Australian Dollar Forecasts Downgraded at Commonwealth Bank of Australia

- Written by: James Skinner

"We expect a recovery in AUD to emerge later this year as market participants price an eventual recovery in the global economy" - Commonwealth Bank of Australia.

Image © Adobe Stock

The Australian Dollar has been one of the biggest fallers among major currencies this year but downgraded forecasts from Commonwealth Bank of Australia (CBA) suggest it could fall further against some currencies and remain an underperformer in the months ahead.

Australia's Dollar has fallen against many currencies so far in the year and rose against only six counterparts in the G20 basket during the opening quarter including the Japanese Yen, New Zealand Dollar, Norwegian Krone, Korean Won, Turkish Lira and South African Rand.

"The main reason for the fall in AUD is the fall in commodity prices. China's Two Sessions meetings did not deliver policy stimulus that we expected to support metal prices," says Joseph Capurso, head of international economics at Commonwealth Bank of Australia.

"The two year interest rate differential with the US is also heavily weighing on AUD/USD. We forecast more weakness in AUD/USD this year for three main reasons," Capurso wirtes in a review of CBA's forecasts last week.

Commbank Research estimates that prices of Australia's export commodities are likely to fall further in the months ahead, and by anything between 15% and 20% in response to subdued infrastructure investment in China and recessionary conditions in other advanced economies.

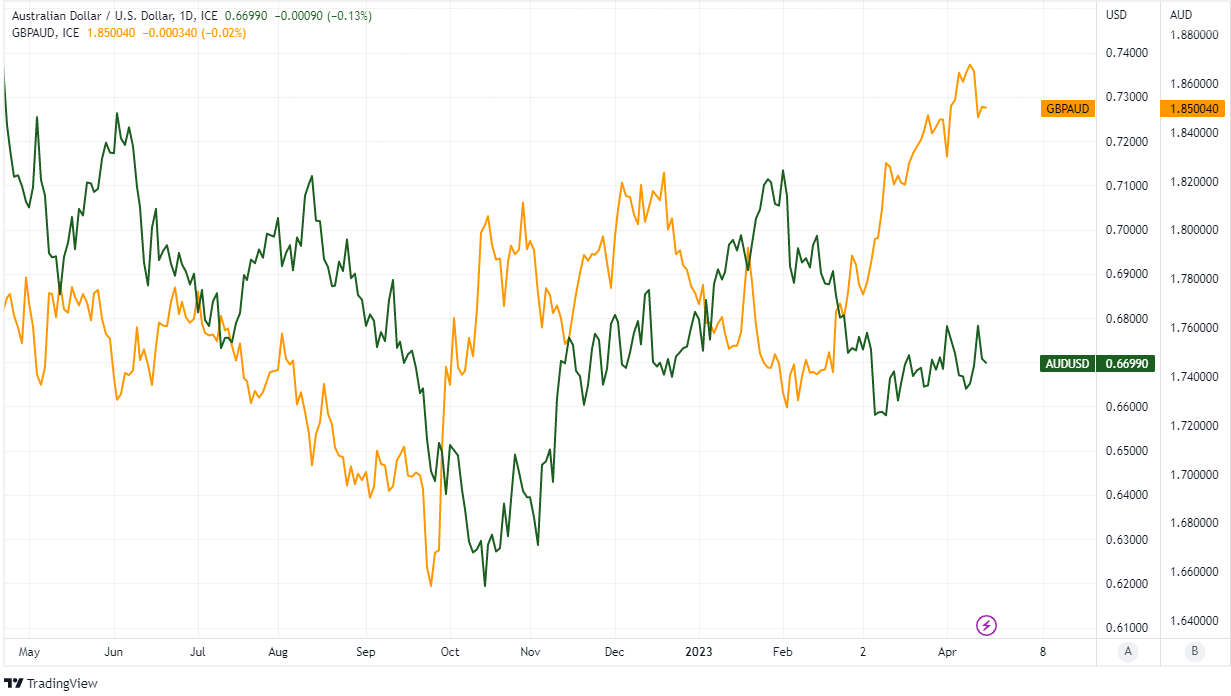

Above: AUD/USD shown at daily intervals alongside GBP/AUD. Click image for closer inspection.

Above: AUD/USD shown at daily intervals alongside GBP/AUD. Click image for closer inspection.

Commodity prices are said to be a prominent influence on the Australian Dollar and their prices are susceptible to the effect of central banks' responses to resurgent inflation, which are expected to hamper economies in Europe, North America and elsewhere over the coming months.

