Parity in EUR/USD Increasingly Touted

EUR/USD remains in a downtrend that could extend all the way down to parity.

The Euro hit a high of 1.0942 before reversing sharply to the 1.0916 level seen at the time of writing.

The declines are largely being driven by a strengthening U.S. Dollar and it is pointed out that the important 10 year German - U.S. yield spread has increased which would typically advocate for a stronger EUR/USD.

Concerning the outlook further losses are being predicted by some big-name institutional analysts.

Strategists at Credit Suisse see the current, short-term, downtrend as being down to increased political risk in the Eurozone.

The first risk comes from the Italian referendum on constraining the powers of the Senate, scheduled for December 4.

If the government loses, as expected, there might be cause to call an early general election in 2017, with the possibility of extremists and anti-EU parties gaining a foothold.

Italy has a fragile economy, with 137% debt to GDP, 11.7% unemployment and its banks have a higher-than-average share of Non-Performing Loans, at 20%.

As such it could be vulnerable to a financial market risk if the political uncertainty started impacting.

“We repeat our view that we believe the political environment in Europe is a major drag on the single currency,” commented Credit Suisse.

It is not just in Italy that political risks exist, ANZ point to elections in France and Germany too:

“Should the Italian referendum fail – which opinion polls suggest it will – there may be an election called in Italy early next year. Elections are also planned in the Netherlands, France, and Germany in 2017.

“These suggest some political risk premium will be priced into the EUR and we look for a move down towards a 1.00- 1.05 range over the coming months,” said ANZ’s Justin Been.

Credit Suisse point to the collapse in the pound as evidence that “highlights the structural political and economic vulnerabilities that can hurt European currencies even when underlying economic data are still decent.”

The apparent failure of the EU and Canada to agree a trade deal has been seen as another headwind facing the EU and the Euro.

The agreement of the trade deal was held up at the last minute by the Belgium region of Wallonia which vetoed it because of fears about exposing its vulnerable farmers to competition from Canada.

“The objections of Belgium's Wallonia region further underlines not only the profusion of political forces capable of hurting sentiment but also the timing randomness of their appearances,” remarked Credit Suisse.

From a Technical perspective, Credit Suisse see the possibility of a bounce at the current level, but then eventually a resumption of the downtrend.

“We would expect to see a bounce here, but beneath it can expose the lower end of the medium-term range at 1.0610/05. We would look for a fresh floor to be found here,” they commented.

In a separate note, Deutsche bank note the pair is oversold according to the Relative Strength Indicator (RSI).

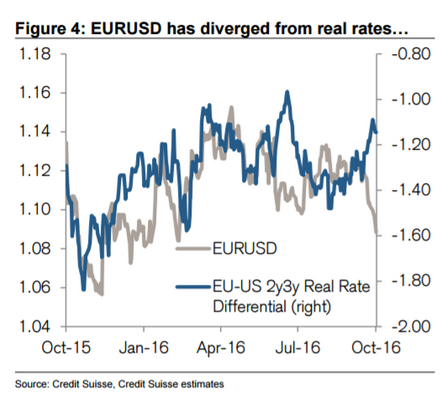

Another indication that EUR/USD may be overstretched to the downside is the extremely wide spread between the EUR/USD pair and the difference between the 2yr US and EU bond yields.

Usually, the two are in sync but whilst bond differentials have risen EUR/USD has fallen, creating a widening shark-like jaw pattern, which is increasingly likely to 'snap shut'.

This would involve a fall in the yield differential and a rise in EUR/USD.