The Pound-to-Australian Dollar Rate in the Week Ahead: Downtrend Expected to Continue

Image © William W. Potter, Adobe Stock

- GBP/AUD in short-term downtrend

- To continue if new lows breached

- Main event for Pound is Brexit vote; for the Australian Dollar Chinese trade figures

The Pound-to-Australian Dollar exchange rate starts the week trading at 1.7785 after a fall of almost half a percent from the previous week.

The main driver was Australian Dollar strength as opposed to Sterling weakness, after hopes of a breakthrough in trade negotiations between Washington and Beijing supported AUD as Australia has close trade links with China.

The technical picture for GBP/AUD is on balance marginally bearish.

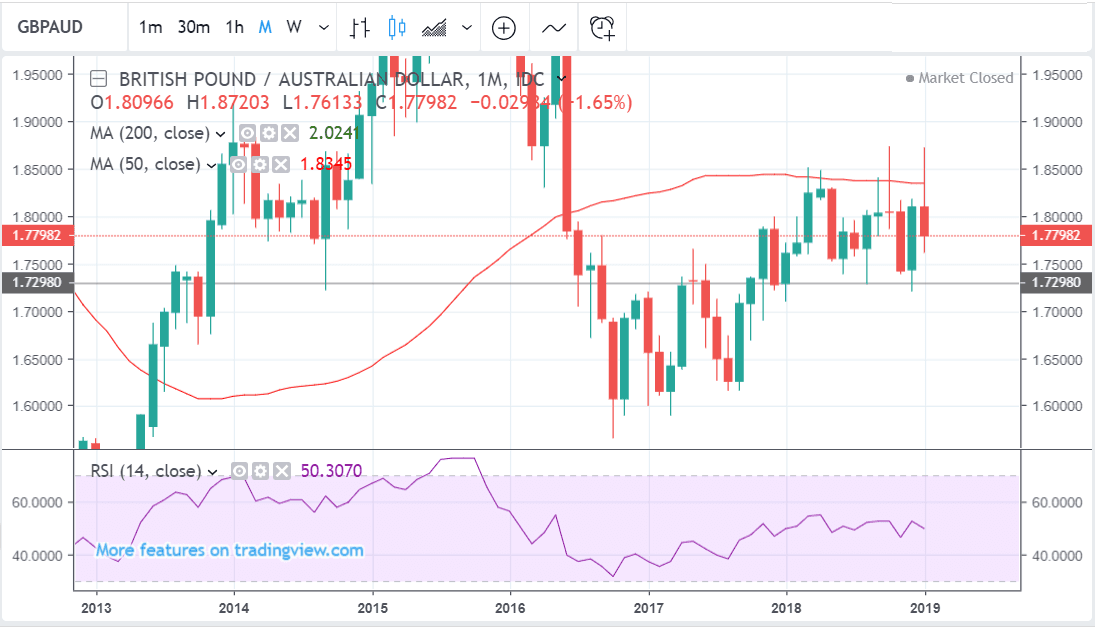

The monthly chart shows the pair hitting a wall of resistance at the level of the formidable 50-month moving average (MA) which has repeatedly rejected attempts to penetrate it ever since March 2018. Whilst, of course, it could break higher, it would have to break clearly above the 1.8732 highs for confirmation.

The weekly chart shows how the pair formed a long bearish shooting star in the week before last, which was followed up by a red, down-bar, providing added confirmation. This would suggest a short-term bearish bias.

Last week’s close was below the 50-week MA which is another bearish sign as it suggests the pair may have broken below the MA and be poised to continue lower.

