GBP/EUR Rate Recovers Post-Bank of England Losses

- Written by: Gary Howes

Image © Adobe Images

The Pound to Euro exchange rate has recovered the losses that followed the Bank of England's March policy decision and we expect trade to centre around the 1.17 fulcrum in the coming days.

Pound Sterling registered a 0.30% recovery against the Euro last week, potentially helped by guidance from Bank of England policymakers Mann and Haskel that the Bank won't be tempted to cut interest rates as soon as May.

The odds of a rate hike as soon as next month rose after both Mann and Haskel dropped their votes for further rate hikes in the March policy update, prompting markets to bet the Bank was gearing up for a cut. Pound-Euro fell to a fresh nine-week low at 1.1626 in response to these developments.

Both Mann and Haskel pushed back against the idea of imminent cuts, reminding us that the UK's interest rates would need to remain at current levels for some time to ensure inflation is coming down.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The Pound to Euro rate recovered as high as 1.1720 at one point on Friday, but ultimately, the gains were unable to stick, leaving the market closer to 1.17 at the time of writing Tuesday.

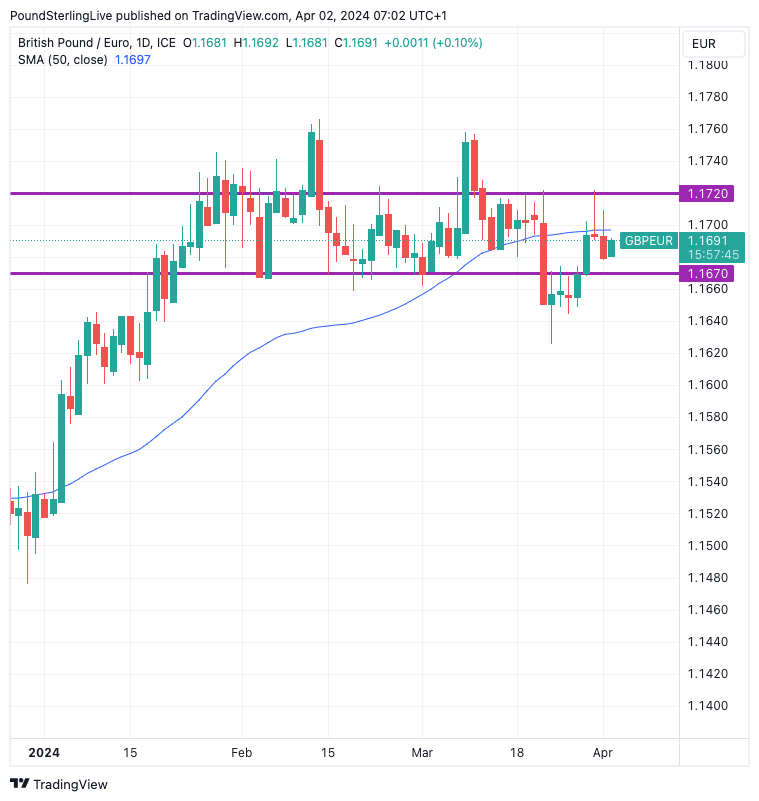

From a technical perspective, we note the exchange rate is struggling to move back above the 50-day moving average, as per the below chart. The 50 DMA (blue line) should serve as the first area of resistance that will likely restrict the Pound's upside potential in the coming days.

Above: GBP/EUR at daily intervals. Track GBP/EUR with your own custom rate alerts. Set Up Here

The above chart also shows the 2024 range, which will remain favoured in the coming days and weeks, judging that it will take a noticeable shift in data to shake the pair from this range.

Looking at the calendar, today's inflation data from Germany will be of interest, which will precede tomorrow's Eurozone-wide release.

Last week's inflation data from France and Spain undershot expectations, which suggests inflation in the Eurozone is comfortably trending towards the European Central Bank's 2.0% target, allowing for the central bank to cut rates in June.

A June cut is fully expected, and for Pound-Euro, there is greater uncertainty as to when the Bank of England will first cut rates.

Although Haskel and Mann appear to prefer an August rate cut, Bank Governor Bailey recently said all meetings are 'live' going forward.

Inflation is expected to fall below the Bank's 2.0% inflation target this month owing to another sharp fall in energy prices that came into effect on April 01, which will show up in the May data.

This morning the BRC revealed shop price inflation had finally fallen below 2.0%, and some economists expect inflation to trend below the Bank's 2.0% target for the majority of this year.

This means the conditions for the Bank to cut are certainly there, which can limit Pound Sterling's upside potential against the Euro and why forays above 1.1720 are unlikely to hold in the near-term.

Over the medium term, the Pound outlook remains constructive. Last week, we reported that, despite recent market developments, analysts at Barclays and Julius Baer continue to predict that the Pound Sterling will rally to fresh multi-year highs against the Euro later in 2024.