SNB Market Interventions Unsustainable Argue Credit Suisse

The risk of a major political crisis in the Eurozone is making SNB interventions ever more costly and impractical say Credit Suisse.

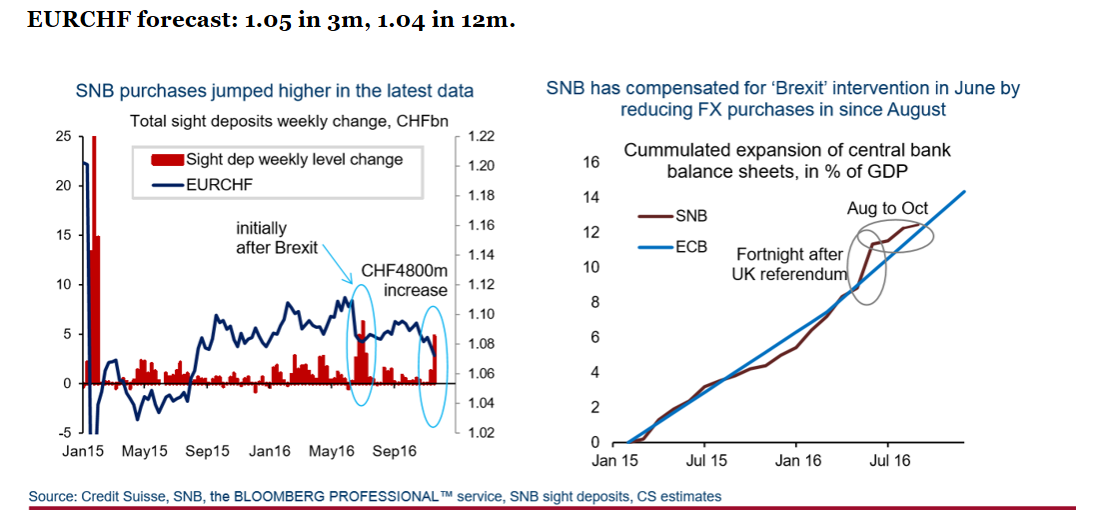

The SNB is unlikely to continue its heavy-handed market interventions amidst growing political instability in the Eurozone and a strengthening domestic economy.

The SNB has long manipulated the Swiss Franc to keep it artificially weak, to help its heavily export-orientated economy.

Most of the time it has successfully defended the Franc, however, in 2015 the SNB gave up the defense of EUR/CHF 1.20, resulting in a sudden unprecedented spike lower that took the exchange rate all the way down to the 0.80s.

This was due to increasing downside pressure from weakness to the Euro as markets anticipated a massive stimulus package from the ECB.

The current peg is 1.08 but we heard from Deutsche Bank this week that the SNB could withdraw this defence line.

In a recent note, they saw EUR/CHF breaking down through 1.08 all the way to parity as a result.

Now Credit Suisse have also joined them in expecting the central bank to give up trying to keep the Franc week.

Credit Suisse expect the pair to fall to the same level that it was at in July 2015.

“We set our 3m forecast to where EURCHF was in July 2015; during a similar period of political uncertainty around the Greek bailout referendum,” they stated in a recent note.

They see growing international resistance to currency manipulation, which could manifest itself in the form of embargos and tariffs in Trump’s new world order.

“Dependence on FX interventions over the longer term becomes a bigger issue under a Trump presidency after institutions like the IMF and US Treasury already raised their eyebrows to SNB policy.

“An improving economy now allows some room for gradual appreciation.

“EURCHF forecast: 1.05 in 3m, 1.04 in 12m,” concluded the Credit Suisse note.