Dollar Dip Lifts Sterling and Others after Mixed U.S. Retail Sales Report

- Written by: James Skinner

"While this report is mixed, the Fed will put much more weight on yesterday’s CPI release when deciding on the rate path," CIBC Capital Markets.

Image © Adobe Images

The Pound to Dollar exchange rate lifted from session lows on Friday after a mixed set of September retail sales figures from the U.S. was followed by declines in most Dollar exchange rates, although some economists say that inflation data released previously matters much more for the outlook.

Dollar rates slumped broadly from session highs after U.S. retail sales emerged unchanged with zero growth when the economist consensus had suggested that a 0.2% increase was likely, although last month's outcome was stronger than expected once car sales figures are overlooked.

The core retail sales measure, which excludes high value items like cars because of the distorting impact they have on trends, rose by 0.1% when economists had looked to see this measure of sales fall by 0.1%.

"The control group of sales (ex. gasoline, autos, restaurants, and building materials) grew a strong 0.4% on the month, above expectations for a 0.3% gain, which was compounded by a positive revision for August," says Krayne Charbonneau, an economist at CIBC Capital Markets.

"While this report is mixed, the Fed will put much more weight on yesterday’s CPI release when deciding on the rate path. As a result, the Fed is now likely to raise rates by 75 bps in November and could be on its way to a higher terminal point than previously thought," Charbonneau said following a review of the data.

Above: Pound to Dollar rate shown at hourly intervals with EUR/USD, USD/CAD (inverted) and AUD/USD

Above: Pound to Dollar rate shown at hourly intervals with EUR/USD, USD/CAD (inverted) and AUD/USD

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Friday's retail sales figures come hard on the heels of other data suggesting that one of the most important measures of U.S. inflation accelerated again in September, leading economists and analysts to reiterate or otherwise raise forecasts for November's Federal Reserve (Fed) interest rate decision.

"Adding a still too strong labour market, with small signs of cooling off and a running high wage growth, the Fed has no other options than to deliver yet another 75 bps hike in early November, the fourth in row," says Kjetil Martinsen, chief economist at Swedbank.

It wasn't clear why the Dollar fell following the sales figures though the response matches the price action seen soon after Thursday's inflation data when the Dollar rallied initially before falling across the board into the European close.

— Kwasi Kwarteng (@KwasiKwarteng) October 14, 2022

Losses for U.S. exchange rates helped lift the Pound to Dollar rate from session lows but still left Sterling in the red against the greenback as well as many other currencies during the final session of the week and following the sudden sacking of the UK's Chancellor by Prime Minister Lizz Truss.

"Reading between the lines, the news seems to make the case that a 'mini-coup' within the Conservative Party is underway, and that the PM's post will undergo a change by the end of October (or sooner)," says Stephen Gallo, European head of FX strategy at BMO Capital Markets.

"The main roadblock to this process occurring rapidly would be internal party rules regarding leadership changes, which may need to be circumvented or re-written this soon after a leadership election," Gallo said on Friday.

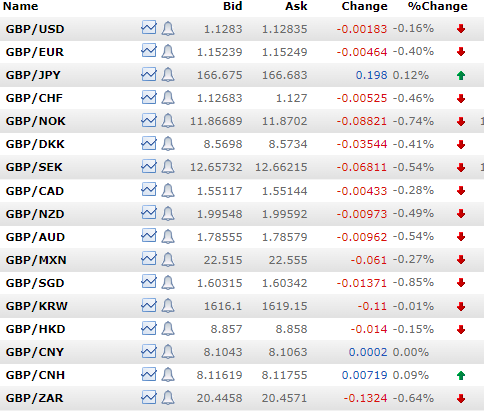

Source: Netdania Markets.