Australian Dollar Slips to New 2023 Low on News Chineses Imports from Australia Slumped 10% in July

- Written by: Gary Howes

Above: Terminal, Shanghai, China. Image © Adobe Stock

The Australian Dollar slipped to a fresh 2023 low against the British Pound and was softer against all its major peers on the day it was announced China saw a sharp slump in both imports and exports in July as an economic malaise continued.

China reported a 12.4% year-on-year decrease in imports, down on June's 6.8% drop, and below analyst expectations for a reading of -5.6%. It was reported that China's imports from Australia fell a sizeable 10.9% in July, helping explain Tuesday's slide in the Aussie currency.

The latest trade figures suggest the downturn in the world's second-largest economy continued into mid-year amidst a slump in global demand for its goods. Chinese exports fell 14.5% y/y in July, after dropping 12.4% in June, the consensus was -13.2%.

"Chinese exports declined at a faster rate in July, in an indication of waning global demand," says Duncan Wrigley, Chief China Economist at Pantheon Macroeconomics.

"Chinese exports are undergoing a pronounced downward trend – as the July data published today illustrates. Even more so than analysts had predicted beforehand," says Ulrich Leuchtmann, Head of FX and Commodity Research at Commerzbank.

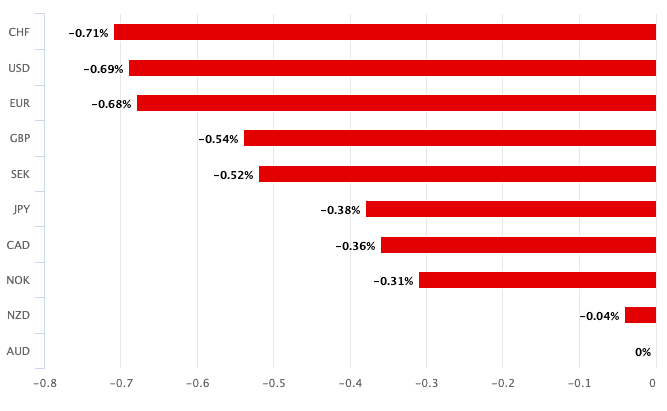

The effect of the data on the Australian Dollar was noticeable with the currency falling against all its peers:

Above: AUD fell against all G10 peers on August 08.

The Pound to Australian Dollar exchange rate meanwhile rose to its highest level since April 2020 at 1.9540 as the entrenched uptrend that has held a grip over this pair since September 2022 extended and we note little to suggest a turnaround is imminent.

The Australian-U.S. Dollar exchange rate meanwhile fell 0.70% to 0.6527 which puts the pair near a major support line (0.65), which if broken could result in a decline to the 2022 lows located near 0.64.

With a dearth of Australia-centric data releases the Australian Dollar was always likely to find developments in China as being the key near-term driver and today's trade data will be followed by a midweek Chinese inflation release that will likely confirm deflationary trends are setting in amidst the economic slowdown.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

The trade statistics showed the import values of iron ore - Australia's main export earner - fell at double-digit rates even as volumes remained relatively well supported, suggesting strong global supply. China is Australia's most important trading partner and a key source of foreign exchange earnings, ensuring the Australian Dollar is often considered a proxy for expressing sentiment towards China.

"The recent emergence of serious deflationary pressures in the world’s second-largest economy is triggering concerns that extend well beyond its borders," says Nigel Green, CEO at de Vere Group.

"Reduced demand for raw materials and commodities due to its economic slowdown is likely to lead to a decrease in global commodity prices. Those countries heavily reliant on commodity exports would then experience economic hardships as their revenues decline," says Green.

The outlook is set to remain subdued as China’s exports are likely to continue falling in H2, says Wrigley at Pantheon Macroeconomics, as the U.S. is likely to enter a mild recession, while the Eurozone economy probably will remain weak.

Chinese authorities have meanwhile announced a number of measures to try and reboot the post-Covid rebound, which some strategists could offer the Australian Dollar support.

But thus far measures have failed to offer the scope required to turn the massive Chinese economy around.

"China is opting for only a limited stimulus, largely focused on supply-side measures, though also including tax cuts for SMEs and an incremental loosening of city-level property policies, such as mortgage terms. Policymakers appear determined to allow household spending and business investment to take the lead in this recovery cycle, even if that means a drawn-out, "tortuous" upturn," says Wrigley.

Above: AUD/USD (top) and GBP/AUD at weekly intervals.

The Australian Dollar will meanwhile continue to track China's Yuan lower as the correlation between the two currencies remains tight on account of the tight trading partnership between China and Australia.

"The covid-related boom of the Chinese export sector is coming to an end at an impressively high rate of deceleration. On the one hand, that is happening at an unfortunate moment, as it coincides with weak domestic demand, thus reinforcing and amplifying the negative economic effects. And on the other hand, that does not bode well for the Chinese currency," says Leuchtmann.

"If the goods that have to be paid for (directly or indirectly) with renminbi are no longer in demand as much, the renminbi is less valuable," he adds.

The rule of thumb remains that what is not good for the renminbi is also not good for the Australian Dollar.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes