Pound-Australian Dollar Forecast to see Further Downside

- Technicals advocate for GBP/AUD downside

- Market recovery aids AUD

- UK's coy exit from lockdown could weigh on GBP

Image © Adobe Images

![]() - GBP/AUD spot rate at time of writing: 1.8960

- GBP/AUD spot rate at time of writing: 1.8960

- Bank transfer rates (indicative guide): 1.8290-1.8430

- FX specialist transfer rates (indicative guide): 1.8520-1.8790 >> more information

Pound Sterling is forecast to maintain a trend of depreciation against the Australian Dollar over the coming days, and potentially weeks, according to the latest technical studies of the GBP/AUD market and observations of the fundamentals currently driving both currencies.

The Pound-to-Australian Dollar exchange rate has been losing value since market anxieties over the global coronavirus pandemic started to ease in March and the Australian Dollar found itself at the forefront of the market recovery, setting in motion and almost unanswered period of decline for GBP/AUD.

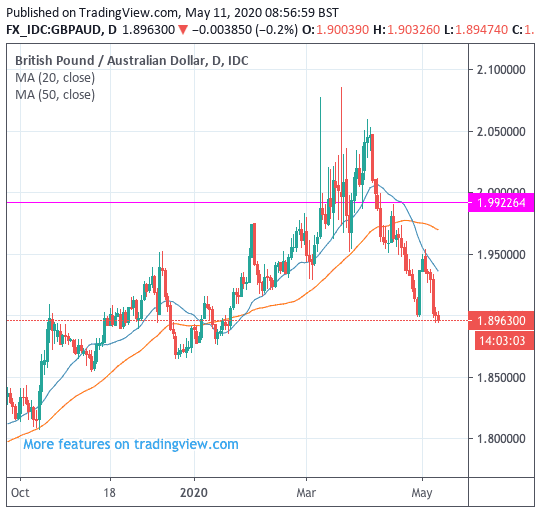

The pair has fallen from a high of 2.0459 to reach 1.8955 at the time of writing, with a key momentum indicator - the RSI - reading at a level below 50, which is suggestive of further declines in the near-term.

Furthermore, the MACD - another directional indicator that chart analysts consult when predicting future price action - is below its signal line and negative. Further evidence of likely downside can be read from the moving average levels: GBP/AUD is located below its 20 and 50 day moving averages, respectively located at 1.9489 and 1.9756.

Only when the exchange rate crosses back above these moving averages we would suggest a shift in favour of Sterling is underway.

Analysis from Trading Central shows that "the downside prevails as long as 1.9920 is resistance". 1.9920 has been identified as a key area for the outlook of the GBP/AUD exchange rate in that only a break above this point would flip the outlook from a negative to positive trend. "The upside breakout of 1.9920, would call for 2.0624 and 2.1043," says Trading Central.

Above: GBP/AUD daily chart with key technical indicators, including the 20 day (blue) and 50 day (orange) moving averages.

Sterling's declines against the Australian Dollar come amidst an ongoing recovery in global equity markets, that reflects a belief amongst investors that the worst of the coronacrisis is now in the rear-view mirror and the global economy is once again starting to open up.

Australia is particularly exposed to improvements in broader market sentiment, largely owing to the country's strong trade ties with China, a country which is now well ahead of its western peers in terms of returning to normal since coronavirus flared up in Wuhan at the start of the year, leading to a strict lockdown policy.

Sentiment has been further supported after the People’s Bank of China over the weekend said it was looking to engage "more powerful" policies to stimulate its economy in the wake of the coronavirus pandemic.

Australia "stands to benefit more from the coming Chinese stimulus than the UK and GBP/AUD is showing signs of trending lower in a G10 FX market that is currently very range bound," says Jordan Rochester, FX Strategist at Nomura.

With China in mind, watch this week's data as well as further efforts by authorities to support the economy.

"AUD/USD faces upside risk this week supported by more evidence of economic recovery in China. On Thursday, we expect Chinese industrial production (2%/yr), retail sales (‑5%/yr) and fixed asset investment (‑7%/yr) to beat consensus expectations. Meanwhile, monetary policy in China could be eased again soon. In its quarterly report, China’s central bank pledged “more powerful” policies to support the economy with no mention of its prior concern about excess liquidity," says Elias Haddad, FX Strategist with Commonwealth Bank of Australia.

Domestically, Australia has suffered a relatively low exposure to the coronavirus, allowing the government there to unlock the economy which should allow for a bout of outperformance.

This contrasts to the UK which is only starting to even consider a post-lockdown environment owing to the severity of the pandemic, with Prime Minister Boris Johnson saying on Sunday that only limited measures to ease lockdown would be implemented in coming weeks. It could only be in August that the entire economy is reopened, ensuring that the Pound could underperform the currencies of those economies which open sooner.

"With signs of lockdowns slowly being rolled back and even some news of early success in anti-viral drug trials risk sentiment continues to improve. We positioned for this via short GBP/AUD last week and continue to see this downtrend being a worthwhile trade," says Rochester.

Johnson overnight announced a three-stage plan and a Covid-19 alert system that will govern the easing of lockdown restrictions in the UK.

These included the “first careful steps” to easing lockdown rules, and allowed for unlimited leisure time, while those who could not work from home were offered the opportunity to return to their normal place of work.

However, there was little by way of detail as the Prime Minister stressed all decisions would be made based on the anticipated reproductive rate of the virus. This uncertainty will likely weigh heavily on the UK's economy which is largely built on services and is therefore particularly prone to the economic ills presented by blanket lockdowns.

Until lockdown is lifted, and consumer confidence starts to rebuild, there is a real threat that the UK economy suffers significant structural dislocation which will lead to a slow and arduous path to recovery.

Sterling is likely to struggle in such a scenario.

The Bank of England is predicting about a 30% plunge in UK GDP in the first half of 2020, but it said in its May policy statement that its central scenario sees activity picking up "fairly rapidly" in second half of 2020 as social distancing restrictions are gradually lifted.

The Bank warned however that the outlook is "unusually uncertain", especially relating to the virus and the potential long-term ‘scarring’ effects of the current lockdown measures on the economy.