Euro-Dollar Trend "Getting More Bearish Now" says City Index

- Written by: Fawad Razaqzada, analyst at City Index

Image © Adobe Images

The trend for the EUR/USD is getting more bearish now, writes Fawad Razaqzada, Market Analyst at City Index.

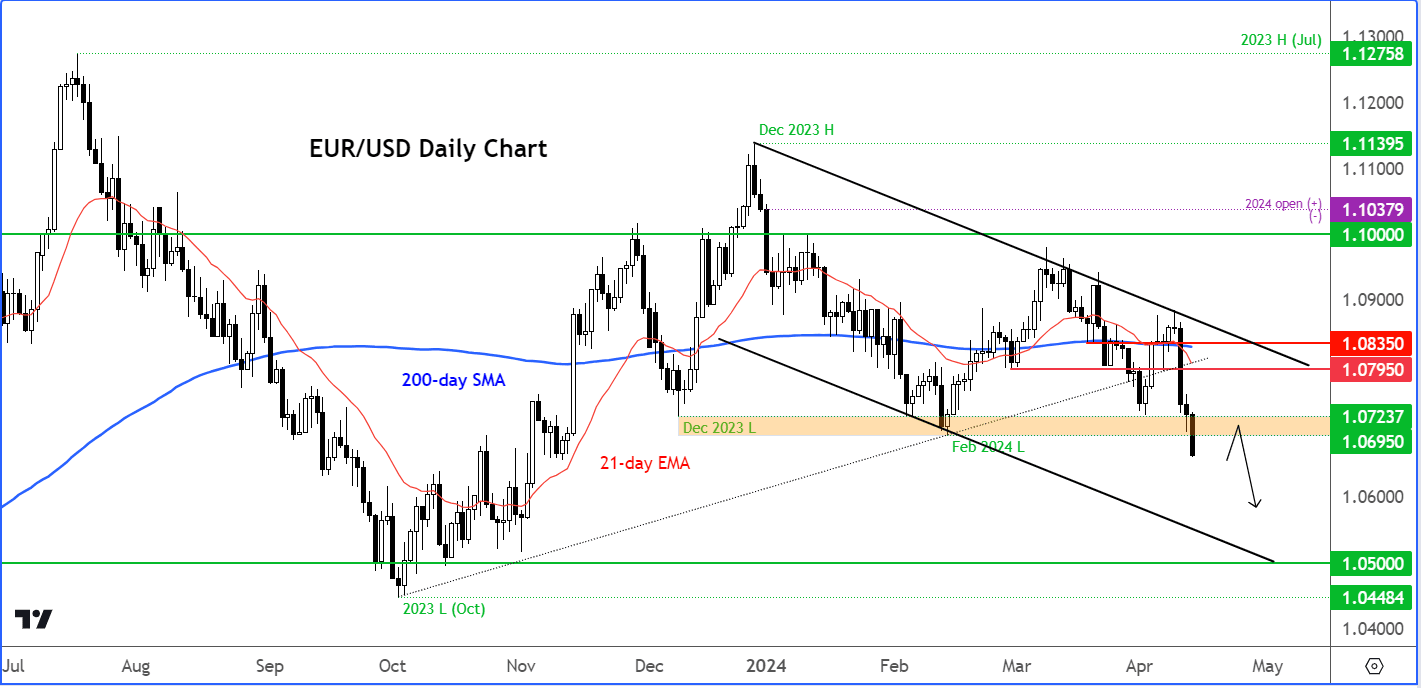

The trend for the EUR/USD is getting more bearish now. This week saw the EUR/USD break below some key support levels, initially taking out 1.0795 and now it has broken below a pivotal area between 1.0695 to 1.0725. This area had offered significant support back in December and again in February.

The EUR/USD has also taken out its bullish trend line that had been in place since October. With the 21-day exponential moving average now falling below the 200 simple moving average, this is an additional bearish signal. With price action being below these moving averages, this suggests that the path of this resistance is clearly to the downside.

Consequently, I’m expecting that EUR/USD is likely to drop to 1.06 handle initially ahead of 1.05 and possibly even testing the October low at 1.0448 thereafter.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

On the upside, resistance now comes in at that broken area of support I mentioned between 1.0695 to 1.0725 area. Should we get past there, the next line of resistance or potential resistance comes in at around 1.0795 followed by 1.0835. These were previous support levels as mentioned.

The pressure on the euro is growing, as the gap between expected rate cuts from the Fed versus the ECB widens to the most this year.

The latter is moving closer to cutting interest rates right as the former’s timeline lengthens. At the time of writing, the EUR/USD was probing its lowest levels since mid-November, after breaking below key support in the 1.0695-1.0725 area.

Image courtesy of Fawad Razaqzada, City Index.

Today, the US economic calendar includes the University of Michigan surveys and a few Fed speakers. But the next big US macro data is not due until late in the month when the Fed’s favourite measure of inflation is released on 26th April.

Until then we may well see the dollar remain supported on any short-term dips, given that both the US and rest of the world's rates story – for example, ECB and BOC – have turned more positive for the greenback.

Euro-Dollar had been stuck in a very tight range in recent months and never looked like it was about to take off any time soon anyway, all thanks to consistent weakness in eurozone data. Its more recent weakness reflects the growing divergence in rate paths between the US and Eurozone.

Track EUR/USD with your own custom rate alerts. Set Up Here

Traders not only perceive a higher likelihood of an ECB rate cut in June compared to the Fed, but they are also factoring in more cuts overall for 2024.

The US dollar side of the story is of course all due to the sticky nature of US inflation, and surprising resilience in data strength overall – plus rising oil prices, which is always dollar-positive. Consumer Prices in March rose to their highest annual pace since October with a print of 3.5% in mid-week.

That was the fourth consecutive month when CPI overshot market expectations, as prices of many basic necessities rose sharply, including car insurance, transportation and hospital services, not to mention rent, electricity and restaurant prices.

From the Eurozone side of things, a weak economy and cooling price pressure has increased the pressure on the European Central Bank to cut rates sooner rather than later.

On Thursday, ECB President Christine Lagarde acknowledged the potential for a reduction in June. Apparently, up to five members of the ECB Governing Council appeared to call for a rate cut at this Thursday’s meeting, according to Bloomberg. Consensus suggests the ECB's first phase of rate cuts could lower the deposit rate by around 100 basis points from 4%.