British Pound Forecast to Face Turbulence this Summer but Strong Recovery vs. Euro & Dollar by Year-End: HSBC

- Written by: Gary Howes

Image © Pound Sterling Live

- GBP to trade heavily this summer as political risk rises says HSBC.

- Warns of 60% chance of 'no deal' Brexit and mounting election risks.

- But still forecasts recovery against USD and EUR before year-end.

Pound Sterling could be in for a rough ride against the Dollar and Euro through the remaining summer months, according to strategists at HSBC, who say the mounting threat of both a 'no deal' Brexit and general election will weigh on the British currency.

However, those looking to transact out of Sterling over coming months should note that HSBC forecast a strong recovery in the UK currency by year-end.

Sterling has fallen notably since the beginning of last month, with losses blighting the Pound ever since Prime Minister Theresa May announced her resignation, which now looks set to open the door to 10 Downing Street for former foreigns secretary Boris Johnson to take the reigns as the UK's first pro-Brexit leader.

However, the ongoing Conservative Party leadership election and resulting threat of a leave-backing Prime Minister is ruffling feathers within the remain-leaning parliamentary wing of the Conservative Party, which can't afford to lose very many of its MPs at all.

According to HSBC, this makes for a difficult summer for the currency.

"Any new leader might struggle to command House of Commons support, with the Conservatives still in a minority, and with Brexit having frayed many of the traditional relationships between and within various parties. The new leader might feel the need to push for a clear 'mandate'," says Dominic Bunning, a strategist at HSBC.

The governing Conservative Party depends on the Northern Irish Democratic Unionist Party to provide it a parliamentary majority of just three votes. However, at least that number of MPs have either threatened to side with the opposition in a confidence vote if the government attempts to pursue a 'no deal' Brexit.

If the government loses such a vote the opposition Labour Party will be given 14 days to attempt to form a government. It's far from certain that Labour could cobble together a government because it'd have to enlist both the anti-Brexit Liberal Democrats and the pro-Brexit Democractic Unionist Party in order to command a majority.

Some others have said they might resign the whip if Borish Johnson is elected leader. Any resignations or defections could force Johnson, who's favourite to succeed Theresa May after the leadership hunt concludes in late July, would risk forcing the new Prime Minister into calling an immediate general election.

"The risk of another significant change in politics – whether because of a change in Government or a significant shift in UK-EU relations – will likely create enough uncertainty to keep GBP soft for the near future," Bunning warns, in HSBC's latest review of currency markets.

Above: Pound-to-Euro exchange rate shown at weekly intervals, alongside EUR/GBP rate (purple line, left axis).

The Pound-to-Euro rate was was quoted 1.1179 Monday and is now down 0.2% for 2019, after having held a 2019 gain of some 5% not so long ago.

Meanwhile, the Pound was changing hands at 1.2740 against the Dollar and is now up just 0.08% for 2019, although it has been even lower in recent weeks.

Above: Pound-to-Dollar exchange rate shown at weekly intervals.

"A new leader might try to renegotiate a deal with the EU – something that PM May tried and failed to do – or might simply announce that the government’s new policy was to leave the EU without a deal. If the new Prime Minister were to favour a more distant relationship with the EU, or publically supported No Deal, this would put downward pressure on GBP-USD," Bunning says.

Boris Johnson has told parliamentary colleagues that he intends to attempt to negotiate changes to the EU withdrawal agreement brought back from Brussels by Prime Minister Theresa May, with a view to having the so-called Northern Irish backstop stripped out of it. However, the EU is still claiming that it won't entertain fresh talks, seemingly suggesting it wants the UK to either accept the treaty or to leave the bloc via a 'no deal' Brexit.

The backstop is a convoluted mechanism that ultimately ensures the UK remains subject to EU trade policy and some laws unless and until the UK can satisfy Brussels that any other future relationship would not compromise the Good Friday Agreement. It's the most the contentious feature of the agreement and was previously described by Johnson as imposing a form of "vassalage" upon the UK.

It's opposition to this backstop as well as the EU's stance that explain why markets are frightened of a Prime Minister Boris Johnson, who was the favourite to replace a long time before she ever resigned from office. Those fears are why Pound Sterling has fallen so sharply since the middle of last month.

"This prior pricing in of political uncertainty may help to curb some of the downside in the currency for now, with the December and January lows in GBP-USD potentially providing support for the pair around 1.2450," Bunning writes.

Bunning and the HSBC team have warned of more losses that could blight Sterling over the summer but are still forecasting that the Pound will finish the 2019 year up at lofty levels not seen since the middle of February, which implies a tacit belief the UK will avoid a 'no deal' Brexit as well as a damaging general election that installs the profligate and openly-Marxist Labour Party leader Jeremy Corbyn in 10 Downing Street.

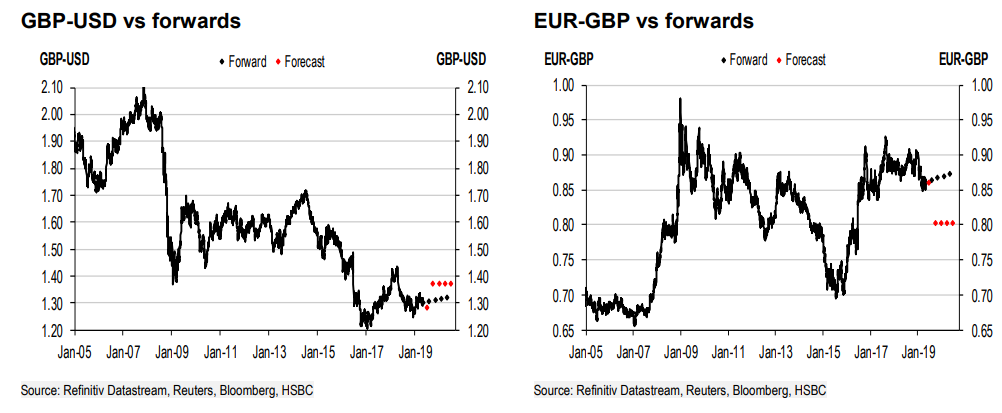

HSBC projects the Pound-to-Dollar rate will rise to 1.37 by year end, from 1.27 Tuesday, which implies an increase of 7.8% over the next five months.

The Pound-to-Euro rate, meanwhile, is expected to rise by 11.4% from Tuesday's 1.11175 to 1.2450 by the time the curtain closes on 2019.

Above: Charts showing HSBC forecasts Vs market consensus forecasts for GBP exchange rates.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement