Euro Strengthens on Strong Eurozone Service Inflation Reading

- Written by: Gary Howes

Image © European Commission Audiovisual Services

The Euro initially touched daily lows against the Pound and Dollar following the release of softer-than-forecast inflation data, but stubbornly high services inflation soon turned the single currency's fortunes around.

The official data showed Eurozone CPI inflation fell to 2.4% year-on-year in March from February's 2.6%, undershooting expectations for a 2.5% print. The core inflation rate - which the ECB is particularly interested - fell to 2.9% from 3.1%, undershooting the 3.0% expected by markets.

The initial undershoot was enough to bolster expectations for a June rate cut at the European Central Bank (ECB) and the Euro to Pound exchange rate dipped to a daily low at 0.8560 as part of an initial market reaction. The Euro to Dollar exchange rate fell to 1.0768.

The Euro soon reversed losses as it became clear that the report's finer details were not as bearish as the headlines.

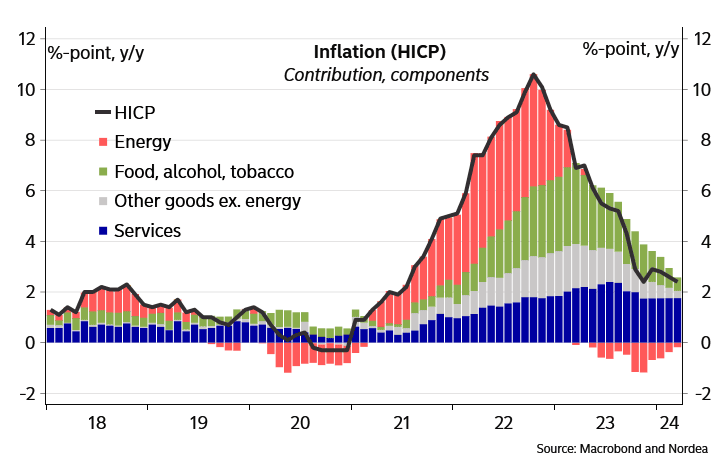

Services inflation - which is highly responsive to wage inflation - remains relatively high at an unchanged 4% y/y in March, and underlying inflation has risen sharply since the beginning of the year.

In fact, the core index rose by 0.3% month-on-month in seasonally adjusted terms, taking the 5-month moving average into an upward trend.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

ECB President Christine Lagarde has communicated that the central bank would only move if Spring pay settlements are contained and consistent with further progress in services inflation. Euro downside is likely to be limited as a result.

"We do not expect the ECB to hurry with their rate cuts and their recent communication has very much supported our expectation that a first rate cut will take place in June," says Tuuli Koivu, Chief Economist at Nordea Bank.

Above: Services inflation will ultimately stem the deflationary process and keep the ECB alert to cutting rates too fast.

"We expect that service price inflation will continue to be elevated due to continuous wage pressures," she adds.

Nordea Bank expects Eurozone wage increases to continue at relatively high levels, which will boost unit labour costs, assuming that there is no significant positive surprise in productivity.

As a result, the ECB will only move gradually on cutting interest rates, given the robust labour market developments which will keep service price inflation at somewhat elevated levels.