Euro-Dollar: Break Below 1.05 "Seems Inevitable" says Soc Gen's Juckes

- Written by: Gary Howes

Image © Adobe Images

The Euro to Dollar exchange rate is on course to break below 1.05, according to a new analysis from Société Générale.

Soc Gen's lead FX analyst, Kit Juckes, says further declines in Euro-Dollar can be expected on account of ongoing U.S. Dollar strength, linked to the country's outperforming economy that eliminates the odds of a mid-year rate cut at the Federal Reserve.

"Two weeks’ of stronger than expected US economic data and higher than expected inflation figures, have dented market expectations of near-term Fed easing and our forecasts have been adjusted, to look for the easing cycle to start in 2025," says Juckes.

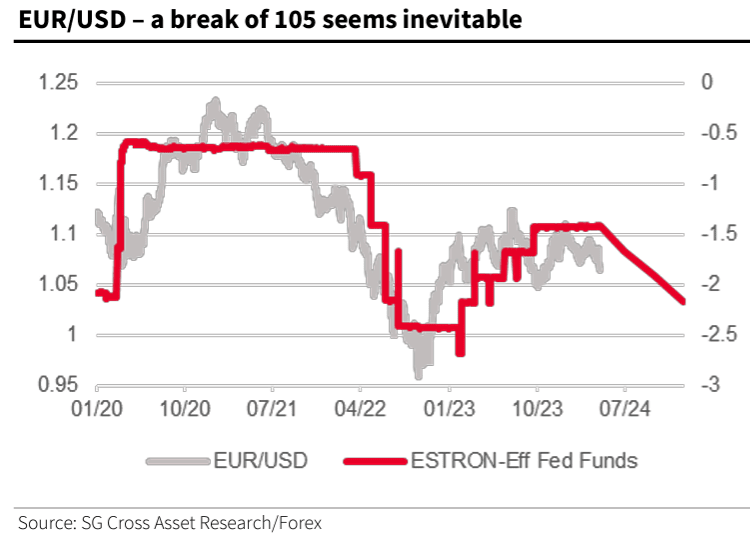

The below chart plots Soc Gen's expected rate path against Euro-Dollar and suggests that while the market has pried in a later start to Fed teasing relative to the ECB, there is further to go.

"A break below EUR/USD 1.05 is likely as that happens," says Juckes.

Soc Gen's economists revised their predictions for U.S. interest rate settings in the wake of last week's inflation data release, saying the economy is too strong to expect a cut in 2024.

The market is close to agreeing, with only one hike now fully priced for the year, compared with over 150 basis points worth of easing that was expected at the dawn of 2024. This repricing in rate expectations boosts U.S. bond yields and has supported the Dollar.

According to Soc Gen, Everything will be dependent on how the CPI data evolve and how resilient the economy is, but the data need to change significantly to reopen the door for rate cuts.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes