Euro / Dollar Exchange Rate Outlook: Down Now, Up Later

The euro has fallen against the US dollar for two weeks now with a broad-based US dollar recovery being underpinned by stronger-than-forecast economic data.

The immediate focus for this exchange rate pairing is the release of what has become a very important set of inflation data due for release tomorrow.

On the back of a weaker US Dollar and rising energy prices through the first four-plus months of the year, market participants are anxiously waiting to see if signs of rising price pressures turn up in the April US Consumer Price Index report, due out tomorrow at 12:30 GMT.

"In recent days, US economic data has started to improve in meaningful areas, particularly for the consumer. Real spending is currently tracking at +3.7% annualised in Q2'16, which would provide a significant bump to growth. After Friday's release of the April US Advance Retail Sales report, the Atlanta Fed's GDPNow Forecast for Q2'16 improved to +2.8%.

"Rising inflation pressures could be the key to convincing market participants that the Federal Reserve is seriously considering raising rates in June. Right now, that's not really on traders' minds - the Fed funds futures contract is still pricing in less than a 10% chance of a rate hike next month,” says Christopher Vecchio, Currency Strategist at DailyFX.

With traders the least long the US Dollar in two years (and the least net-short EUR/USD over the same time period), Vecchio says any data that suggests that market is too dovish on the Fed's rate normalisation path could catalyse more strength from the US Dollar.

The euro exchange rate complex is looking firm and trades at around 1.1338 against the dollar and 0.7878 against the pound.

Concerning the levels to watch, a close below 1.13 could invite a move to fresh May lows and we would ultimately look for a test of strong support at 1.1220, that is once we clear modest support around 1.1270/75.

Ultimately EUR/USD to Remain Supported

The euro may be under pressure this month, but one theme we have been running with for some time now at Pound Sterling Live is an increasingly positive view being formed on the euro going forward on a multi-month timeframe.

As an example, last week we heard how forecasters at both UniCredit Bank and Deutsche Bank had upgraded their euro forecasts; it must however be pointed out that Deutsche Bank do still forecast the euro to fall notably.

This week we can report that the tone on the EUR/USD is certainly a dour one with the majority of forecasters suggesting that the exchange rate is likely to continue struggling suggesting any bounces will offer dollar buyers a fleeting moment of opportunity.

We do not see any inconsistencies with the two themes - one is stronger euro in the longer-term while the other is weaker euro in the nearer-term.

The key mystery to unravel is just how far the near-term weakness is likely to extend.

