Pound-Australian Dollar Could Rise 3% in Q1 says Westpac

- Written by: James Skinner

- GBP/AUD could rise 3% before quarter end says Westpac.

- BoE to hold rates steady in Jan while the RBA cuts in Feb.

- RBA rate cuts seen tipping rate differential in GBP's favour.

- BoE will eventually cut too but RBA rates will go even lower.

Image © Westpac

- GBP/AUD Spot rate: 1.8902, down 0.27% for today

- Indicative bank rates for transfers: 1.8194-1.8326

- Transfer specialist indicative rates: 1.8571-1.8684 - >> Get your quote now

The Australian Dollar advanced on the Pound ahead of the weekend but the antipodean unit is likely to reverse course and cede ground to its British rival in the months ahead, according to Westpac research, because interest rate cuts in the UK and Australia are set to leave Sterling with an edge.

Sterling retreated Friday after retail sales data for December added to expectations the Bank of England will cut interest rates on January 30.

"Pricing for a BoE bank rate cut (to 0.50%) by the 26 March meeting has jumped from 15% chance to about 65%. Westpac’s base case is a Q2 rate cut. If the BoE does hold steady through Q1 and the Q4 optimism over avoiding a hard Brexit on 31 January returns, then GBP/USD should be able to recover to our 1.33 end-March target," says Westpac's Sean Callow in a Wednesday research note. "AUD has found support from improved risk appetite, including equity market record highs and a pickup in key commodity prices. But even before Australia’s bushfire crisis we were expecting the RBA to cut the cash rate."

The Aussie Dollar was higher ahead of the weekend amid cheer in the market over China's latest batch of economic data.

The world's second largest economy grew at an unchanged 6% pace in the final quarter but better-than-expected December retail sales and fixed asset investment figures suggested it may have gained momentum around year-end. Australia's Dollar is substantially underwritten by a mammoth commodity trade with China that is also important for the Aussie economy so good news in Beijing can often be felt quickly in Sydney, Melbourne and Canberra.

Above: Pound-to-Australian-Dollar rate shown at hourly intervals, responding to UK retail sales figures.

The Pound is this week's worst performing major currency, having fallen against all its major peers after Monday's GDP data for November showed the economy contracting by 0.3%, while inflation numbers out mid-week showed prices waning further. Inflation of 1.3% is well below the BoE's target of 2% and growth was just 0.6% in the 12 months to December, leaving it substantially below the economy’s estimated 1.25% inflation-producing rate of expansion.

Retail sales slumped in December, meaning the economy hasn't seen any boost whatsoever from the so-called Black Friday sales promotions, which it typically does. The economy could now be on course for a final quarter contraction that would elevate the importance of the January 29 autumn forecast statement and March budget for Sterling. That might see a fiscal stimulus unveiled.

Above: Pound performance against major rivals in 2020. Clings to fractional gain over Aussie. Source: Pound Sterling Live.

Economic data out this week may well have sealed the deal for an imminent rate cut, but Sterling was still up 0.58% against the Aussie for the five days to Friday morning and Westpac says the British currency can continue to get the better of its antipodean rival in the weeks and months ahead.

Not least of all because the Reserve Bank of Australia (RBA) is expected to outdo the Bank of England on the rate cutting front as its seeks to bolster Australia's softening economy from the effect of bushfires.

"The RBA’s 2.8% growth forecast for 2020 seems very optimistic (we are on 2.1%, consensus 2.3%). Markets price only a 45% chance of the RBA cutting next month. If they deliver, GBP/AUD should push towards 1.96 into March," Callow says. "AUD’s yield advantage in this part of the curve has vanished, with both cash rates at 0.75% and guidance for historically low rates for some time. In isolation, yield spreads suggest plenty more downside risk for AUD."

British and Australian cash rates are at parity but both economies will be tested by problematic domestic conditions up ahead, although the RBA is seen as likely to respond sooner and in a bigger way. And that's bad news for the Australian Dollar, which has been propped up of late by resilience in some commodity prices and optimism about the global economic outlook, while also being constrained by a new record low 0.75% cash rate.

