting the U.S. Dollar which remains on the front foot against the antipodean currencies.

Yet the Australian Dollar has been a relative winner having advanced against most of its peers, despite the recent rise in long-term bond yields, suggesting some idiosyncratic strength is at play.

For sure, some of this outperformance is linked to the improvement in Chinese-linked assets, as indicators suggest the worst of the Chinese slowdown has passed.

The end of peak China pessimism could also spell the end of peak AUD pessimism.

Looking at the fundamentals, the UK's calendar is empty this week and all focus will be on the Reserve Bank of Australia (RBA) which will give its latest interest rates decision and guidance on Tuesday at 04:30 BST.

"The RBA and RBNZ meet next week. We see rates on hold with a hawkish bias despite weak domestic and global conditions," says Micaela Fuchila, Economist at Merrill Lynch in Australia.

Any hawkish bias would be consistent with Australian Dollar strength, which could mean further GBPAUD downside. So although GBPAUD is oversold, these conditions could yet persist.

Bank of America says there is clear evidence that suggests the Australian consumer is under pressure as households draw down savings, and inflation/ bracket creep erodes disposable income. Economists see the RBA and RBNZ leaving rates on hold in October, but there is some risk for further hikes in November (especially from the RBA).

"In our view, current economic conditions do not justify a hawkish stance, but elevated inflation means both Reserve Banks will retain their hawkish bias to ensure inflation expectations do not re-accelerate on the back of higher oil prices," says Fuchila.

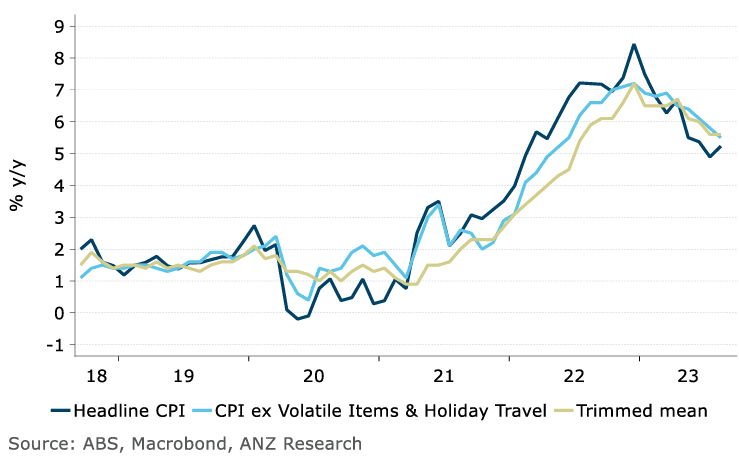

Above: "Monthly CPI reaccelerated to 5.2% y/y: Headline CPI indicator rose in August, and trimmed mean inflation was stable at 5.6% y/y." - ANZ.

Tuesday's decision will be Michele Bullock's first appearance as Governor Fuchila says there is a risk she seeks to reset the tone of the RBA's communications.

"We expect another hawkish pause from the RBA when it meets this week," says Adam Boyton, Head of Australian Economics at ANZ. "The post-meeting statement will likely note the labour market is still tight but easing and that inflation remains too high."

August monthly CPI indicator printed at 5.2%, up from 4.9% in July, although this was largely a result of higher energy costs which the RBA would likely ignore.

But ANZ's economists note "a little more inflation in other parts of the basket versus our expectations".

"For now, we still see the RBA on an extended pause, but signs inflation might be running a little higher than expected are consistent with the risk we have been highlighting, namely if the RBA moves this year or early next rate rises are more likely than cuts," says Zollner.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes