GBP/EUR Rate Forecast from Credit Suisse Shows the Rally is Not Yet Done

- Written by: Gary Howes

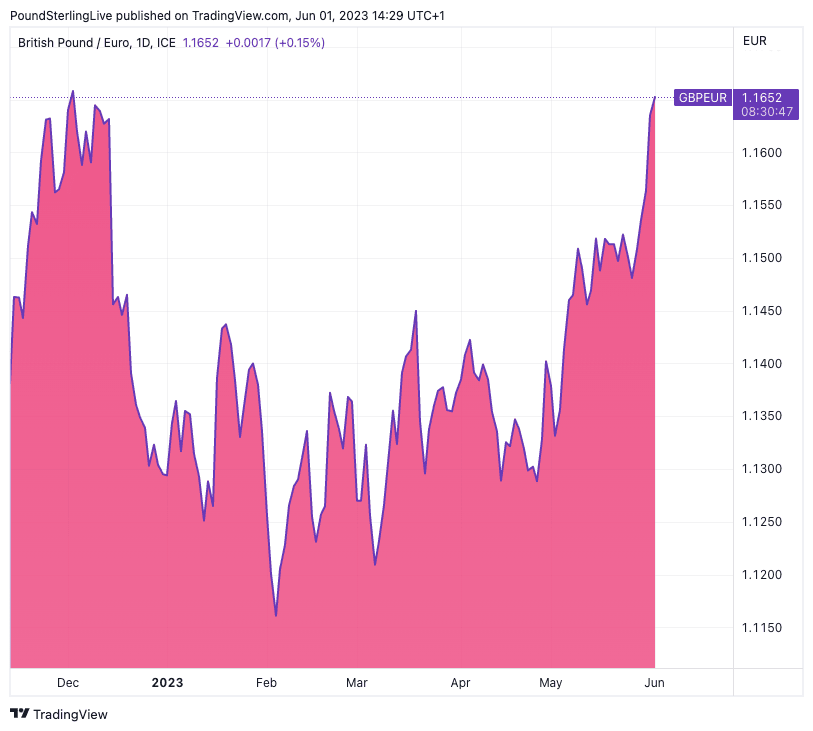

The British Pound has now risen by 3.0% against the Euro in 2023, taking the exchange rate to its highest level since December, and further gains can be expected according to one investment bank.

Credit Suisse was one of the only major investment banks to hold a tactically bullish stance on Pound Sterling heading into 2023, an out-of-consensus stance that has proven fruitful.

In a new briefing to clients, Shahab Jalinoos, head of FX research at Credit Suisse in Zurich, says his original target for EUR/GBP at 0.8700 (GBP/EUR @ 1.15) has been breached, but the pair can extend lower as Sterling strengthens further.

"One of our core views throughout 2023 has been that UK rates pricing has been far too benign given the very obvious price and wage pressures in the UK economy. Ultimately the BoE is an inflation-targeting central bank and for now, that target is still 2%, even as the UK has the biggest inflation problem in the G10," says Jalinoos.

The Pound has risen against the Euro over recent days to its highest level since December 2022 at 1.1650, held aloft by rising UK yields and a relative underperformance by yields in the Eurozone following softer-than-expected Eurozone inflation releases this week.

UK yields were boosted by last week's news UK inflation read at 8.7% year-on-year in April, a figure that handsomely beat analyst expectations.

By contrast, the Euro has retreated as German inflation massively undershoot expectations for May, with France following suit. On Thursday it was meanwhile reported by Eurostat that area inflation likely fell to 6.1% in May, from 7% previously, following a broad moderation that left the annual pace of price growth running below the 6.3% economist consensus.

The core inflation rate - which the European Central Bank pays close attention - fell from 5.6% to 5.3% in May when the average of economists' forecasts was that it would fall only as far as 5.5%.

Credit Suisse meanwhile says the UK Treasury and Bank of England appear aligned on the need to bring inflation down, meaning there will be little political interference in the Bank of England's desire to raise rates in order to bring inflation lower.

"With the Chancellor Jeremy Hunt openly supportive of the need to bring inflation back down, in our view the BoE has both the mandate and responsibility to continue the rate hiking cycle that has seen it already deliver 11 rate hikes, worth 425bp, since Feb 2022. Sonia futures already price GBP as being a stand-out G10 high yielder by December at a terminal rate around 5.50%, a rate reached by the BoE hiking by 25bp at each of the next 4 meetings," says Jalinoos.

"The simple fact that GBP will likely enjoy a material yield premium over the EUR for the far foreseeable future is likely still being digested after so many months of GBP having been a favourite market short. This is what allows for further EURGBP downside momentum towards our target," he adds.

Credit Suisse strategists are looking for Euro-Pound to trade towards 0.8550, giving a Pound to Euro exchange rate target of 1.17.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes