Pound-to-Australian Dollar Rate Week Ahead Forecast: Why the Uptrend Could Resume

- Written by: Gary Howes

Image © Greg Brave, Adobe Stock

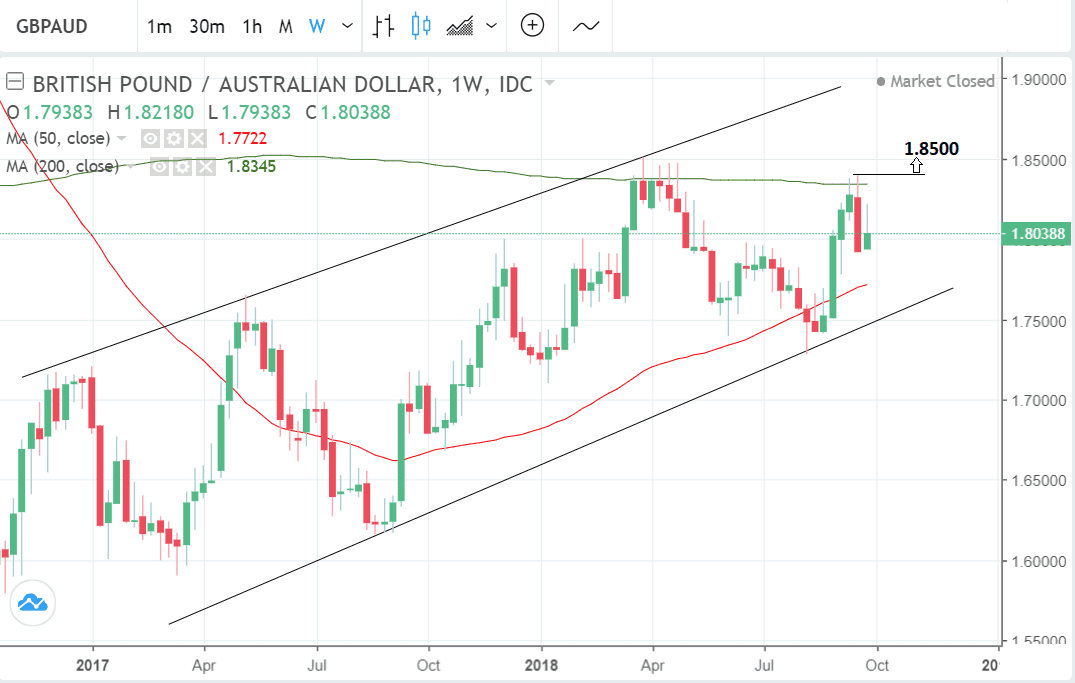

- GBP/AUD rallying steadily within a neat rising channel

- Weekly chart looks bullish and suggests bias for more upside

- RBA meeting dominates AUD calendar this week

The Pound-to-Australian Dollar exchange rate has recovered from its post-Salzburg lows and is trading with a positive bias at 1.8072 at the time of writing.

Sydney markets are closed at the start of the new week, however a meeting of the Reserve Bank of Australia means local dealers will hit the ground running on Tuesday.

GBP/AUD rebounded in the previous week from lows at 1.7923 to end the week at 1.8039; the recovery in the pair was aided by Australian Dollar weakness from continued U.S.-China trade tensions and overall U.S. Dollar outperformance.

In the week ahead we expect a continuation higher, on balance, based on the trajectory of the exchange rate on the weekly chart.

The pair has been rallying steadily within a neat rising channel, all year, and we expect this overall trend to extend.

The post-Salzburg Sterling decline looks less bearish on the weekly chart and more like a simple pull-back rather than a reversal, suggesting there is more upside to come, at least from a technical perspective.

The 200-week Moving Average (MA) in the 1.83s is the main obstacle to further gains and for confirmation, we would, therefore, prefer to see a break above the 1.8400 highs.

Although that is a long way off, such a move would probably green-light an extension higher to a target at 1.8500 initially.

