The Pound-Euro Exchange Rate Pushes Through 1.20 Barrier

Image still courtesy of BBC News.

- Exit poll suggests Cons. majority of 86

- Blyth Valley falls to Cons. for first time since 1950

- Sterling can extend gains say analysts

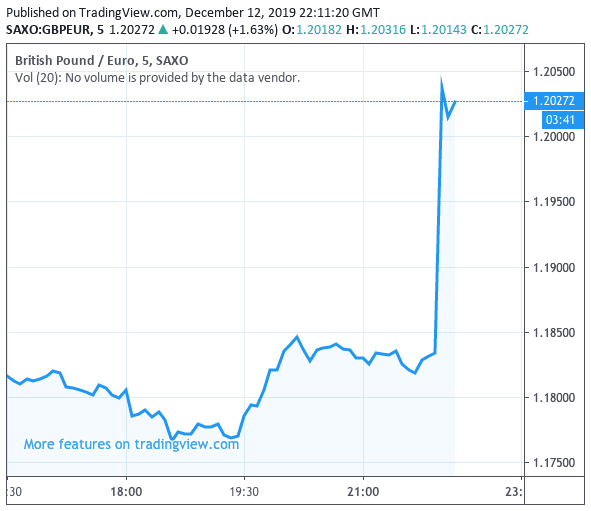

The British Pound has risen back to levels last seen against the Euro in the immediate wake of the EU referendum of 2016, after an exit poll that suggests the Conservatives of Boris Johnson have won a solid majority in the General Election.

The Pound-to-Euro exchange rate has risen through the key 1.20 level after an exit poll predicted the Conservatives are on course to win 368 seats, up 51 since 2017, while Labour were on course for their worst result since 1924 should they secure the predicted 191 seats, a loss of 71 on 2017.

The Conservative's would therefore win a majority of 86 seats in the election if the exit poll is correct, giving Johnson the numbers in parliament he needs to deliver Brexit on January 31, and in doing so put an end to months of uncertainty that has been hanging over the UK economy, and its currency.

"All the fears about a hung parliament have proved unfounded. This looks like a comfortable evening ahead – the margin of victory is huge and even if it not quite as big as the exit poll indicates, the Conservatives will still have a huge majority. It’s a big enough margin that even if things come in a bit we are in for a Tory victory tonight and looking at a strong Conservative government. If it plays out like this, it would be the biggest majority for the Tories since the heady days of Margaret Thatcher," says Neil Wilson, Chief Market Analyst at Markets.com.

The Pound-to-Euro exchange rate moved to record a high of 1.2064 following the releaes of the exit poll, having been as low as 1.1755 earlier in the day, meaning the purchasing power of Sterling against the Euro is at its strongest level since the EU referendum of June 2016.

"If the exit poll is correct, a large Conservative majority should lead to a smoother Brexit outcome. It would give the prime minister more breathing room to extend the transition period, and if that happens the pound could push higher," says James Smith, Developed Markets Economist at ING.

In a first hint that the exit poll might in fact be correct, the Conservatives have snatched the former Labour stronghold of Blyth Valley.

The Conservatives polled 17440 against 16728 for Labour, this is a traditional Labour heartland seat which the Party has represented since 1950.

Should the exit poll be correct, this would represent the Conservative’s largest majority since 1987, when the party was led by Margaret Thatcher.

Exit polls have called the number of seats for the leading party within four seats of the actual result since 2005 following an overhaul of the methodology deployed to extrapolate the final result from the sample of around 100 polling stations.

However, those watching Sterling should be aware that 2019 is different to previous elections owing to the overhanging theme of Brexit, that could lead to significant tactical voting.

"There may be a greater number of idiosyncratic factors in different areas around the UK this time. For example a greater incidence of tactical voting could water down this exit poll’s accuracy. There are probably more local factors at play this time as well," says Philip Shaw, Economist at Investec.

"Sterling has taken the news well," adds Shaw. "Its initial reaction was to rally against other currencies. At the time of writing it stood at $1.3475 (a gain of three and a half cents) and 83p against the euro (1.5p stronger)."

Shaw says markets must now wait until the 650 results begin to come in.

The first is expected at around 11.00pm (Houghton and Sunderland South), while by 4.00am we should have some 75% of the results.

Concerning the outlook for the Pound, should the actual results confirm the projections of the exit poll, foreign exchange analysts suggest the currency might extend its gains.

"If constituency results confirm the exit poll it’s entirely possible that the sterling rally will extend much further. Either way it looks like sterling is in for an eventful night," says Ranko Berich, Head of Market Analysis at Monex Europe.

“Sterling soared higher by over 2% as nervous traders who had been selling sterling during the day, just in case it was another hung parliament, began buying it with gusto. I suspect there was as much relief, as there was excitement at the size of the majority that was so unexpected. Sterling is now set to challenge some fairly significant levels against both the euro and the US dollar. If sterling breaks above these levels, it could very well drive some big moves higher towards 1.25 and 1.40, at least in the short term,” says Andy Scott, Associate Director at JCRA.

* Time to move your money | Get industry-leading exchange rates and maximise your currency transfer potential with Global Reach. Speaking to a currency specialist will also help you to capitalise on positive market shifts while protecting against risk. Find out more here. * Advertisement