Israel-Iran: GBP/USD Rate Recovering from 5-month Low

- Written by: Gary Howes

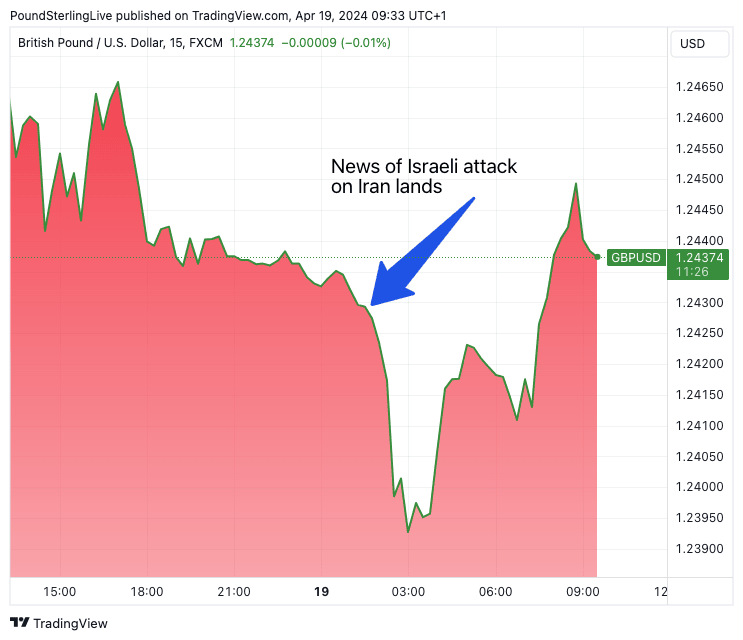

The Dollar rallied following news of Israeli airstrikes against Iran, but it has since pared those gains as the attacks were clearly signposted.

The Pound to Dollar exchange rate fell to 1.2389, its lowest level in five months after Israel launched a series of attacks on multiple military targets inside Iran.

The attacks represent an escalation in Middle East tensions and have prompted a typical risk-off market reaction: oil higher, stocks lower, Dollar and yields higher.

Above: GBP/USD at 15-minute intervals. Track GBP and USD with your own custom rate alerts. Set Up Here

But the attacks were clearly signposted and should not be completely unexpected. In addition, Iran has downplayed the damage, signalling no appetite to escalate.

These two factors are enough to justify a paring in the Dollar's advance and could allow currencies such as the Pound and Euro to recover recently lost ground.

"Israel’s retaliatory strike on Iran overnight triggered an initially big reaction across asset classes, although markets appear moderately less concerned at the European market open. Safe-haven currencies are leading the pack," says Francesco Pesole, FX Strategist at ING Bank.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

ING says the Pound and Euro are vulnerable to further weakness against the Dollar on Middle East tensions

If we do see a geopolitical risk escalation, GBP should, however, be in a more vulnerable spot than the euro, given the pound’s higher sensitivity to global risk sentiment and CFTC data showing that GBP has the largest net-long positioning in G10.

"The euro isn’t as exposed as higher-beta currencies to a potential escalation in the Middle East, although extending the dollar considerations above, substantially higher energy prices could lead to a more structural bearish stance on EUR/USD," says Pesole.

But ING says the Pound is likely to be more vulnerable to geopolitical inspired weakness. "If we do see a geopolitical risk escalation, GBP should, however, be in a more vulnerable spot than the euro, given the pound’s higher sensitivity to global risk sentiment and CFTC data showing that GBP has the largest net-long positioning in G10," says Pesole.

The Pound sits in the middle of the G10 pack when markets are in a clear 'risk-off / risk-on' yo-yo. It tends to lose against the Dollar, Yen, Franc and, to a lesser degree, the Euro when markets are running scared. It does tend to gain against the commodity Dollars, particularly the NOK, AUD and NZD.