Yen Recovers on "Decisive" FX Intervention Threat

- Written by: Gary Howes

Above: File image of Shunichi Suzuki. Image © Pound Sterling Live, a modification of the original by Dean Calma / IAEA. Licensing: CC 2.0.

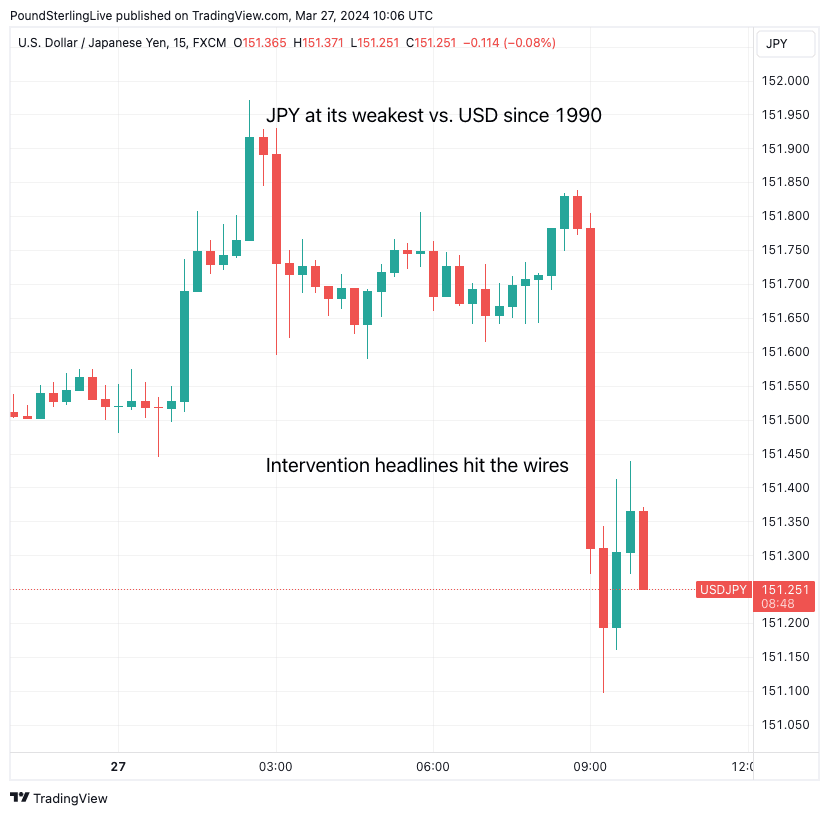

The Japanese Yen has staged a sharp recovery on news that Japan's Ministry of Finance may take "decisive steps" to shore up the currency's value.

Japan's finance minister, Shunichi Suzuki, said on Wednesday that authorities could take "decisive steps" against yen weakness after the currency fell to a 34-year low against the dollar. Analysts point out that this is language he hasn't used since 2022 when Japan last intervened in the market.

After Suzuki's comments, authorities announced that the Bank of Japan, the Finance Ministry and Japan's Financial Services Agency would hold discussions to "discuss" international financial market developments.

Markets took this as a sign authorities were finally readying to intervene in the markets and prop up the Yen.

The Dollar-Yen exchange rate fell a third of a per cent to 151.35 on the news, having hit its strongest level since 1990 earlier in the day.

Track JPY with your own custom rate alerts. Set Up Here

"Now we are watching market moves with a high sense of urgency," said Suzuki. "If there's excessive moves, we will take decisive steps and not rule out any options."

This is the second time this week Suzuki has issued verbal intervention, having said Tuesday that "rapid currency moves are undesirable" and that Tokyo will not rule out any steps to support the Yen.

We reported earlier today that Goldman Sachs had lowered its Japanese Yen forecasts, judging the recent interest rate hike at the Bank of Japan was not enough to alter the Yen's direction.

"The Bank of Japan hiked rates for the first time in 17 years, and for just the fourth time since the introduction of the zero interest rate policy in 1999. While this marks another giant leap for the BoJ, we think it is a small step for the Yen," says Goldman Sachs in a weekly currency research note detailing the forecast changes.

Regarding the threat of FX intervention, Goldman Sachs expects Japan policy to continue to be sensitive to the exchange rate, but it remains the case that the benign macro risk environment should weigh on the Yen over time.

"Fundamentally... we do not think the BoJ’s actions will prompt significant repatriation from Japan-based investors—that would need to come from a change in the returns available abroad," explains Goldman Sachs.

Goldman Sachs raises its forecast path for Dollar-Yen higher again to 155, 150, and 145 in three, six and 12 months (vs 145, 142 and 140 previously).