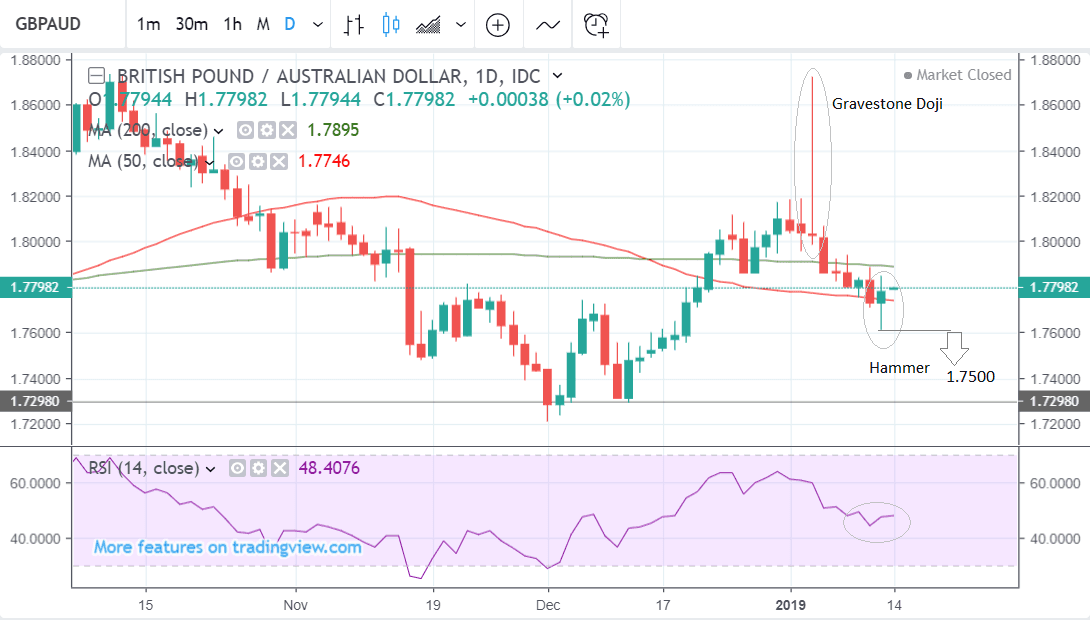

The daily chart shows how the pair formed a very bearish ‘gravestone doji’ Japanese candlestick pattern at the January 3 flash-crash highs, before declining.

It then successfully broke below the 200-day MA and looks to have probably broken below the 50-day MA.

GBP/AUD has formed a bullish ‘hammer’ candlestick right on the 50-day and looks poised to rebound higher. If Monday’s price action is also positive that will provide supporting confirmation of more upside.

A break below the hammer’s lows at 1.7610 would, nevertheless, provide the confirmation for a move down to the next target at 1.7500.

Bearish momentum, as measured by RSI is slightly weak and suggests a less bearish outlook, although the signal is not strong enough to question the overall downside bias.

Nevertheless, a break below the 1.7610 lows is a requirement for expecting further downside.

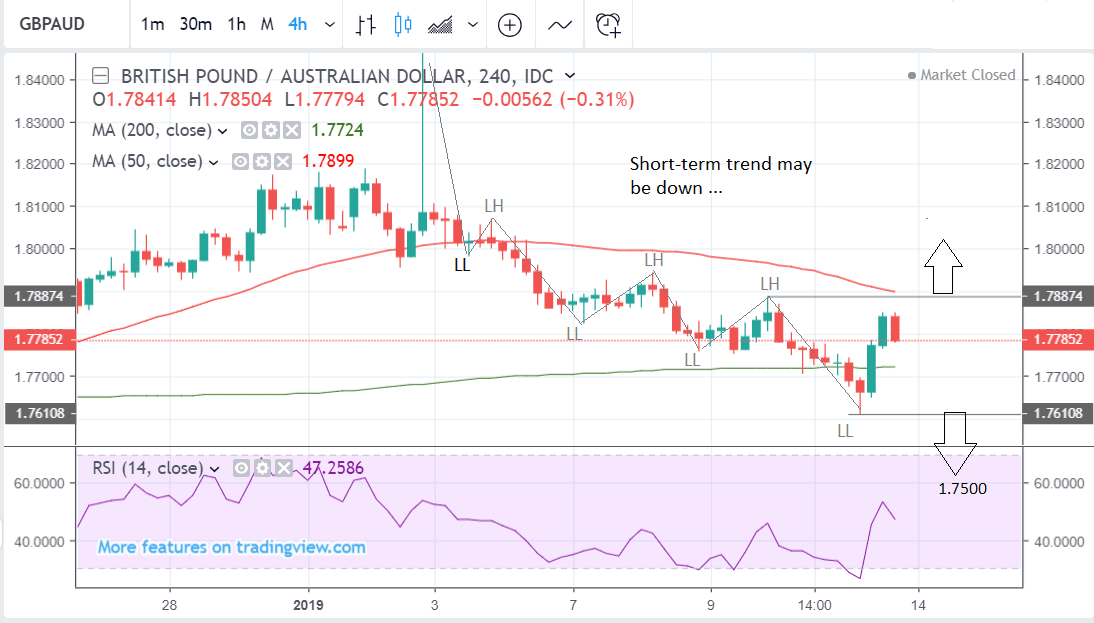

Supporting the formation of a new, short-term, downtrend is the 4-hour chart which is showing an established peak and trough progression lower, with more than two lower lows (LL) and lower highs (LH) in succession - a sign of the birth of a new downtrend.

The strong bounce on Friday, however, has brought into the doubt the sustainability of this downtrend and could mark a reversal. A break above the lower high at 1.7890 would raise serious doubts about the validity of the short-term downtrend.

