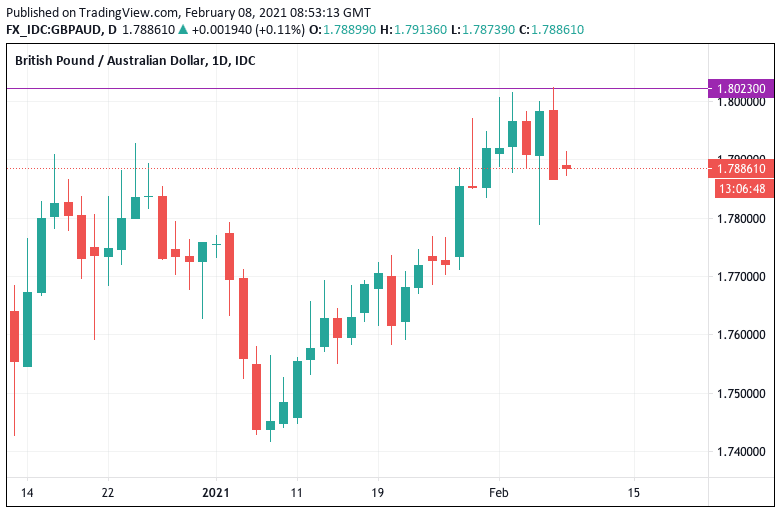

Has the Pound-Australian Dollar Rate Peaked?

- GBP/AUD rejected at 1.80 again

- Near-term consolidation likely

- Stock market rally aids AUD

- But BoE policy could limit GBP/AUD downside

Image © Adobe Stock

The Pound-to-Australian Dollar exchange rate (GBP/AUD) put in a new near-two month peak on Friday, before dipping sharply in a reversal move that raises questions as to whether buyers have run out of steam.

The exchange rate had been trending higher since January 07, with gains taking the market back up to 1.8023 on Friday, the strongest level since December 10. But the pair then suffered a sharp sell-off that saw a 0.64% decline registered.

The decline mirrors previous attempts to close the day above 1.80 which have all failed so far this month, suggesting this could be a new line in the sand for the market:

Has the GBP/AUD now rolled over, and are losses therefore likely to ensue?

Martin Miller, a Reuters market analyst, warns that seasonality could be one factor to watch over coming days as he notes the Aussie Dollar tends to traditionally record advances in February.

"Those expecting AUD/USD gains in this month will take comfort from seasonal trends. An analysis of AUD/USD's February performance since 2000 shows it has risen in 14 of the past 21 years. Seasonality should not be considered in isolation, but combined with other factors it can be a useful tool," says Miller.

Those watching the Pound-Australian Dollar exchange rate should be wary of a turn higher in the headline Australian Dollar-U.S. Dollar exchange rate, as this pair can tend to lead the rest of the AUD market.

In short, a bullish AUD/USD could well lead to a softening in GBP/AUD.

"AUD/USD left a long tail on last week's candlestick line, a technical sign that the downside is being rejected. The scope grows for bigger gains towards the 2021 0.7819 peak set in January. Fourteen-week momentum has been positive since early November, reinforcing the underlying bullish cycle," says Miller.

- GBP/AUD spot at publication: 1.7888

- Bank transfer rates (indicative guide): 1.7267-1.7390

- FX transfer specialist rates (indicative): 1.7473-1.7760

- More information on acquiring specialist rates, here

The Australian Dollar tends to display a strong positive correlation with rising stock markets, going higher as the major stock exchanges appreciation.

Therefore, an extension of the market rally over coming weeks could well play into the hands of Aussie Dollar bulls.

"When risk appetite grows, funds usually flow into the Australian dollar," says Miller. "Optimism about a global economic recovery and a weak U.S. dollar had supported the Aussie in Friday's session, but sketchy progress in fighting the coronavirus pandemic is seen as a threat by investors and could cause a bout of AUD/USD selling if those perceived risks rise."

Global markets and commodity prices are moving higher at the start of the new week, underpinning the Australian currency's most recent advance.

"The risk-on mood seems to be driven by a combination of falling case numbers in developed countries, whilst efforts by Congressional Democrats to pass Joe Biden’s $1.9TRN stimulus without Republican support has delivered a fresh shot of confidence into equity markets," says Neil Wilson, Chief Market Analyst at Markets.com.

Although the GBP/AUD has suffered a near-term setback, it could yet prove too soon to call the death of the 2021 rally as those fundamental forces that triggered recent gains remain alive.

A jump in Pound Sterling's value following last Thursday's Bank of England event combined with a dovish message from the Reserve Bank of Australia the following day to trigger a new two-month high in the GBP/AUD on Friday.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

Buyers of Australian Dollars saw the best exchange rates on offer since December 10 after RBA Governor Philip Lowe continued to hammer home the message that Australian interest rates will not be rising soon.

Lowe told lawmakers ahead of the weekend that the outlook for the Australian economy has improved but interest rates will remain low for a while.

He said the RBA was unlikely to raise interest rates until at least 2024 as employment and inflation remain well short of target.

The message should keep ensure the yield paid on Australian Government bonds remains as low as possible for a while yet, thereby ensuring the cost of borrowing in the Australian economy stays at levels supportive of economic growth.

The RBA statement on monetary policy didn't send "the AUD flying, despite being upbeat. The reason: The RBA is committed to an extended period of easy policy," explains Kit Juckes, an analyst at Société Générale.

Also driving yields lower is the RBA's quantitative easing programme, whereby the Bank enters the open market to snap up government bonds, creating a demand that simultaneously lowers the yield paid out on those bonds.

Contrast this with the Bank of England who on Thursday said staff had been instructed to work on guidance about the appropriate strategy for tightening monetary policy, i.e. less quantitative easing and higher rates in the future.

So on the one hand the RBA is really pushing back against the idea of higher rates and on the other the BoE is hinting that higher rates lie ahead, creating a divergence has helped pull the GBP/AUD exchange rate higher.