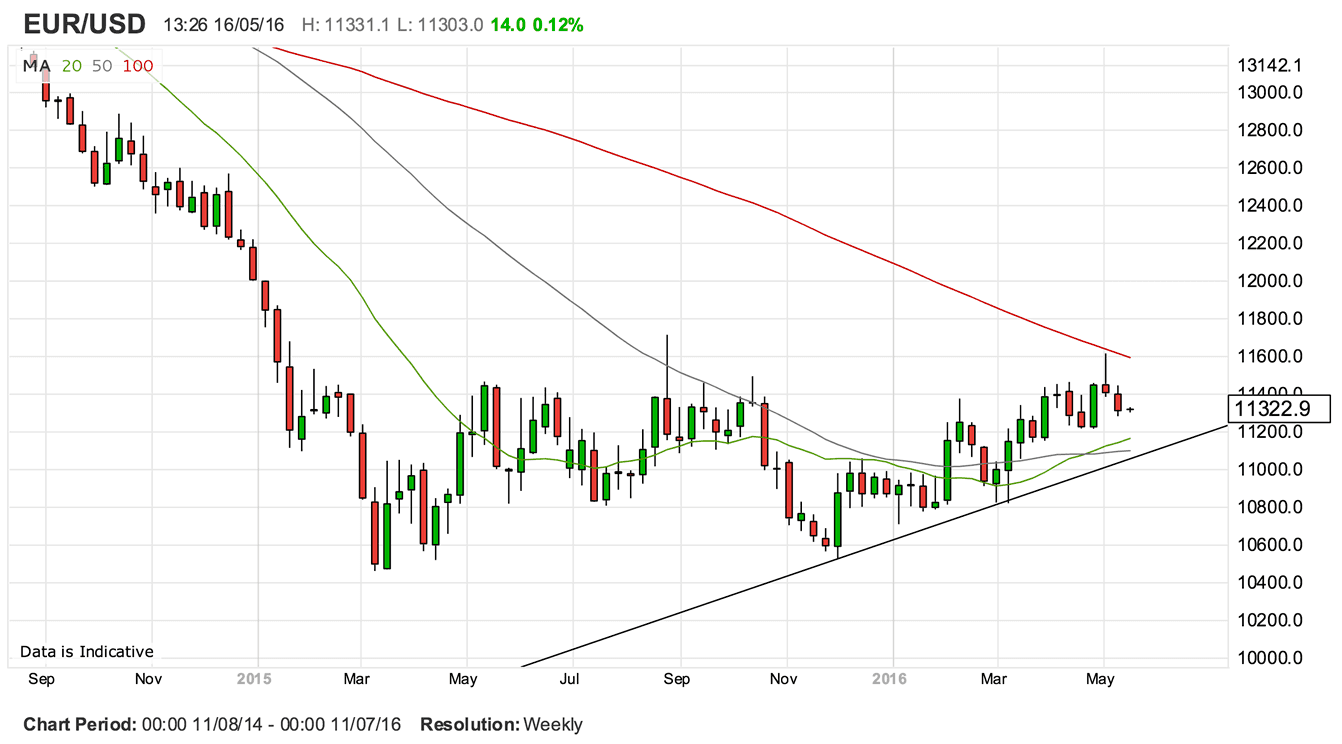

Firstly, a look at the below weekly chart shows that Since November the exchange rate has been heading higher; it is so important to consult a number of timeframes when trying to get a feel for where a currency is headed.

What this tells us is that the euro is allowed to have some downtime, and there is still some way to go before those hoping for a stronger shared currency should consider throwing in the towel.

There are multiple support zones on the chart that hint at where strong buying interest in the euro will likely be found. The 20 and 50 week moving averages look like an obvious zone of support and they both lie below 1.12 at the present time at 1.1160 and 1.11 respectively.

We could potentially see euro weakness limited to these numbers.

Demand for Euros to be Limited Over the Next Week

The soft-patch in the euro comes despite the undoubtedly positive German GDP statistics released on the 13th of May.

The data was unequivocally positive and confirms Germany to now be the fastest growing economy in the G7 space. This positivity should aid fellow Eurozone countries and we would expect the European Central Bank to hold interest rates steady and refrain from any further EUR-negative policy action as a result.

In an environment of stable monetary policy expectations the EUR is likely to remain broadly stable.

“The EUR has been supported, mainly on the back of stable central bank rate expectations. One must note that Eurozone inflation expectations as measured by 5Y forward breakeven rates have been stabilising, irrespective of the appreciating single currency,” says Valentin Marinov, Head of G10 FX Strategy at Credit Agricole.

Greece Back in the Spotlight

Nevertheless, there are areas of negativity to overcome, and it appears that this is where market attention is focussed at present.

Commentators have flagged up the return of Greek concerns as a driver of near-term EUR weakness.

Eurozone finance ministers are not scheduled to meet again until May 25th, but there are three major sticking points building up as that date approaches points out Stephen Gallo, an analyst with BMO Capital Markets.

The first is the disagreement between the IMF and Greece’s Eurozone creditors, with the IMF wanting a firm commitment to a Greek debt write-off.

The second is the lack of agreement between the Greek government and its Eurozone creditors regarding roughly €3.6 billion worth of contingency measures that Greece would need to implement if it doesn’t meet its budget surplus target by 2018.

The third sticking point, notes Gallo, is the lack of support from the Greek parliamentary opposition for the next round of austerity measures, which must be implemented in return for another aid disbursement over the summer.

Furthermore, “the euro’s negative relationship with risk appetite will lessen EUR weakness during risk-off periods, but we expect the 1.1350 area in EURUSD to be a good sell area in this week in view of rising Greek default risks and the uncertainty surrounding the UK’s EU referendum. Support is in the 1.1035-1.1130 range,” says Gallo.

What we are hearing is that direction either up, or down, in the euro / dollar pairing is unlikely to be a feature of this market for some time, but when it does come we believe the break could well be higher.