Bank of England's Greene Pours Cold Water on a June Rate Cut

- Written by: Gary Howes

Above: File image of Megan Greene. Image © Informa Connect Global Finance

Another member of the Bank of England's Monetary Policy Committee (MPC) has cautioned the market against betting on imminent interest rate cuts.

Megan Greene, an external member of the MPC, looks to be rooted in the 'hawkish' camp that would prefer to cut interest rates in August, as opposed to June, which is when the consensus expects the Bank to kick off the cutting cycle.

"Markets now expect the Bank of England will cut rates earlier and by more than the Federal Reserve this year," said Greene in an article for the Financial Times. "The markets are moving rate cut bets in the wrong direction."

The Pound fell after markets brought forward the expected first cut to June from August following last month's Bank of England interest rate decision and guidance.

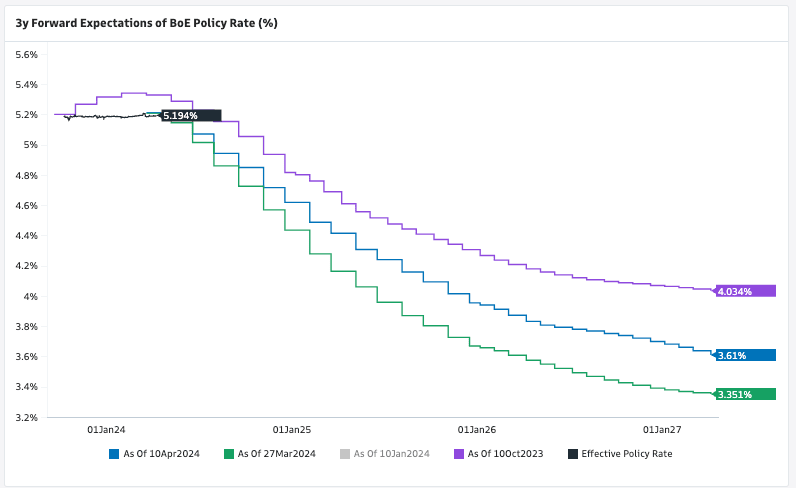

Above: Markets see lower UK rates in the outlook than was the case in October 2023. But expectations have risen since the lows that followed the Bank of England's March decision. Image courtesy of Goldman Sachs.

This was encouraged by two members of the MPC dropping their votes for further rate hikes in favour of holding rates.

But both members - Catherine Mann and Jonathan Haskel - have said in speeches since the decision that they are not in favour of cutting interest rates.

We read into this that Mann and Haskel are uncomfortable with the market's move to fully price the first rate cut in June, judging it too soon. That is why we expect them to favour a first cut in August.

On the basis of Greene's latest commentary, we would put her in this camp. That makes a decent three-person body of voters that will resist a June cut.

Greene says, "lower UK potential growth means greater inflationary pressures, all else being equal."

"With both weaker supply and demand in the UK than the U.S., we have to look at signs of persistence to compare the inflation dynamics and potential rate paths. I’m worried that second-round effects are having a larger and longer-lasting impact in the UK," she adds.

Greene is concerned UK inflation will stay above the Bank's 2.0% target on account of strong wage growth in the UK.

"Higher inflation expectations have translated into higher pay growth, by some metrics now between 6-7 per cent in the UK versus 4-5.5 per cent in the US. Such sticky wage growth is a significant component of services inflation," she explains.

Greene wants to see wage growth slow further if services inflation is to return sustainably to target-consistent levels. "This last mile may prove the hardest. UK services inflation remains much higher than in the US."

The odds of a June rate cut at the Federal Reserve were all but quashed by last Friday's strong U.S. job report and this week's inflation figures that showed inflation is increasing in the U.S.

Following the U.S. inflation figures, markets also lowered expectations for a Bank of England rate cut in June, but it is still seen as a likely outcome.

"The chances of UK rate cut in June just dropped from 60% to 50% on the (not unreasonable) view that BoE & ECB will not want to front run the Fed and invite amplified imported inflation," says Simon French, an economist at Panmure Gordon.

"Momentum in the markets has been towards pricing in later rate cuts by the Fed as economic growth remains robust. In my view, rate cuts in the UK should still be a way off as well," says Greene.