Advertisement

Bank-beating exchange rates. Get up to 3-5% more foreign exchange by using a specialist provider to get you closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

The Australian Dollar: What to Watch

The main driver for the Aussie Dollar will probably be trade data from China, out on Monday at 3.00 GMT, since China news appears to be impacting on the currency more than any other factor at the moment, due to the fact it is Australia’s largest trade partner.

Trade talks between China and the U.S. concluded last week, “with substantial progress on many issues but with plenty of outstanding ones remaining,” says Raffi Boyadjian, an analyst at XM.com.

Negotiators have agreed to continue working for a deal.

“A weak set of trade figures would likely add to the pressure on Chinese authorities to quickly resolve their differences with the U.S.” Continues the analyst. “Exports from China are forecast to have grown by 3% year-on-year in December, easing from the prior 5.4%. Imports are expected to have accelerated, however, from 3% to 5.0%,” says Boyadjian.

Clearly, a swifter resolution to trade negotiations, will be positive for the Australian Dollar.

The main 'hard data' release for the Aussie is Aussie employment data, out on January 24, at 12.30 GMT.

This is expected to show a rise of 20k in December.

Overall the labour market is viewed as strong in Australia with an unemployment rate of 5.1%, however, gains are often shown to be made in the part-time labour market rather than full-time, which is not as positive. Last month, for example, part-time employment rose 43.4k whilst full-time actually decreased by -6.4k.

A strong labour market leads to a strong currency. Lower unemployment usually results in higher wages, higher inflation, and then higher interest rates, which are the primary driver of currencies.

Higher interest rates tend to drive up currencies because they attract and keep greater inflows of foreign capital.

The Pound: A Big Week for Brexit Politics

By far the most important event in the week ahead is the vote on Theresa May’s Brexit deal, scheduled for Tuesday 15, at 19.00 GMT. The outlook definitely favours the government to lose, and it is more a question of ‘by how much’ rather than ‘whether’.

The Pound's reaction will therefore likely depend on the size of the loss, and what comes next. If the loss is large - defined by a 100 or more MPs - as some analysts believe, it might signal the death of the government’s deal and could prompt a knee-jerk move lower in Sterling.

"Very few commentators expect the deal to pass, so the move in GBP would likely be limited on that news alone," says Jordan Rochester, analyst with Nomura. "But we would be looking at the size of the defeat to understand whether a repeated vote could get over the line."

The expected defeat would probably lead to a vote of no-confidence in the government, called by the Labour Party. But we don't see the government losing such a vote as the DUP and Conservative party would unite to defend their hold on power.

"We’d expect the government to win a vote of no confidence as turkeys rarely vote for Christmas," says Nomura's Rochester.

We think the government will ultimately rework the Brexit deal and bring it back to parliament for a second airing, and there is talk of some EU concessions being made available to help the deal cross the line on a second vote.

While there is a majority in Parliament who are committed to avoiding a 'no deal' Brexit, as proven by last week’s finance bill vote, there is not necessarily a majority to command an alternative plan.

Last week's reports that a large portion of Labour Party MPs are open to supporting the deal if they can secure their own changes is a significant shift in the debate we believe: if these MPs secure some changes to the deal, a softer Brexit is in sight, which represents an all-out positive for Sterling.

Last week's report the government is considering a delay to the Article 50 process is also notable in that it suggests government ministers are aware that all alternative Brexit scenarios that would follow the failure of May's deal, would need more time to formulate and execute. While the reports were officially denied by 10 Downing Street we believe this a case of where there is smoke, there is fire.

“Perhaps the best-case scenario for the Pound, barring the deal passing in parliament, would be a delay to the article 50 process. This decision would have to be agreed by the EU, however they are likely to do so, with the Pound set to appreciate due to the removal of the pressure of hitting the 29th March deadline for exiting the EU,” says Michael Brown, Senior Analyst at Caxton FX.

Brexit aside, the two main economic releases in the week ahead are inflation out on Wednesday and retail sales on Friday. Of the two, analysts think the latter is most likely to have the greater impact on Sterling.

“With the Bank of England not expected to raise interest rates unless Parliament approves a smooth Brexit, the inflation data is unlikely to have much impact in currency markets. Retail sales on the other hand could see a stronger response by traders as it’s a better gauge of UK growth momentum,” says Raffi Boyadjian, an analyst at broker XM.com.

Retail sales are forecast to show a -0.7% fall in December according to consensus estimates. If so the Pound could fall due to a drop in expected Q4 growth.

Wednesday’s inflation data, meanwhile, is expected to show a rise of 0.2% month-on-month (Mom) and 2.2% compared to a year ago, when it is released at 9.30, with little changed from the previous print. The higher the result the better for the Pound and vice-versa.

Advertisement

Bank-beating exchange rates. Get up to 3-5% more foreign exchange by using a specialist provider to get you closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here