Pound-Australian Dollar Rate's Uptrend Forecast to Extend

- Written by: Gary Howes

- GBP/AUD pointed comfortably skyward

- AUD weighed by Chinese data disappointment

- Aus Covid situation deteriorates

Image © Adobe Images

- GBP/AUD reference rates at publication:

- Spot: 1.8890

- Bank transfer rates (indicative guide): 1.8230-1.8360

- Money transfer specialist rates (indicative): 1.8720-1.8759

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

A combination of disappointing data out of China and renewed a renewed deterioration in Australia's Covid situation is expected to maintain pressure on the Australian Dollar over coming days.

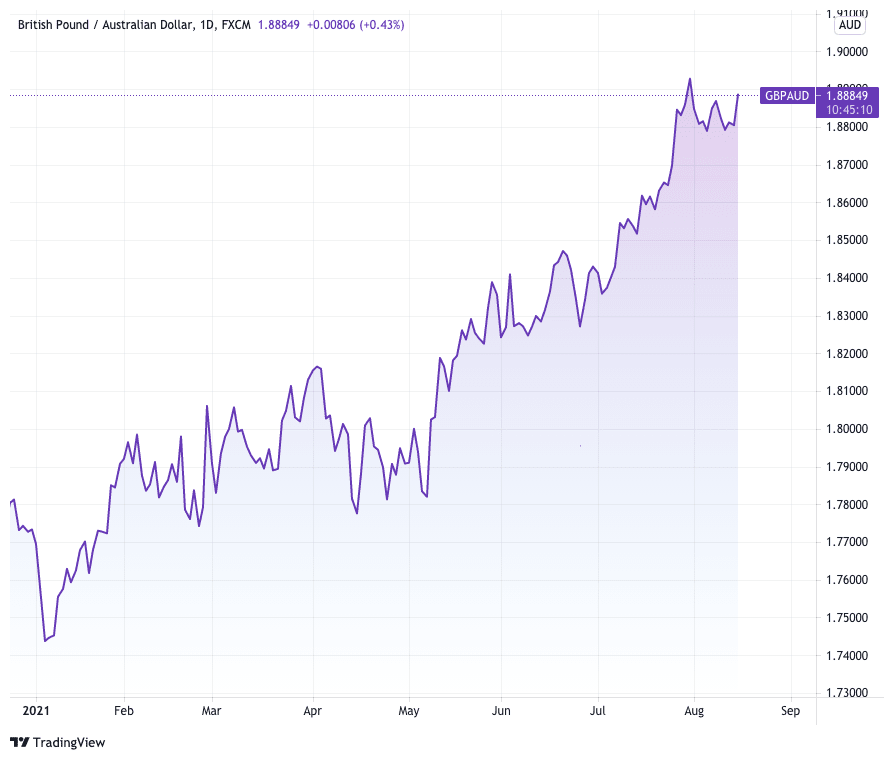

The Pound-to-Australian Dollar exchange rate (GBP/AUD) has been in an uptrend since January and further gains are expected in light of fresh evidence that the Chinese economy is suffering a slowdown amidst the spread of the Covid-19 Delta variant.

Analysts have said a good portion of the Australian Dollar's recent decline in value is linked to fears of a Chinese slowdown, fears reinforced on Monday after China reported growth in industrial production fell for a fourth straight month to 6.4% Year-on-Year in July, down on the 8.3% recorded in June.

Fixed asset investment increased 10.3% Year-to-Date in July against the 12.6% reported in the period January-June.

Retail sales retreated to 8.5% Year-on-Year from 12.1% in June, meanwhile the country's surveyed jobless rate edged up 0.1% to 5.1%.

"July’s data suggested China’s roaring recovery from the pandemic was losing steam," says Nathan Chow, Senior Economist/Strategist at DBS Bank.

"Among others, concerns about the delta variant will weigh on retail spending and economic growth in 2H. The latest wave of cases erupted in Nanjing and spread to more than half of the country’s 31 provinces," adds Chow.

