EUR/USD Uptrend Nears Completion: Commerzbank

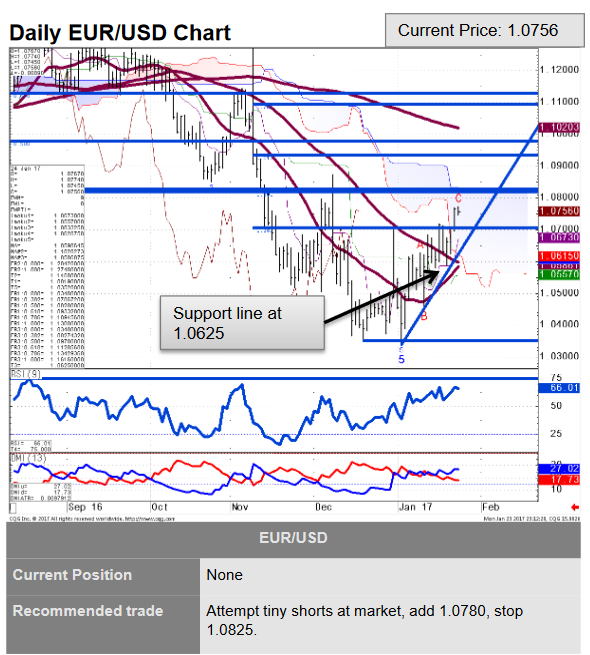

Technical strategists at Commerzbank have said they are initiating tiny shorts on EUR/USD now that an A-B-C correction which began at the 1.03 lows has finished.

The call comes as the exchange rate trades at 1.0721 having hit a 7-week high at 1.0775 on the previous day.

TD Resistance, which comes from an indicator based on the Fibonacci principle, at 1.0780 (on the 4-hour chart) is restricting upside increasing their certainty in the bearish call.

A TD Perfected, which is from the same suite of indicators as TD Resistance, is showing a set-up on the daily chart which is a further encouraging bears.

“We look for the 1.0625 near-term support line to be eroded – failure here is needed to add weight to the idea that the correction higher is complete and would cast attention back to the 1.0375/40 recent lows,” said Commerzbank’s Karen Jones.

Their recommended trade is to make small shorts at market with a stop at 1.0825 and adding more at 1.0780.

Despite the bearish call, Jones adds, “we are unable to rule out a move to 1.0820, 50% retracement and 1.0875, the December high.

But she is overall bearish given the longer-term downtrend.

“This will make little impact on the overall bearish chart,” She concludes.