GBP/AUD Rate Risking Slide Back toward 2022 Lows

- Written by: James Skinner

- GBP/AUD under pressure as antipodeans outperform

- Risking slide back to 2022 lows around 1.72 short-term

- Minutes suggest RBA's +0.50% rate steps to continue

- As Aussie job boom stokes already rising inflation risks

Image © ArchivesACT, Reproduced under CC Licensing, Editorial, Non-Commercial

The Pound to Australian Dollar exchange rate came under pressure early in the new week after a buoyant Sterling was unable to offset a rally by antipodean currencies like the Aussie, which has pushed GBP/AUD below 1.75 and left it at risk of sliding back toward 2022 lows in days ahead.

Sterling rallied broadly to open the new week, leading GBP/AUD to rise briefly back above the 1.75 handle that was lost in the prior week’s trading, before a Tuesday comeback by the antipodean currencies sent the Pound to Australian Dollar rate tumbling again.

Risky currencies including both Sterling and the Aussie were all buoyant in Europe on Tuesday as the U.S. Dollar beat a retreat from recent highs for a second session running although GBP/AUD came under pressure previously during the Asia Pacific trading session.

“The minutes note that the cash rate was “well below the lower range of estimates of the nominal neutral rate” and that “further increases in interest rates will be needed to return inflation to the target over time”. Next week’s inflation report is expected to show that inflationary pressures continued to heat up in the June quarter,” says Jarek Kowcza, a senior economist at St George Bank.

Above: GBP/AUD shown at 15-minute intervals with AUD/USD.

Above: GBP/AUD shown at 15-minute intervals with AUD/USD.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

Australia’s Dollar rallied overnight and throughout the Tuesday session after minutes from the July 05 monetary policy meeting at the Reserve Bank of Australia implied strongly that the RBA will continue lifting its 1.35% cash rate in increments of at least 0.50% during the months ahead.

“Ahead of the release of the June quarter Consumer Price Index (CPI) at the end of July, members noted that domestic inflationary pressures, including those outside of the labour market, continued to build,” the meeting record stated.

“Information from the Bank's liaison program continued to indicate that wages growth would increase from the low rates of recent years as firms compete for staff in a tight labour market,” the minutes also stated in another part.

Minutes of the July meeting comfirmed the RBA board view that Australian interest rates are “very low for an economy with a tight labour market and facing a period of higher inflation,” and this view is only likely to have become more entrenched in light of employment figures released last week.

Above: GBP/AUD shown at hourly intervals with AUD/USD.

Above: GBP/AUD shown at hourly intervals with AUD/USD.

Australia’s job market has gone from strength-to-strength since the onset of the pandemic and showed no signs of any slowdown during June when employment increased by 88.4k, the largest amount of any month since November 2021 and the country’s reopening from its most severe ‘lockdown.’

“The resilience of the economy was most evident in the labour market. Employment had grown significantly in preceding months and the unemployment rate was at a multi-decade low,” the July 05 record states.

“Members agreed that arguments for raising interest rates by 50 basis points were stronger. The level of interest rates was still very low for an economy with a tight labour market and facing a period of higher inflation,” the meeting record said in its concluding part.

June’s employment growth already pushed the unemployment rate to a new historic low of 3.5% although it’s the levels of wage growth resulting from this kind of a jobs boom that the RBA is most likely to be interested in, with any sharp pick up a possible trigger for a faster increase in the cash rate.

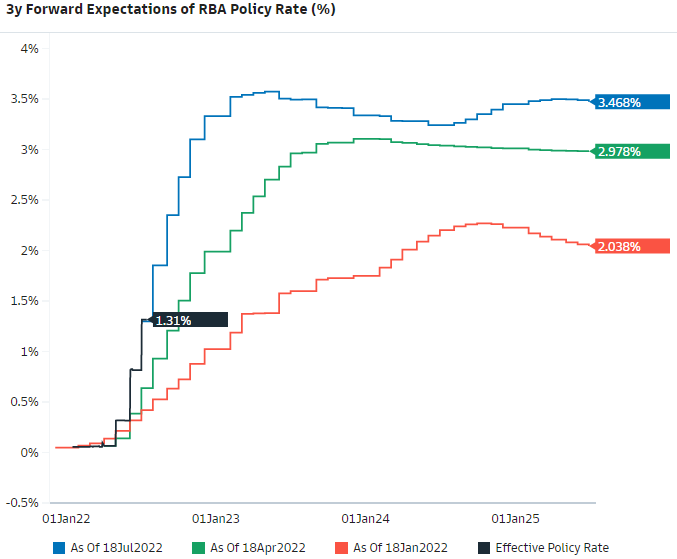

Above: Market-implied expectations for the RBA’s cash rate with earlier iterations. Source: Goldman Sachs marquee.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

“We continue to expect the RBA to increase the cash rate +75bp to 2.1% in August, before reaching a terminal rate of 3.35% by year end,” says Andrew Boak, chief economist for Australia and New Zealand at Goldman Sachs.

Tuesday’s minutes showed clearly that the RBA already viewed the strong job market as an emerging source of inflation risk even before last week’s data was released and this may be a part of why the market was so enthusiastic about the Australian Dollar on Tuesday.

It's possible that the RBA's earlier view of the domestic economy has, when combined with the recent job data, led the expectations of some in the market to move closer toward the Goldman Sachs view that the RBA is likely to surprise markets with a 0.75% increase in its cash rate next month.

To the extent that such enthusiasm persists it could maintain the nascent pressure on the Pound to Australian Dollar rate, which was approaching its 2022 lows on Tuesday and levels that are also some of the lowest for Sterling in the post-Brexit referendum period.

The minutes and recent data may also heighten the market’s focus on the next set of inflation figures due out from Australia on July 27 and when it comes to RBA policy and the Australian Dollar, they've almost certainly raised the importance of the second quarter Wage Price Index due out on August 17.

Above: GBP/AUD shown at daily intervals with AUD/USD.

Above: GBP/AUD shown at daily intervals with AUD/USD.