"The main risk to our AUD/USD forecast is if China's recovery is weaker than we expect," Capurso says.

"In particular, the Chinese economy has not rebounded strongly like other economies have following the removal of lockdowns. However, it is possible Chinese authorities resort to infrastructure investment if the advanced economies recession is deeper than expected," he adds.

Interest rate differentials have also been flagged as a likely weight around the ankles of the Australian Dollar, and particularly in relation to the U.S. Dollar owing to CBA's view that financial markets have been mistaken to speculate that borrowing costs are likely to be cut before year-end.

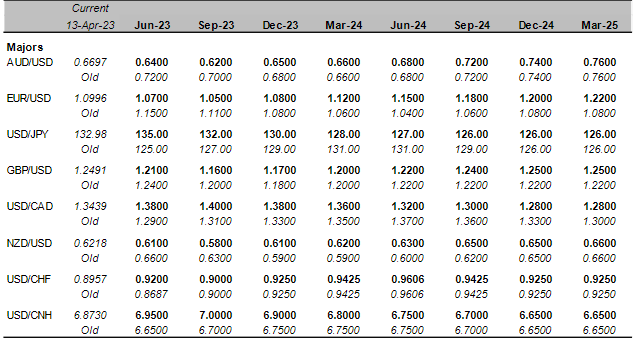

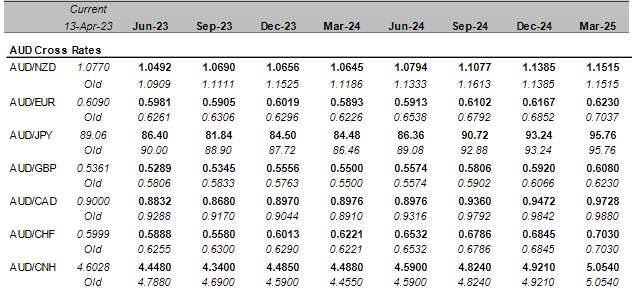

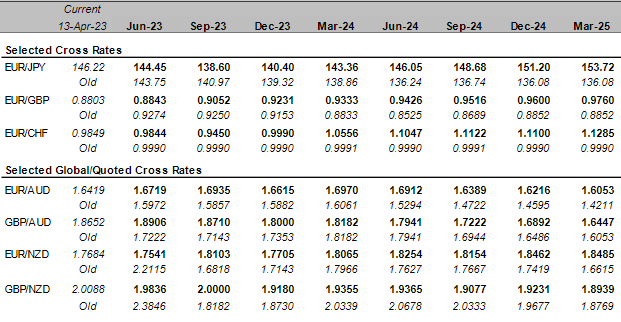

Source: Commonwealth Bank of Australia.

"We consider market expectations for near term cuts in the US Funds rate will be reversed," Capurso says.

"Another downside risk to our AUD/USD forecast is a spread of issues in small US banks to large banks in the US and elsewhere. In that scenario, AUD/USD could quickly fall below 0.60. We place a low probability on this bank stress scenario," he adds.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

The March failures of some small and midsized lenders in the U.S. led to a shift in expectations for interest rates and derivative markets now imply that investors see the Fed as having all but finished its monetary tightening cycle.

But U.S. inflation remains far above the targeted level and the CBA team says borrowing costs are likely to be kept at or above current levels for a longer period of time than the markets give credit for in what would be a potentially bearish outcome for the Australian Dollar.

Source: Commonwealth Bank of Australia.

"History suggests the FOMC will wait until core inflation has fallen much closer to a 2% to 3% range before cutting the Funds rate, Recent public comments from FOMC officials suggest they want inflation to trend down before they stop their rate hike cycle, let alone start cutting the Funds rate," Capurso says.

Interest rate differentials have become an outright headwind for the antipodean currency over the last year and in part because the Reserve Bank Australia (RBA) has been more cautious about using its own cash rate to bring Australian inflation back to the desired levels.

The RBA's stated policy and preference has been for keeping the economy on an even keel and the labour market in good condition as it uses the cash rate to guide inflation back to within the two-to-three percent target band.

Australia's cash rate has been lifted 10 times to a decade high of 3.6% over the last year but the RBA has been outpaced by some other major economy central banks including the Fed in the U.S., the Bank of England, the Bank of Canada and the Reserve Bank of New Zealand.

"We expect a recovery in AUD to emerge later this year as market participants price an eventual recovery in the global economy," Capurso and colleagues say.

Source: Commonwealth Bank of Australia.