Pound-Australian Dollar Slumps as Trade Data and U.S.-China Talks Stoke Risk Appetite

- Written by: James Skinner

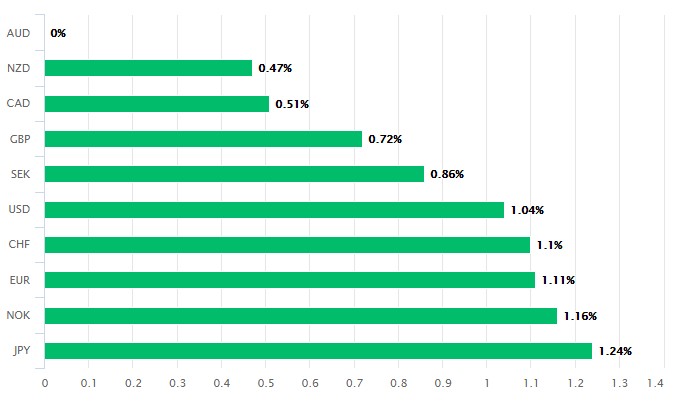

- AUD surges as data, RBA QE exit and trade talks stoke risk appetite.

- AUD/USD up +1% as GBP/AUD slides despite GBP gains elsewhere.

- But worse trade data around corner as AUD/USD rally seen waining.

- AUD/USD strength keeps GBP/AUD on back foot as more losses loom.

Above: Governor Philip Lowe. Photo: O'Neill Photographics/Goldman Sachs. Source: RBA on Flickr, reproduced with permission from the RBA press office.

- GBP/AUD spot at time of writing: 1.9150

- Bank transfer rates (indicative): 1.8482-1.8616

- FX specialist rates (indicative): 1.1.8865-1.8980 >> More information

The Pound-Australian Dollar rate slumped Thursday as strong March trade surplusses, a Reserve Bank of Australia (RBA) curtailment of quantitative easing and fresh trade related talks between the U.S. and China cheered the market and drove a rally in risk assets.

Australia's Dollar was up across the board with strong gains over all rival currencies including a Pound Sterling that was also on its front foot, after Chinese and Australian trade surplusses surprised on the upside for the month of March and as the RBA curtailed its qunatitative easing programme. Australia's trade surplus rose from A$3.87bn to A$10.60 bn in March despite a sharp global economic slowdown while China's rose from $139bn to $318bn.

"China’s trade data also shows April exports 8.2% y/y, which is very hard to believe even given the rush on PPE, and imports -10.2% y/y, which is depressingly easy to believe," says Michael Every, a strategist at Rabobank.

Rising shipments of iron ore and non-monetary gold helped lift the Australian trade surplus although a steep -4% fall in the value of goods and services imports, a typical sign of domestic economic weakness, was also a substantial driver of the improvement. Trade balances measure the difference in value between imports and exports, which represents real world currency flows and are important indicators of GDP growth for internationally trading economies.

China's trade surplus was also improved after continuing the rebound out of January's surprise deficit and off the February level of $139bn, potentially indicating that there was some life left in the global economy toward the end of last quarter. However, the U.S., UK and host of other countries didn't actually begin to 'lockdown' until the final week of March so worse data could be just around the corner for those two trade surplusses.

"AUD/USD was supported by the surprising strength in the Chinese trade surplus. The even more surprising Australian trade surplus had no impact on AUD. The RBA did not buy any bonds at its regular auction today. The RBA has been tapering its bond purchases since the initial flurry of activity," says Joseph Capurso, a strategist at Commonwealth Bank of Australia.

Also boosting the Australian Dollar was the RBA's absence from the domestic bond market. The bank has bought A$50bn worth of Australian government bonds since late March, which is just less than 10% of the A$550 bn total government debt clocked up by the end of the first quarter, although it quickly began to curtail its involvement in the bond market the moment it had achieved the 0.25% three-year yield target set at the time the programme was launched.

"The Bank is prepared to scale-up these purchases again and will do whatever is necessary to ensure bond markets remain functional and to achieve the yield target for 3-year AGS. The target will remain in place until progress is being made towards the goals for full employment and inflation," says Governor Philip Lowe, in a Tuesday statement.

Australia's Dollar has been rising steadily since late March although the rally was given new life in early April when the Aussie government began to get the better of the coronavirus and speculation began to suggest European and U.S. economies could also soon be looking at reopening. However, aiding those gains was a bottoming out of Australia's short-term bond yields and the RBA's decision to begin tapering off its acquisitions of Aussie government bonds. The RBA initially set out to buy A$5bn per day.

Above: AUD/USD rate recovers off March lows in April as government bond yields bottom and risk appetite returns.

"AUD/USD’s near term bounce has not been enough to reassert upside pressure and for now we maintain a negative bias. The market has eroded the short term uptrend, which is now acting as resistance at .6507 and below here we have minor support along the 55 day moving average at .6311 and also at the .6265/55 recent lows. Should the .6265/55 support area give way, the .6213 late March high and then .5981, the current April low, would be back in focus," says Karen Jones, head of technical analysis for currencies, commodities and bonds at Commerzbank. "Above .6570 we look for a test of the .6681/87 March high and 200 day moving average where we would expect it to struggle."

Thursday's QE tapering and strong trade surplusses came as markets cheered reports that Chinese Vice Premier Liu He and U.S. Trade Representative Robert Lighthizer will speak next week with a view to organising the implementation of January's agreement that ended the trade war between the world's two largest economies. Tensions are however, rising again amid U.S. allegations the coronavirus originated from a research lab in Wuhan.

This cocktail has stoked an improvement in risk appetite and a rally in stock markets as well as commodity currencies, lifitng the AUD/USD rate more than 1% on Thursday and weighing on the Pound-Australian Dollar rate despite a robust performance from Sterling against many other majors.

The GBP/AUD rate has recently bounced off its 200-day moving-average and may be aided in the short-term if the AUD/USD rally comes apart, although it faces the risk of renewed and heavy losses toward month-end and into June if the UK proves too slow to exit 'lockdown' and an extension of the Brexit transition period remains absent.

"Australia is earlier to relax its lockdowns with much lower growth in virus cases than that of the UK, it stands to benefit more from the coming Chinese stimulus than the UK and GBP/AUD is showing signs of trending lower in a G10 FX market that is currently very range bound," says Jordan Rochester, a strategist at Nomura, who advocated on Friday that the bank's clients sell the Pound-Australian Dollar rate around 1.94 and look for a move down to 1.86.

Above: Pound-Australian Dollar rate retreats toward 200-day average and 61.8% Fibonacci retracement of 2019 uptrend.