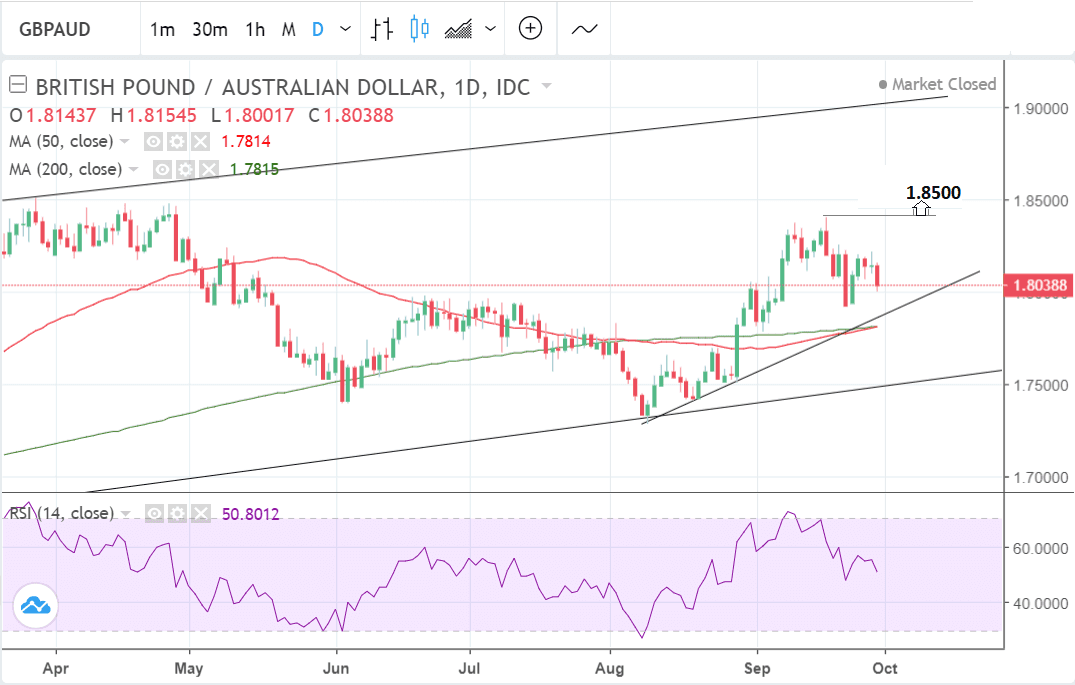

The pair is trading above the 50 and 200-day MAs which further suggests the uptrend will resume. When asset prices are above the 50 and 200-day MAs institutional investors, for one, usually consider them to be in an established uptrend.

Advertisement

Lock in Sterling's current levels ahead of potential declines: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

The Australian Dollar: What to Watch this Week

The main release for the Australian Dollar in the week ahead is the Reserve Bank of Australia policy meeting on Tuesday at 5.30 B.S.T.

The RBA is not expected to raise interest rates at the meeting despite steady growth. The minutes from the last meeting showed the governing council does not see any change in policy as being likely in the near-term, although eventually, they see a greater chance of interest rates being raised than lowered, which is positive.

The Australian Dollar tends to rise when the RBA puts up base interest rates because it attracts more inflows of foreign capital drawn by the promise of higher returns.

Although no change from the current 1.50% level is forecast at the meeting on Tuesday investors will be scrutinising the RBA's official statement as well as commentary at the press conference afterward for signs future expectations may have altered.

"We expect a generally upbeat tone to be maintained against the background of a very gradually improving labour market and wage picture, with the strong Q2 GDP report providing further support. Other areas of interest will be anything the RBA has to say on the recent round of independent rate hikes from major banks, plus commentary on China/US tariffs," says Adam Cole, a strategist with RBC Capital Markets.

The Reserve Bank of Australia has held its Cash Rate at 1.50% since mid-2016.

Growth firmed modestly in Q2, although for now, CPI inflation remains near the bottom end of the central bank’s 2% to 3% target range, and wage pressures remain muted.

"While the latest monetary policy minutes reaffirmed that the next move in the Cash Rate was more likely to be an increase than a decrease, policymakers also saw no strong case for a near-term adjustment," says a note from Wells Fargo.

Any market impact on the Aussie is likely to be muted owing to a likelihood the Bank maintains a similar stance.

The other main economic event for the Aussie in the week ahead is the release of retail sales data for August at 2.30 on Friday, October 6, which is forecast to rise by 0.2% compared to July.

The greater the increase the more of a likelihood it will push up AUD.

The Pound: What to Watch this Week

The main focus for the Pound in the week ahead will be discussions focused on Brexit at the Conservative party conference which starts on Sunday, with the most attention on Theresa May's speech at the end of the conference, on Wednesday, October 03.

May is expected to continue to try to generate support for her Chequers' proposal despite rejection from both the EU and eurosceptics in her own party.

The consensus amongst senior conservatives is for a Canada-style trade deal instead which if it materialises could weaken the Pound.

"Brexit developments can buck the market at any moment, either way," says Robert Howard, who sits on the foreign exchange desk at Thomson Reuters. "Fortune may favour the brave, but speculators holding or mulling Sterling longs must be wondering about just how bold they should be as the annual UK Conservative Party conference looms."

Traders will be wary that the Pound has suffered at previous conferences.

Data from Reuters shows the Pound fell 3.75 cents in the first week of October last year, after a disastrous keynote conference speech by PM Theresa May.

"Sterling suffered from May's misfortune, amid perceptions that her hold on power had never looked weaker. A year earlier, the Pound fared even worse after May's conference message was perceived as signalling that Britain was heading for a hard Brexit," says Howard.

That first week of October 2016 ended with a "flash crash" for GBP, which saw cable tank to 1.1491 – its lowest for 31 years.

The main 'hard' data release for the Pound in the week ahead is likely to be Purchasing Manager Indices data (PMIs) for the manufacturing, services and construction sectors.

Manufacturing PMI, an indicator of activity in the Manufacturing sector, is forecast to slow in September, falling to 52.5 from 52.8 in the previous month of August, when it is released at 9.30 B.S.T on Monday.

Services PMI is forecast to fall to 54.0 from 54.3 when it is released at 9.30 on Wednesday.

Construction PMI is expected to decline to 52.5 from 52.9 when it is released on Tuesday.

PMI's are survey-based indicators; a result above 50 signals expansion and below 50 contraction.

Other data for the Pound, includes the Nationwide house price index (HPI), out at 7.00 on Tuesday, and the Halifax house price index, out at 8.30 on Friday.

Advertisement

Lock in Sterling's current levels ahead of potential declines: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here