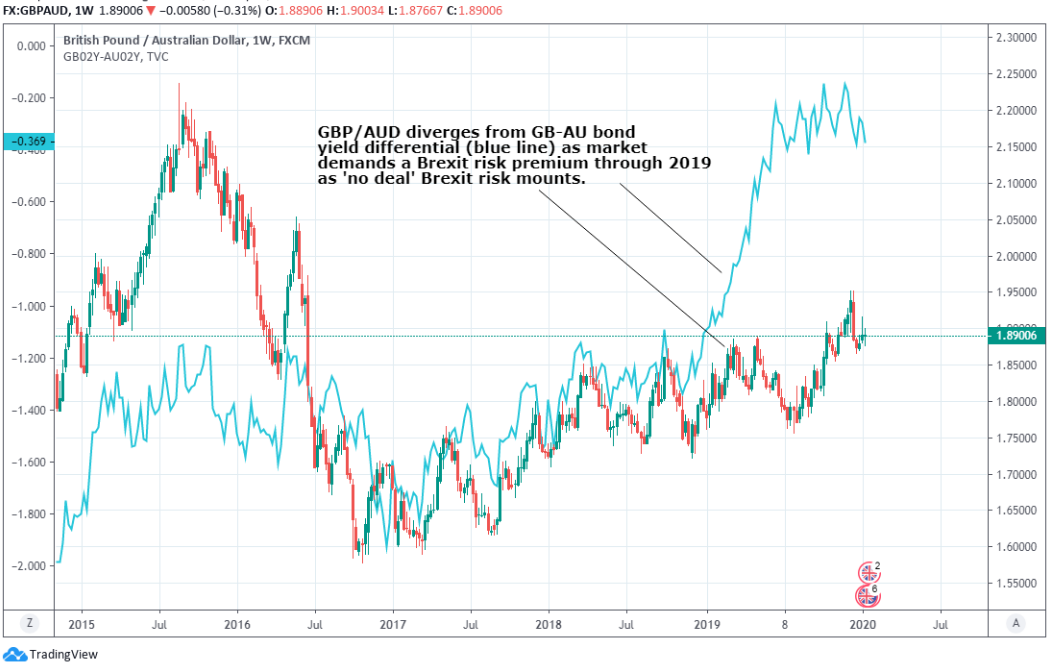

Above: Pound-to-Australian-Dollar rate at daily intervals, with GB-AU bond yield spread (blue line, left axis).

"Q3 GDP data released the day after the RBA meeting showed worrying weakness in private demand, notably consumption. Devastating bushfires add to our concern. Westpac expects a cut to 0.5% in Feb then to 0.25% in Jun and QE in H2 2020. We expect growth to fall well short of RBA forecasts and loose policy will be needed to prevent A$ appreciation. Markets price only a small chance of more than 1 cash rate cut this year," Callow warns.

Australia's economy has weakened amid soft consumer spending that has roots in a housing market downturn and years of weak wage growth, although it's also been under pressure due to the U.S.-China trade war. The RBA has cut the cash rate three times already in the hope of fostering faster growth that enables its long-elusive inflation target to be met but horrific and ongoing bushfires are now posing a further threat to labour market, consumer spending and economy.

Financial markets are not yet prepared for a rate cut from either the Bank of England or Reserve Bank of Australia any time soon, which means both currencies could respond if any changes are announced in the weeks ahead. Pricing in the overnight-index-swap market implies a January 30 BoE Bank Rate of 0.55%, close but not quite equal to the next level down of 0.50%, while the implied RBA rate for February 04 was 0.61% Friday.

Interest rate changes influence the capital flows as well as speculative short-term trading activity that governs the currency market, with lower rates often driving investors out of, or deterring them away from a currency. Rate decisions are made according to the outlook for inflation, which is sensitive to the pace of economic growth and many other things, with rate cuts deployed to combat slowing growth and the consequent fading of inflation pressures.

Above: Pound-to-Australian-Dollar rate at weekly intervals, with GB-AU bond yield spread (blue line, left axis).

Time to move your money? The Global Reach Best Exchange Rate Guarantee offers you competitive rates and maximises your currency transfer. Global Reach can offer great rates, tailored transfers, and market insight to help you choose the best times for you to trade. Speaking to a currency specialist helps you to capitalise on positive market shifts and make the most of your money. Find out more here.

* Advertisement