Bank of England Has One Cut Left: Pantheon

- Written by: Gary Howes

Image © Adobe Images

Incoming data shows a resilient economy that doesn't need materially lower interest rates.

This is according to a new analysis from Pantheon Macroeconomics - the independent research house - following a flush of above-consensus UK data releases.

"Businesses became more optimistic over growth prospects in October despite the deluge of tax-hike rumours ahead of the November Budget," says Elliott Jordan-Doak, Senior U.K. Economist at Pantheon Macroeconomics.

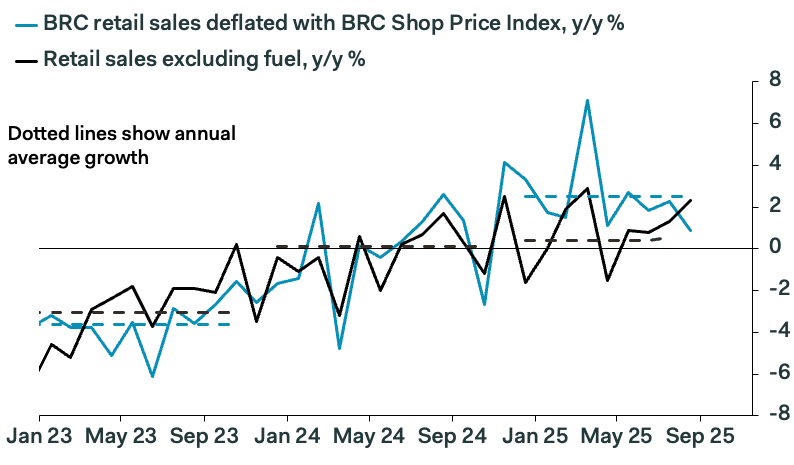

The October PMI survey reached a two-month high at 51.1 from 51.0 in September, above the consensus of 50.5. Retail sales rose by 0.5% month-to-month in September, beating consensus at -0.4%. GfK's consumers confidence rose to -17 in October, from -19 in September, beating estimates for -20.

These data indicate an economy that looks to be on the up again and Pantheon Macroeconomics thinks this will limit the scope for further Bank of England interest rate cuts.

Despite Bank Rate being well above pre-pandemic levels at 3.0%, the economy continues to put in a robust, albeit uninspiring, performance.

Inflation is meanwhile nearly double the Bank of England's target.

This suggests to Pantheon Macroeconomics that the neutral level of Bank Rate - at which it is neither inflationary nor disinflationary - is much higher than was the case in the decade preceding the pandemic.

This means cutting too far risks stimulating inflation.

"We think the growth data and survey leading indicators show an economy proving surprisingly resilient to high interest rates, inflation nearly double the MPC's target, tariff uncertainty, and pre-Budget speculation," says Jordan-Doak.

The growth picture suggests to him that the neutral rate is high and that rates are only modestly restrictive.

Growth only a little below potential means that spare capacity will build only slowly, leaving Pantheon comfortable with its decision to bring forward its call for the next rate hike from February 2026 to this December.

Rate setters are then on hold thereafter.