Dollar-Yen: Conditions for Test of 155 Building says City Index Analyst

- Written by: Fawad Razaqzada, analyst at City Index

Image © Adobe Images

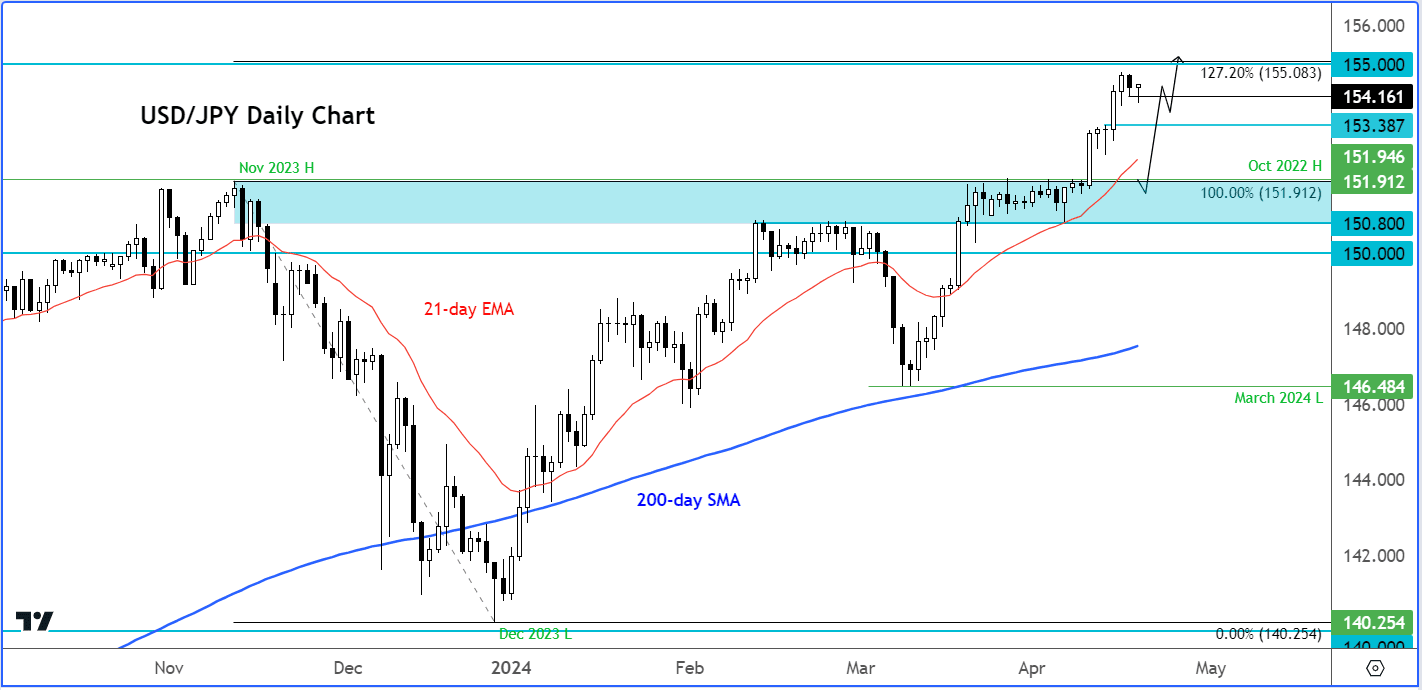

Dollar-Yen's recovery from its overnight lows means the price is forming a potential hammer candle on the daily timeframe.

A daily close around current levels of 154.50ish could point to a potential continuation towards that 155.00 handle, where the Japanese government may intervene.

On the downside, support is seen at around 154.00 followed by 153.35ish. The long-term support area is at around 151.90 to 152.00. This area was significant resistance back in October 2022 and November 2023, and, to a lesser degree, in latter parts of March and early April of this year.

Dollar-Yen has managed to bounce back after dipping slightly below the 154 handle overnight on the back of the joint press release by Japan, Korea, and the US, in which the Asian nations expressed their worries regarding the recent and persistent weakness of the yen and won.

Image courtesy of City Index.

The fact that the yen has resumed its selling suggests traders are now either testing the patience of authorities or calling their bluff, as verbal intervention has so far been ineffective.

The possibility of coordinated FX intervention between Japan and Korea is now quite higher, particularly if crucial levels are breached. On the USD/JPY, that level is likely to be around 155.00.

The fundamental backdrop remains supportive for the dollar in the wake of the recent stronger-than-expected releases of March CPI and retail sales data, hawkish Fed commentary and dovish-leaning ECB, BOC and RBA.

Fed hawks, exemplified by Michelle Bowman, hinted at the potential need for rate hikes, and the looming possibility of heightened tensions in the Middle East continues to buoy demand for the dollar.

For the USD/JPY traders, the focus has now shifted to potential FX intervention.

Finance ministers from Japan and Korea have expressed "serious concerns" about the sharp depreciation of their currencies. While it may be premature to interpret the joint statement as US endorsement of Asian FX intervention, the newfound coordination between Japan and Korea raises the possibility of simultaneous intervention by both countries.

That puts the USD/JPY and JPY crosses (and obviously the USD/KRW) into sharp focus as they approach key technical levels. But intervention without a change in the direction of monetary policy in Japan is only going to provide temporary relief as we saw last time when they intervened. This puts the upcoming BOJ policy meeting into sharp focus.

The next Bank of Japan’s policy meeting is scheduled for Friday, April 26. The Japanese government has been quite vocal about the ongoing depreciation of the Japanese yen, after traders continued to favour the higher-yielding foreign currencies over the yen despite the BoJ’s first rate hike in March in 17 years.

While the Policy Rate went back above zero for the first time in 8 years, this failed to slow the yen’s decline. Traders wanted a stronger commitment from the BoJ towards further policy tightening.

This is something the BoJ will need to address, otherwise the only other solution to support the yen is through FX intervention, which is becoming increasingly likely.