The Australian Dollar was amongst the laggards in global FX following the release of the data, courtesy of Australia's tight trade connections to China.

The data revealed a particular softness in the steel market, which will have significant implications for future demand of iron ore, Australia's premier export.

"The data also showed the steepest decline in steel production in over a decade, which has weighed on iron ore demand from the steel mills and sent prices tumbling. We do not see current levels as a buying opportunity as the market balance should continue to soften," says Carsten Menke, Head of Next Generation Research at Julius Baer.

Falls in the Aussie Dollar mirrored moves in Emerging Market currencies, stocks and commodities as the Chinese data lead to softer investor sentiment globally.

The GBP/AUD exchange rate recovered a third of a percent to quote at 1.8881 on the back of this Australian currency's weakness, the 2021 high is at 1.8972 and was reached on July 30.

The medium-term trend for the exchange rate remains higher, particularly given the soft fundamentals now driving the Aussie:

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

DBS Bank says Chinese provinces with local communities currently classified as medium- and high-risk account for more than one-third of national GDP.

"The deteriorating outbreak has triggered tightening of virus controls. Millions are shelving travel plans during the peak summer season. High-frequency indicators of mobility from domestic flights to road congestion already show signs of slowing," says Chow.

DBS Bank say the risks to Chinese economic output have grown as the Covid outbreak could yet spread further. In addition, extreme weather conditions such as high temperatures and flooding in some areas have affected industrial production.

A shortage of computer chips and electricity is also expected to weigh on output.

Domestically, Australia's Covid situation remains challenging.

The state of Victoria saw its Governor impose a curfew on Melbourne while New South Wales reported its highest daily case count yet which case doubt on hopes that restrictions there would be lifted at month-end.

"The AUD could continue to mirror broad USD moves and lag NZD given the ongoing increase in COVID-19 cases and lockdowns as well as declines in iron ore prices says Marek Raczko, an analyst at Barclays.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Victoria Governor Daniel Andrews announced a night-time curfew on Melbourne and extended the lockdown for two more weeks after criticising the "selfish choices" of people who allegedly breached restrictions to take part in take-away pub crawls, picnics, sleepovers and an engagement party.

The curfew will operate from 9pm to 5am each day and begin immediately.

It is the second time Victoria has imposed a curfew to enforce stay-at-home orders.

"The standard risk bearers in FX are all weaker, especially the AUD which may have also been hit by a further extension of the lockdown in Melbourne by two weeks," says Daragh Maher, Head of Research, Americas, at HSBC.

New South Wales meanwhile reported its worst day of the COVID-19 pandemic, with 478 cases and seven deaths.

The data suggests hopes for restrictions to be eased on August 28 are now remote, which risks the slowdown in economic growth risks extending into the final quarter of the year.

Currently economists and the Reserve Bank of Australia expect a strong rebound of growth towards the end of the year as vaccination rates rise and restrictions are eased.

However the country still has a relatively low vaccination rate relative to other developed market peers. Last week we reported Westpac as saying there is clear evidence that the Australian Dollar's underperformance has linkages with the slow vaccination rollout.

Expectations for a strong rebound in growth towards year-end could also be hampered by a lack of unified strategy amongst the various states as to how to handle the next phase of the crisis.

The central government wants the country to open up when a certain vaccine threshold (70-80% of adults) has been achieved. However, Western Australian authorities today hinted they would continue to pursue a zero-covid approach, regardless.

This would imply the country risks seeing a two-speed recovery amidst divergent policy implementation.

For its part the Reserve Bank of Australia (RBA) has said it would continue to ease back on the support it is to offer the economy by whittling down the size of its quantitative easing programme over coming months.

Should the economy enter recession, and uncertainty over the Chinese recovery and the domestic pandemic remain elevated, the odds will grow that the RBA's exit from ultra-loose policy settings could be abandoned.

This will in turn suggest a lower interest rate profile for Australia over coming months and years, which in turn will act as a headwind to the Australian Dollar.