Dollar To Push Pound & Euro Lower Says Top Forecaster

- Written by: Gary Howes

-

Image © Adobe Images

Ongoing Dollar strength will ensure one of the world's top forecasters stays ahead of the pack with its counter-consensus expectation that the Greenback will outperform in 2024.

The Dollar is 2024's top-performing G10 currency and can maintain this strength, according to Valentin Marinov, Head of FX Strategy at Crédit Agricole.

"The USD is still on course to outperform all its G10 FX peers in Q124, in a big hit to the rather consensual (but not ours) bearish USD view for 2024," he says.

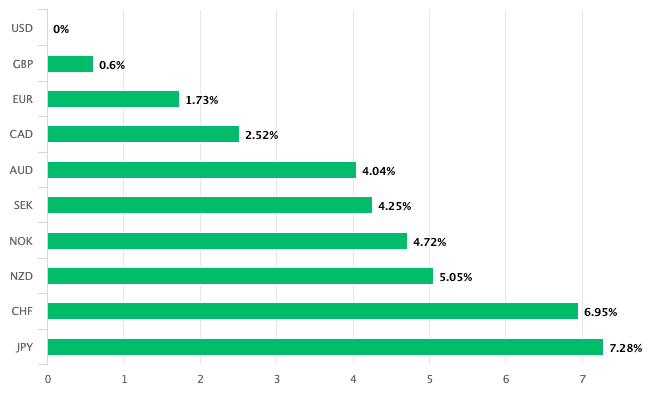

Above: USD performance in 2024. Track GBP/USD with your own custom rate alerts. Set Up Here

Crédit Agricole was the number one forecaster for the Euro-Dollar (out of 76) according to Bloomberg's FX forecast rankings for Q4 2023. It was number six (out of 68) with its forecast for the Pound to Dollar rate in the same period.

The call for ongoing USD strength comes after the Federal Reserve's March policy update, which saw policy makers adjust slightly expectations for the trajectory of the Fed's base rate. The Dollar was sold after the meeting, as investors took a broadly 'dovish' take on the Fed's balanced guidance.

Live GBP/USD Money Transfer Exchange Rate Checker | ||

Live Market Rate: | get quick quote | |

Corpay: | ||

Banks: Median Low | ||

Banks: Median High | ||

These data are based on the spread surveyed in a recent survey conducted for Pound Sterling Live by The Money Cloud. | ||

But Crédit Agricole thinks the market might have got it wrong again, after all it started the year on the wrong side of the Fed, betting on more rate cuts for 2024 (as much as 150bp) than were likely. In December, the Fed projected three cuts, which the market has ultimately accepted.

"The USD’s knee-jerk reaction to the March FOMC raises the prospects that some FX participants could get caught wrong-footed twice over roughly the same reasons," warns Marinov.

He says the Fed is by no means to be interpreted as dovish, citing three reasons:

(1) the new dot plot was only one member short for the 2024 median to move to only two rate cuts

(2) the 2025 and 2026 medians were lifted by 25bp

(3) the U.S. GDP projections were revised higher across the forecast horizon.

"While our US economist sticks to his call for a first Fed cut in July and only 50bp worth of easing this year, our stance still leans towards buying any USD dips that a usually negative seasonality could exacerbate in April," says Marinov.

Crédit Agricole forecasts Euro-Dollar at 1.07 by June 2024 and 1.05 by year-end. A gradual recovery through 2025 is predicted.

For the Pound-Dollar exchange rate, the forecast profile is 1.26 by mid-2023 and 1.25 by December. A steady recovery through 2025 is predicted.