GBP/AUD Rate's Week Ahead Forecast: Central Bank-Centric

- Written by: Gary Howes

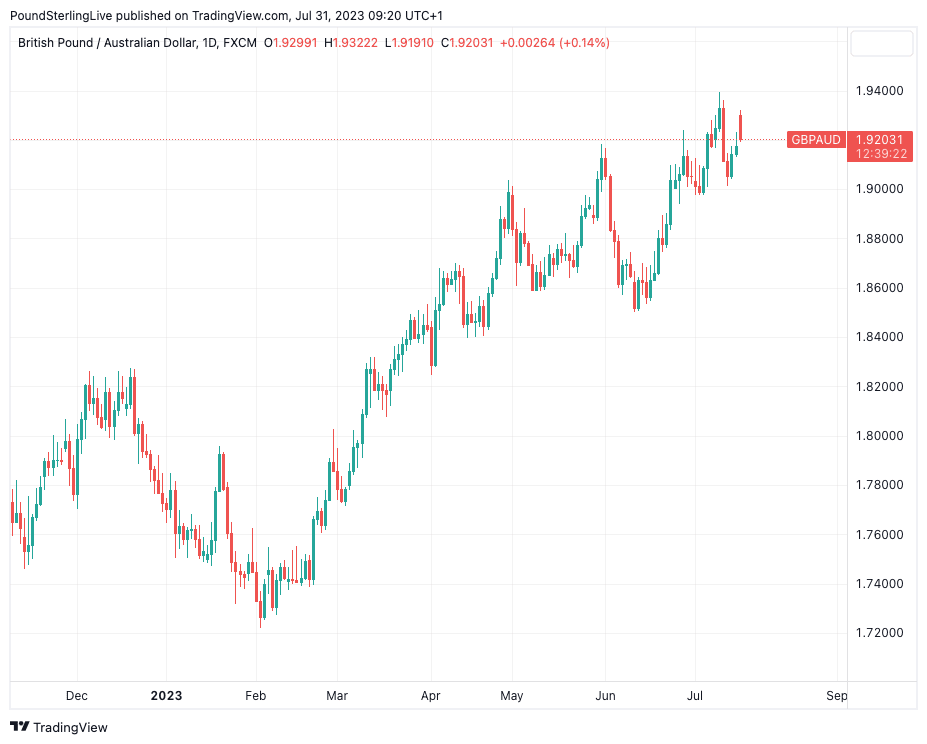

- GBPAUD uptrend intact

- RBA in focus Tuesday

- Surprise hike could soften GBPAUD

- Bank of England is up on Thursday

- Where a number of scenarios are in play

Image © Newtown Grafitti, Reproduced under CC Licensing.

The Pound to Australian Dollar exchange rate (GBPAUD) remains in an uptrend that is yet to show any signs of decay and further advances are therefore likely, however, two central bank meetings will set the tone for this pair in the coming week.

GBPAUD has been trending higher since September 2022 and the recent July pullback in the exchange rate to ~1.90 was shallow and consistent with the pattern of 'higher lows' that would be expected of an uptrend.

The 2023 high is at 1.94 and is therefore in play this week, but a busy event calendar populated by the Reserve Bank of Australia on Tuesday and Bank of England on Thursday could yet stymie the rally.

Market pricing currently shows investors are positioned for the central bank to hold interest rates.

Therefore, if the RBA proceeds with a hike the foreign exchange market would likely bid the Aussie Dollar higher as this would amount to a 'hawkish' surprise, something Commonwealth Bank of Australia is expecting.

"AUD/USD can temporarily lift by 0.8%, or around ½ cent, if the RBA hikes by 25bp as our Australian economics team expect," says Karol Kong, a strategist at Commonwealth Bank of Australia.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

Ahead of the decision, the Australian-U.S. Dollar exchange rate is up half a per cent at 0.6686 while the GBPAUD exchange rate is down by half a per cent at 1.9209.

Economists at Barclays are also on the hawkish end of the spectrum and expect the RBA to deliver a final 25bp hike at this meeting.

"A strong labour market and increasing wages, which drove up services inflation in Q2, will likely keep the board concerned about possible increases in inflation again, especially as one-off tariff hikes come into effect in Q3. We note the possibility that a rate hike may be delayed to September but think the most likely time is the August meeting," says Barclays in a weekly note.

Above: GBPAUD is trending higher.

Although an interest rate hike could prove initially supportive of the Australian Dollar it will most likely be the guidance as to future policy that guarantees the enduring reaction.

For example, an interest rate hike accompanied by a firm commitment to no further hikes could be interpreted as being 'dovish' as it could prompt markets to raise expectations for interest rate cuts to start sooner than previously expected.

