Euro-Dollar Looking "Expensive" Warns ING

- Written by: Gary Howes

Image © Adobe Images

The Euro to Dollar exchange rate is richly priced says ING, but even a "dovish" European Central Bank (ECB) this Thursday won't topple it.

Instead, research from ING finds that a decline in equity markets and a discernable divergence in central bank policy would be needed to bring the Euro closer to a 'fairer' valuation against the Dollar.

"At these levels, EUR/USD looks expensive," says Francesco Pesole, FX Strategist at ING. "The good performance of equities is largely to be blamed".

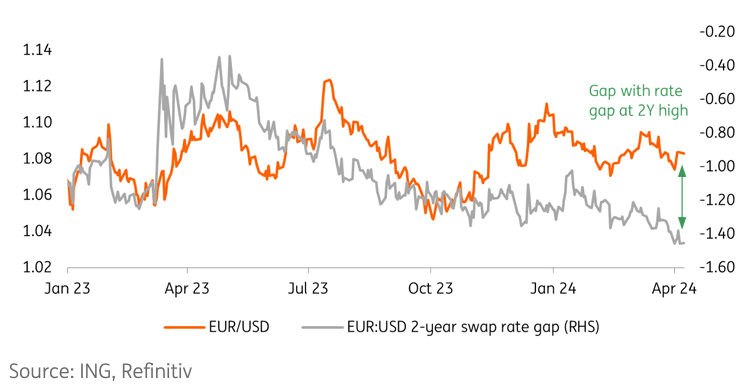

Interest rate differentials between the Eurozone and the U.S. are typically the major driver of Euro-Dollar, and on this basis, the exchange rate should be lower.

This is because interest rates (measured via swaps market) are higher in the U.S. over the Eurozone has grown over recent months, which would typically be associated with a notably lower Euro-Dollar.

"We are now observing the highest gap between EUR/USD and its depressed short-term swap rate differential in around two years. The good performance of equities is largely to be blamed for this decoupling, and especially given how global risk sentiment (to which EUR/USD has a positive beta) has been lightly affected by the repricing higher in Fed rate expectations," explains Pesole.

He says Euro-dollar looks expensive at current levels, but an equity sell-off would likely be required to push it lower.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

Another potential trigger would be a more notable divergence in central bank policy. ING notes global markets are expecting most central banks to move in tandem with the Federal Reserve when cutting interest rates.

This has dampened FX volatility, and "we suspect that tangible signs of policy divergence will be needed to drive larger moves in G10 FX," says Pesole.

But the ECB is only likely to cut interest rates in June, with markets attaching a 50/50 probability that the Federal Reserve will also cut at this point.

This week's ECB policy update is therefore unlikely to alter Euro-Dollar valuations by much, despite the exchange rate's apparent overvaluation.

"A stabilisation around 1.0800 in the near term remains likely in EUR/USD, although drops to 1.07 or lower look more likely than a break higher to 1.09/1.10," says Pesole.