Canadian Dollar: Inflation Surprise Pressures Bank of Canada to Cut Interest Rates

- Written by: Gary Howes

-

Image © Adobe Images

The Canadian Dollar fell after it was reported Canadian inflation was softer than markets were expecting in February, opening the door for the Bank of Canada to signal rate cuts as soon as April.

The Pound to Canadian Dollar exchange rate rose a third of a per cent to 1.7278 after Statistics Canada said CPI inflation rose 0.3% month-on-month in February, which was half the expected rate of 0.6%.

This took the year-on-year increase further into the Bank of Canada's 1-3% inflation target band to 2.8%, down from 2.9% in January.

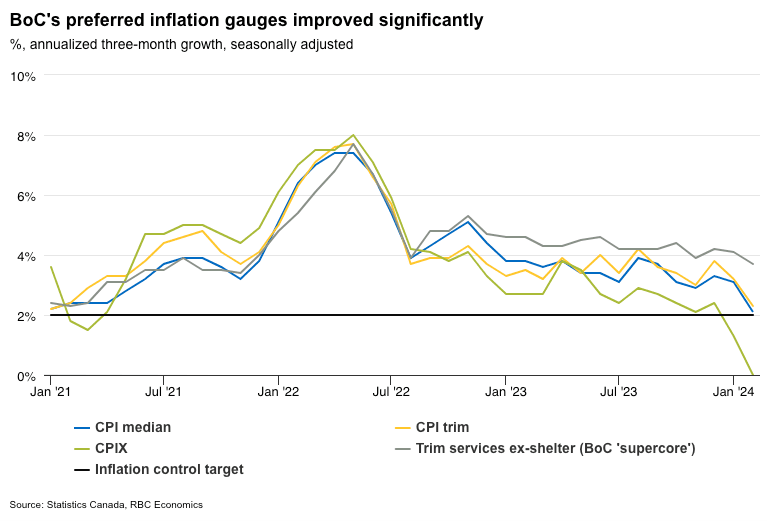

The Bank of Canada’s aggregate core inflation measures – CPI trim (+3.2%) and CPI median (+3.1%) - both eased further towards the top end of the inflation target range in Canada. Analysts at Royal Bank of Canada point out that the more recent three-month rolling average growth rates for those same measures averaged 2.2% in February, the lowest reading in three years.

Live GBP/CAD Money Transfer Exchange Rate Checker | ||

Live Market Rate: | get quick quote | |

Corpay: | ||

Banks: Median Low | ||

Banks: Median High | ||

These data are based on the spread surveyed in a recent survey conducted for Pound Sterling Live by The Money Cloud. | ||

"2024 just keeps coming up Canada on the inflation front, with February posting the second consecutive downside surprise. At 2.8% y/y, inflation seems to be settling comfortably into the Bank of Canada’s 1% to 3% target range for inflation," says Randall Bartlett, Senior Director of Canadian Economics at Desjardins Bank.

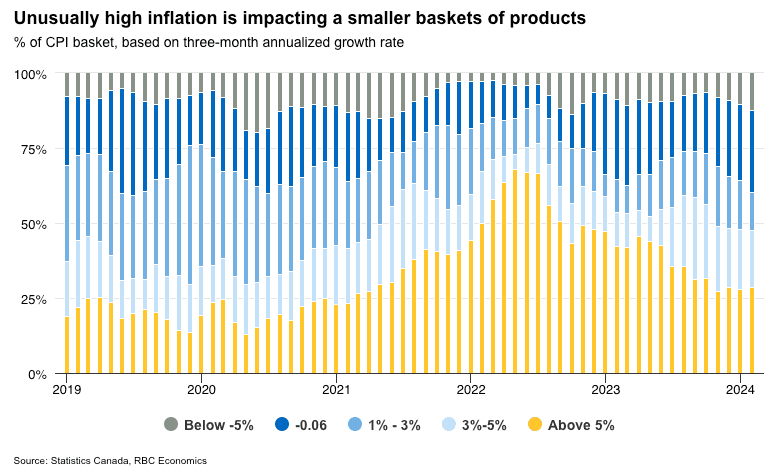

Markets had anticipated a pick-up in inflation, but the disinflation process continued unabated and it is hard to find any areas of concern in the price basket.

As a result, the Bank of Canada will now find itself with increasingly limited arguments for keeping interest rates at current levels.

The market knows this and has duly raised the odds of an earlier rate cut, which is weighing on the Canadian Dollar.

"Bond yields fell and the Canadian dollar weakened as investors pulled forward expectations for a first interest rate cut from the Bank of Canada," says Katherine Judge, an economist at CIBC.

Claire Fan, Economist at Royal Bank of Canada, says the February report builds on the January report "that was already showing broad-based easing in price pressures in Canada".

"We continue to expect a persistently soft economic backdrop to further slow inflation readings in Canada in the months ahead, allowing for the BoC to start lowering interest rates around mid-year," she adds.

But economists at Desjardins Bank say a clear policy pivot will come sooner.

"At 2.8% y/y, headline inflation in the first two months of 2024 is coming in well below the Bank’s forecast of 3.2% for Q1 in the January 2024 Monetary Policy Report. Along with weakness in the Bank’s consumer and business surveys and recent spike in business insolvencies, February’s inflation print helps to reinforce the case for rate cuts to begin in June 2024. The Bank will likely signal a change in policy at its upcoming April meeting," says Bartlett.

CIBC are also inclined to believe the Bank of Canada will cut in June.

"This report is clearly encouraging from the Bank of Canada's perspective. It is the last inflation report that policymakers will receive before the April forecast update and announcement, and will allow policymakers room to sound more dovish at that meeting, even though they will likely want to wait to see more evidence of the labour market loosening before pulling the trigger on interest rate cuts in June," says Judge.