This could weigh on the Australian Dollar.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

In a similar fashion, holding interest rates, but keeping the door open to further hikes could support the currency, ensuring a decision that will offer a decent amount of interest for those watching Aussie Dollar direction this week.

An outright 'bearish' development for AUD would involve no hike and a signal that no further hikes are imminent a development that would help GBPAUD to test new 2023 highs, all else being equal.

"We expect the RBA to leave the cash rate unchanged in August. This would mark the second month of what is likely to be an extended pause," says Adam Boyton, Head of Australian Economics at ANZ.

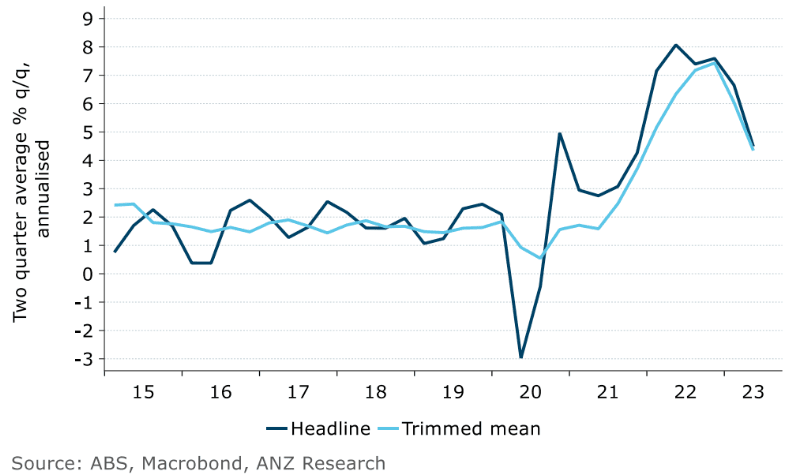

Several factors support ANZ's expectation of an extended pause: inflation is moderating more quickly than the RBA expected (second quarter headline inflation was 0.3ppt below the May SoMP forecast, and trimmed mean 0.1ppts below).

The RBA described its policy stance as being "clearly restrictive" in the minutes from the July meeting and ANZ's economists observe broader signs of slowing consumer demand.

"If the volume of retail sales falls in Q2 as we and the market expect, that would mark three consecutive falls something only previously seen during the GFC," says Boyton.

Above: Aus inflation is moving in a direction consistent with an RBA pause says ANZ.

But the RBA reaction will have a limited shelf life as the Bank of England delivers its own decision on Thursday, where either another 50 basis point hike or 25bp hike is expected.

The initial reaction to a smaller hike would be Pound weakness, but again, the enduring reaction would most likely rest with the guidance.

After all, a seemingly 'hawkish' 50bp hike won't be considered hawkish if it is accompanied by guidance effectively saying this is the last hike.

Instead, a 25bp hike backed by a clear majority of the Monetary Policy Committee and relatively unchanged guidance would be supportive of the status quo, which embodies the Pound's 2023 uptrend.

Markets will also be keeping an eye on the Bank's latest economic forecasts, particularly inflation forecasts, where any uplift would potentially be regarded as hawkish and supportive of the Pound.

While there is a chance the Pound ends Thursday lower it would take an outright 'dovish' turn from the Bank to turn the Pound's trend, and for now the UK's inflationary backdrop precludes such a development.

Although the two central banks form this week's highlight for the Aussie Dollar, global drivers will also have an impact.

Last week we saw the Australian Dollar take cues from both U.S. and Chinese data releases and would expect the same over the coming days as global investor sentiment is a key driver of this currency.

The U.S. labour market report out Friday is of particular interest with a strong report likely to boost the U.S. Dollar and weigh on sentiment, which could undermine the Aussie if it encourages markets to bet for further Fed hikes.

But, more generally, sentiment remains broadly buoyant with investors expecting the U.S. economy is likely to avoid a 'hard landing' scenario whereby the economy falls into recession owing to interest rate rises at the Federal Reserve.

Firm economic activity data, falling inflation and expectations that the Fed is close to ending its rate hiking cycle all underscore this optimistic theme and can keep the AUD supported over the coming days.

AUD was up against the majority of its peers after the Fed last week confirmed a further rate hike in September was not a done deal, instead preferring to base its next decision on the flavour of incoming data.

The outcome was consistent with an improved investor sentiment linked to expectations that the interest rate hiking cycle in the U.S. has come to an end; a sentiment which tends to support AUD.

With this in mind, investors will remain alert to any negative data surprises that would upend this trend, and mid-month U.S. inflation figures due mid-month will therefore be closely watched.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes