Sell EUR/USD Even if US Treasury Yields Start to Fall say Deutsche Bank

Foreign exchange strategists at Deutsche Bank confirm they like being short EUR/USD even if the surge in US Treasury yields fades and retraces.

Traders at Deutsche Bank are holding onto the EUR/USD short positions, opened at 1.0750.

Deutsche are long-term bears on the Euro; last week we reported that they are forecasting the pair to break below parity over coming months.

The call comes despite Deutsche believing the rally in US bond yields, which has fuelled a correlative upside in the Dollar, may be overstretched.

The surge in US Treasury yields in the wake of Donald Trump's election victory has triggered a rally in the US Dollar which saw the Dollar index recently hit a 14-year high.

Deutsche Bank believe there are some factors that should at least contain the rise in Treasury yields, including: i) limits to how steep the US yield curve will get before carry constrains the long-end backup in yields.

Strategists cite the observation that US Treasury Note 10s minus 2s as having rarely traded above 250bps for any length of time.

Another constraint on US bond yields is the “global negative output gap, the world likely still has a disinflationary bias, although protectionism is bound to challenge this,” say Deutsche.

the US rally in US treasury yields does appear to be fading and this should halt the Dollar's advance.

The overstretched nature of US 10-year yields rally requires some consolidation.

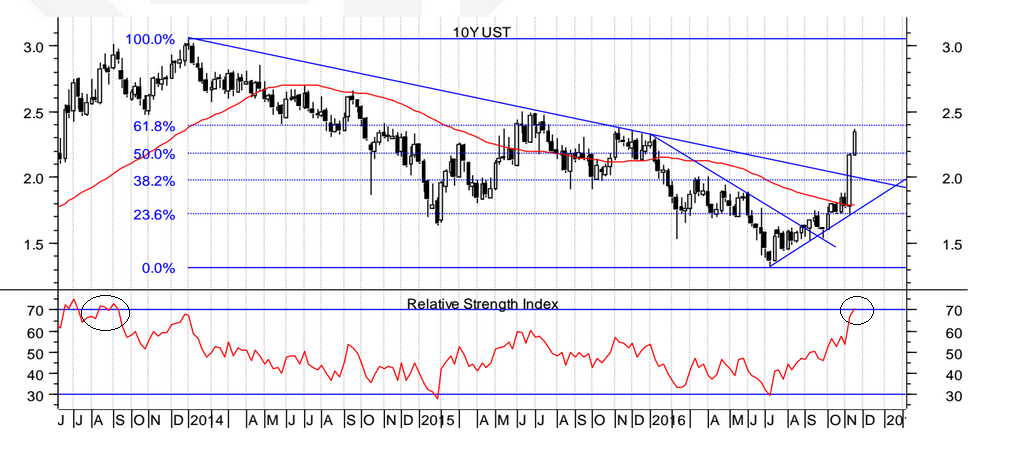

The chart below shows how the RSI momentum indicator is flashing overbought by moving over 70 on the lower pane of the Treasury Bond yield chart.

This is a sign the rally in yields is becoming overstretched and likely to stall/consolidate or even start to fall.

Whilst it is unlikely the rally will end altogether it may take a breather now, before going higher again at a later date which should signal a resumption of the Dollar's rally.

US Dollar Still a Safe-Haven

Another wildcard negative for yields would be increased political risk from Europe, as this would weigh on risk appetite.

“Trump’s election and Brexit have underscored the rise in global political risk. Most immediately pressing is the French Presidential election that has enormous ramifications for the EUR’s future, and global risk,” say Deutsche.

Yet even in such an event, Deutsche Bank believe the Dollar would likely gain from a ‘desperate flight’ to ‘safe’ US (and Japan) quality.

As such, the Dollar appears to be in something of a win-win situation, in which increased political risk from a rise in protectionism, particularly in Europe, will give rise to safety flows to USD, whilst a fall in risk will still maintain the current reflationary Dollar-positive status-quo.

In regards to the impact on Europe of Trump and Brexit, there are some skeptics, such as Unicredit’s Chief Economist Erik Nielsen, who says that these essentially Anglo-Saxon phenomena would not lead to copycat protectionist wins in continental Europe.

The economist says:

“Brexit and Trump are not the result of an accelerating populist wave about to overwhelm Continental Europe.

“That said, the UK and US leaders may try to interpret their victories that way, and if successful (still a big if!) they might help legitimise radicalism – and in that sense, Europe is at some risk.

“But nothing of the magnitude now priced in European equity and fixed income markets.”

However, the fact remains that it is the Far right Presidential candidate in Austria who is ahead in the polls and likely to win on December 4, and in the

Netherlands it is the far right populist PPP party which is in the lead, whilst in France, Marine Le Pen would be likely to win were she up against Hollande in the second round (though not the other candidates).

Yet Nielsen may be biased in his analysis by his own personal aversion to the far right, as happened in the past when he was vehemently opposed to - and expected neither Brexit nor Trump to win.

Deutsche are more convinced of the possibility of a populist revolution sweeping Europe.

“One broad point about Trump’s election is there is scope for an over-reaction, but there is even more potential for a failure of the collective imagination to understand the forces unleashed,” commented Deutsche.

The win-win for the dollar is also in some respects a lose-lose for the Euro, making their EUR/USD short a low-risk play.

“One trade where the economic and political risks align perfectly, in our view, is the short EUR/USD currency trade,” concludes the German lender.